The transaction was made to restructure the investment portfolio. Following the transaction, NHSV reduced its holding from 12.5 million certificates to 7.2 million certificates.

According to the report on the change in net asset value (NAV) of VCAM-NH VABF as of the transaction date, October 28, the NAV was recorded at 11,381.5 VND/certificate, corresponding to a deal size of approximately 60 billion VND.

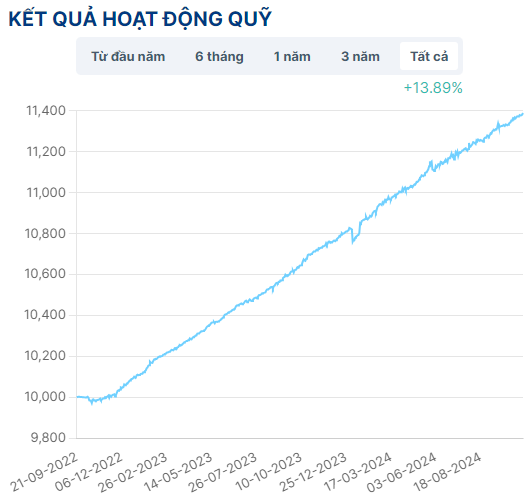

As of October 29, the NAV of the fund reached 11,388.8 VND/share, up nearly 14% from its establishment.

Source: VCAM-NH VABF

|

NHSV and Vietnam Securities Investment Fund Management Company (VCAM) established the Vietnam Bond Investment Open-ended Public Fund (VCAMFI). On September 22, 2022, the State Securities Commission granted a Certificate of Registration for the Establishment of a Public Fund to VCAMFI with an initial scale (AUM) of 150 billion VND. VCAMFI was later renamed the Vietnam Bond Investment Fund VCAM-NH (VCAM-NH VABF).

The fund is managed by VCAM itself. In terms of connections, Mr. Nguyen Van Quang is currently both a member of the Fund Representative Board and Acting Deputy General Director at NHSV.

Mr. Nguyen Van Quang holds a Bachelor of Economics in Investment from the National Economics University and a Master of Business Administration from James Cook University. He is introduced by VCAM-NH VABF as having more than 10 years of experience in the securities industry.

As of September 30, 2024, in addition to Mr. Quang, VCAM-NH VABF had two other members on the Fund Representative Board: Mr. Nguyen Minh Hoang and Mrs. Phan Thi Hong Lan. The fund’s Chairman of the Board is Ms. Nguyen Thanh Phuong, known for being a co-founder of VCAM and Vietcap Securities (VCI).

VCAM-NH VABF is a type of open-ended fund, mainly investing in corporate bonds, term deposits, and fixed-income instruments (including certificates of deposit, government bonds, fixed-rate products, and other securities).

According to the Q3/2024 financial statements of VCAM-NH VABF, as of September 30, 2024, the fund’s net asset value exceeded 170 billion VND.

The asset structure mainly comprises listed bond investments of over 125 billion VND, including bonds from Agricultural BAF Vietnam (BAF), Technical Infrastructure Investment of Ho Chi Minh City (CII), Construction Coteccons (CTD), VietinBank (CTG), Electricity of Gia Lai (GEG), LPBank (LPB), Masan Group (MSN), Investment and Trading (TNG), Agribank (VBA), Vinhomes (VHM), and Vincom Retail (VRE).

The investment portfolio also recorded 16 billion VND in term deposits with a term of more than three months. In addition, the fund had nearly 26 billion VND in bank deposits and cash equivalents, almost entirely in bank deposits for fund operations at Vietcombank, the fund’s supervisory bank.

Additionally, the fund had nearly 4 billion VND in receivables and accrued dividends and interest from investments.