“A Step Closer to the Dream of Market Upgrade”

With Circular No. 68/2024, issued on September 18, the Ministry of Finance allows securities companies to provide a Non Pre-funding Solution (NPS) service to foreign institutional investors (FIIs), enabling them to place orders without sufficient funds. The circular will come into effect on November 2, 2024.

As per the circular, securities companies have the flexibility to determine the margin requirement for FIIs based on their assessment of the investor’s payment risk. This margin will be agreed upon between the securities company and the investor.

In cases where an FII fails to pay the full amount for a stock purchase, the responsibility for paying the remaining amount falls on the securities company where the investor placed the order. The securities company has the right to disclose information about the investor’s insufficient funds, thereby mitigating the risk of non-payment.

Additionally, the securities company has the right to sell by agreement or transfer ownership of the purchased stocks to the indebted investor to safeguard its interests. However, this must comply with the regulations on foreign ownership limits.

The limit for receiving buy orders is based on the convertible assets of the securities company, not exceeding twice the difference between the value of the company’s equity and the debt balance of securities lending.

In terms of timing, FIIs can buy stocks at T+0 and receive funding at T+1 to T+2. This addresses the requirements for market upgrade set by FTSE Russell, including delivery-versus-payment (DVP) and handling failed trades.

This is a significant step towards meeting the criteria for upgrading Vietnam’s stock market from Frontier Market to Secondary Emerging Market status as defined by FTSE Russell.

Previously, NPS was identified as one of the two critical issues that needed improvement to facilitate the participation of FIIs in Vietnam’s stock market, along with foreign ownership limits.

According to VNDIRECT Securities, there are three potential impacts of implementing Circular 68: attracting more FIIs as Vietnam’s regulations move closer to international standards, increasing foreign capital inflows into the stock market, and improving market liquidity.

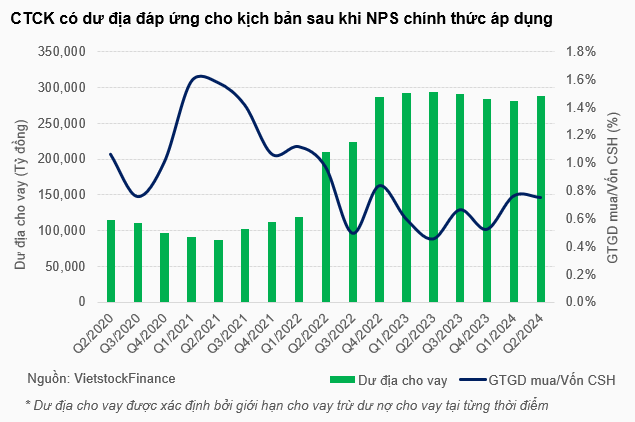

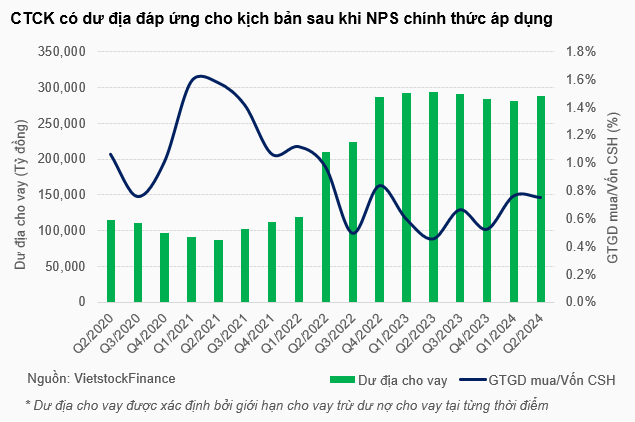

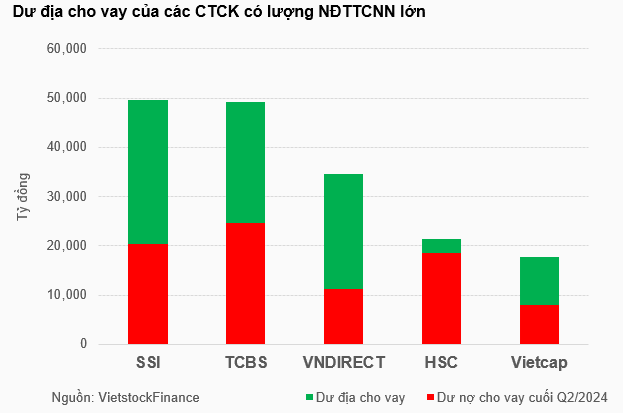

Over the years, as many securities companies have increased their capital, the total equity capital in the market has significantly increased, providing more room for lending activities, as indicated by VietstockFinance. This increase in capital has resulted in a higher lending capacity for securities companies.

The lending capacity of securities companies has increased significantly since the second quarter of 2022 and has consistently maintained a high level in the subsequent periods. Analyzing the average quarterly purchase volume of foreign investors from 2020 to the present, the value of foreign purchases does not exceed 2% of the total equity capital of securities companies. This indicates that securities companies have the capacity to accommodate a significant increase in foreign orders once NPS is officially implemented.

What Challenges Need to be Overcome with the Implementation of NPS?

As with any new initiative, there are potential risks associated with NPS. Mr. Vo Kim Phung, Head of Analysis Division at BETA Securities, shared his perspective. Similar to margin lending activities, securities companies need to prepare countervailing funds to provide credit limits for each customer regarding this new product. The total credit limit for margin lending and payment support products cannot exceed twice the company’s equity. This puts pressure on companies with a large number of FII clients.

As of the second quarter of 2024, securities companies with a significant number of FIIs compared to the market include SSI Securities, Techcom Securities (TCBS), VNDIRECT Securities, Ho Chi Minh City Securities (HSC), and Vietcap Securities, among others. While the pressure may not seem overwhelming, there is still a risk of not being able to meet the demand if foreign orders surge. This intensifies the pressure on securities companies to increase their equity capital.

Another potential risk is systemic risk in cases where investors fail to make timely payments. VNDIRECT Securities emphasized the importance of securities companies enhancing their risk management regarding customers, margin ratios, market conditions, and appropriate lending ratios. The competitive pressure in the industry may exacerbate these risks over time.

Mr. Phung also highlighted the possibility of encountering failed trades if the buyer cannot fulfill their payment obligations. The temporary solution is for the securities company to transfer the stocks to their proprietary trading portfolio and then handle them through agreements or forced sales, similar to traditional margin lending practices.

If a securities company sells a large volume of stocks to recover its capital, it could lead to a significant drop in stock prices over a few sessions. Moreover, after introducing this product, securities companies will need time to fine-tune their operations and assess its effectiveness.

Huy Khai

“Vietnam and UAE Elevate Bilateral Ties to Comprehensive Partnership”

On October 28, 2024, in Abu Dhabi, Prime Minister Pham Minh Chinh held talks with UAE President Sheikh Mohammed bin Zayed Al Nahyan. During this significant meeting, the two leaders agreed to elevate bilateral relations to a Comprehensive Partnership, marking a new chapter in the diplomatic ties between Vietnam and the UAE.

Request for Eurasian Economic Union Members to Increase Quotas for Vietnamese Goods

Prime Minister Pham Minh Chinh has urged the Eurasian Economic Union to enhance trade exchanges between Vietnam and Central Asian countries.