The market plunged into a fierce sell-off during the afternoon session, driving two-floor matching liquidity twice as high as in the morning and stocks plummeting across the board. VN-Index evaporated 1.06% (-13.49 points) and pierced the short-term bottom at the beginning of October as it fell to 1,257.41 points.

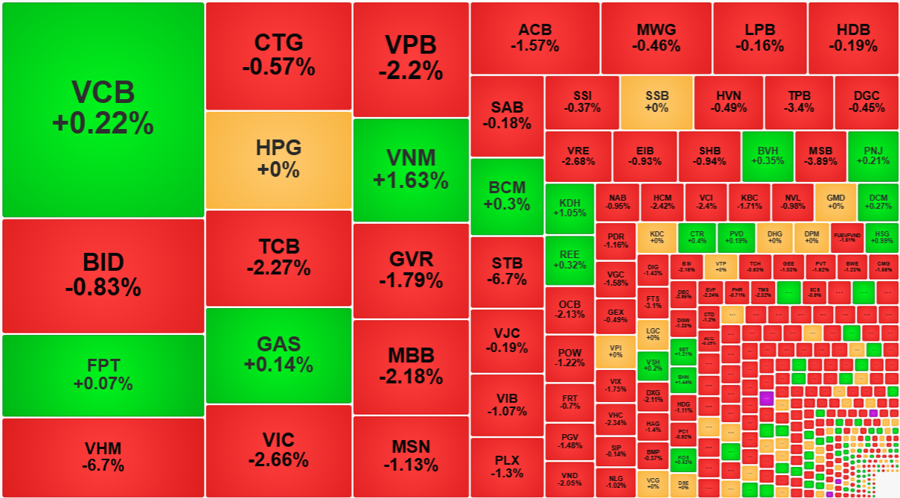

VHM took a “nosedive” as if in freefall this afternoon, falling a further 4.05% and closing with a total loss of 6.7%. Liquidity did not increase much, VHM matched only in the afternoon session about 779.2 billion VND, up just over 4% compared to morning trading, but the decline margin was twice as much. This stock alone blew away 3.3 points of the VN-Index.

In addition to VHM, many other large-cap stocks also fell sharply. VPB fell an additional 1.72%, closing 2.2% lower than the reference price. MSN released good business results, but the price fell 1.51% in the afternoon compared to the morning, reversing from a gain to a loss of 1.13% compared to the reference price. VIC “dove” deeper by 1.29%, closing down 2.66%. TCB fell a further 1.46%, ending the day 2.27% lower… The VN30 basket recorded 14 codes with losses of more than 1%, including 8 codes with losses of more than 2%. In addition to VHM, STB also fell 6.7%, TPB by 3.4%, and VRE by 2.68%…

VN-Index was actually quite lucky as some of the largest codes were not heavily damaged: VCB remained slightly green at 0.22%, FPT rose 0.07%, GAS gained 0.14%, HPG was unchanged, BID and CTG fell by less than 1%. If these pillars had collapsed like the above codes, the VN-Index could have evaporated twice as many points, even triggering a flood of sell-offs.

The VN-Index’s breadth at the end of the day was poor, with 102 gainers and 284 losers, not much worse than the morning session, but the price level was significantly lower. Specifically, HoSE had only 65 codes falling more than 1% in the morning session, but closed with 134. In the morning, very few stocks experienced sell-offs, with trading focused on VHM. In the afternoon, in addition to VHM, STB also traded more than 1,108 billion VND at the floor price. About 20 other stocks had liquidity ranging from 100 billion to 500 billion VND and were also among the biggest losers. Together, the liquidity of these 134 weakest codes accounted for 64.3% of the floor’s total matching value. Even excluding VHM’s transactions, this group still accounted for 53.4%.

HoSE’s afternoon liquidity surged to 9,443 billion VND, twice as much as in the morning, but both the breadth and transaction ratio of the group with the deepest losses indicated that sellers were the ones actively creating liquidity. It was still quite fortunate that there was no appearance of a series of floor prices. The VN30-Index closed down 1.49%, Midcap fell 0.94%, and Smallcap lost 0.73%. Blue-chip stocks were the most damaged, with a focus on banks and real estate. Seven bank codes in the VN30 basket fell by more than 1%, and out of the total 27 codes, only 5 were in the green: ABB, VBB, BAB, SGB, and VCB. Real estate still had a few outliers that went against the trend, such as QCG, OGC, NVT, and KDH…, but they were not representative. Dozens of stocks in this group fell by more than 1%, including the largest pillars: VHM, VIC, and VRE, which posted sharp declines.

Foreign investors were more active in the afternoon but remained net sellers. Specifically, they dumped an additional 1,076.6 billion VND on HoSE, double the morning session, and bought 944.4 billion VND, 2.3 times more, corresponding to a net sell of 132.2 billion VND. In the morning session, the block net sold 102 billion VND. The codes that were sold the most were HPG -93 billion VND, VRE -80.2 billion VND, STB -59.9 billion VND, DGC -56.2 billion VND, VHM -45.7 billion VND, and KBC -21.2 billion VND. On the buying side, VPB gained 88.5 billion VND, FPT 70.1 billion VND, VNM 68.4 billion VND, SSI 67.1 billion VND, MWG 61.8 billion VND, and PDR 31.5 billion VND.

With a loss of 13.49 points today, the VN-Index has officially pierced the short-term bottom at the beginning of October. This is also the biggest decline in 12 weeks, leading investors to wait for lower support levels.

The Market Tug-of-War Rages On

The VN-Index slipped back into the red, despite positive effects from the two recent recovery sessions, indicating that the tug-of-war between bulls and bears is still ongoing. Moreover, trading volume remaining below the 20-day average suggests a lack of returning liquidity in the market. Currently, the MACD and Stochastic Oscillator indicators continue to trend downward, reinforcing bearish signals and dampening short-term prospects.

The Dollar’s Turbulent Ride: A Year-End Review of the Volatile Currency Market

Sharing at the Khớp Lệnh program on October 28, 2024, Mr. Nguyễn Việt Đức, Digital Sales Director of VPBank Securities Joint Stock Company (VPBankS), stated that the exchange rate is currently under significant pressure and has been the main factor hindering the stock market’s performance in recent times. He also highlighted the presence of numerous variables that could come into play towards the end of the year.

The Market Beat: A Surprising Rebound Led by Banking and Real Estate Sectors

The VN-Index staged a strong recovery in the afternoon session, buoyed by gains in the banking and real estate sectors. It closed the day up 5.85 points, or 1.264.48%. The HNX-Index also turned green, rising 0.49 points to 226.36, while the UPCoM-Index edged slightly lower, falling 0.08 points to 92.38.