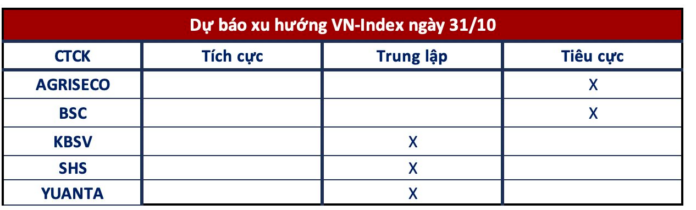

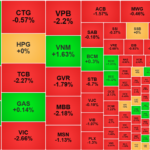

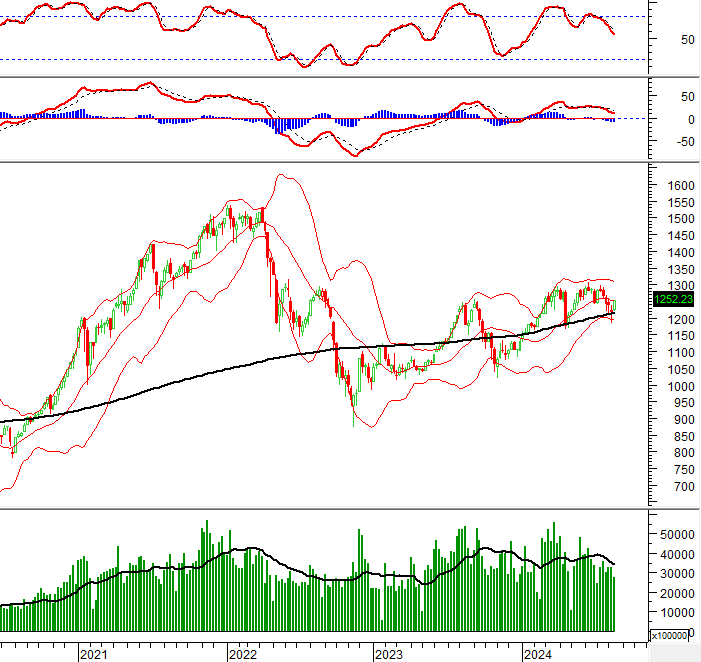

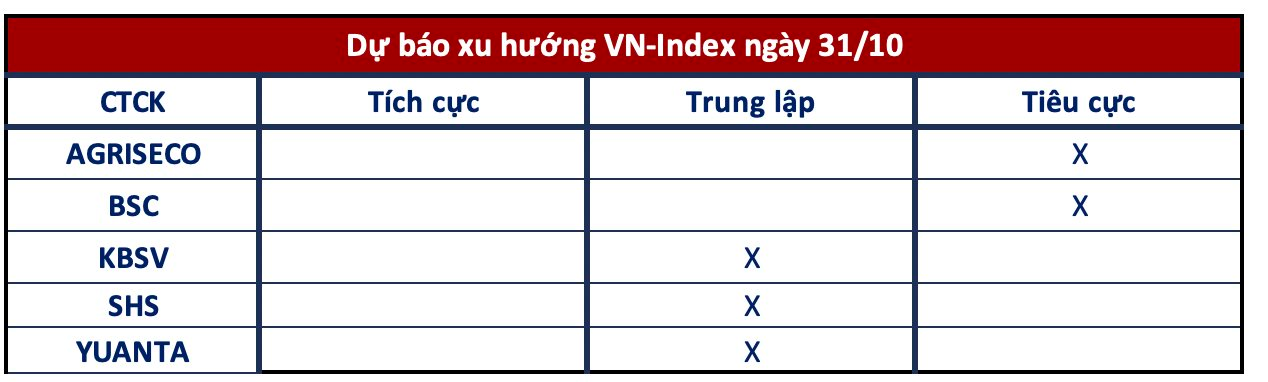

The market opened slightly higher on October 30, but weak demand, particularly for VN30 stocks, quickly pushed the VN-Index below the reference level. At the close, the VN-Index stood at 1,259 points, a slight decrease of 3 points. Trading value on the three exchanges reached nearly VND 14,250 billion, a drop of over 20% compared to the 20-session average. Most securities companies are relatively cautious in their assessments of the next trading session, advising investors to trade cautiously. VN-Index likely to retreat further Agriseco Securities Despite forming a pullback candle, the VN-Index has not yet confirmed a return to the uptrend as investor sentiment remains cautious amid the lack of a leading industry group and subdued demand. Agriseco Research maintains the view that the index will continue to fluctuate in the current trading week and is likely to retreat to a deeper support level around the 1,245 (+/-5) point range to stimulate new demand. Investors are advised to refrain from new investments and maintain a safe cash ratio to ensure an active position when the market offers more attractive prices. BSC Securities Currently, the VN-Index is seeking equilibrium around the 1,260 level, and investors are advised to exercise caution in the coming sessions. Investors advised to maintain low portfolio weight KBSV Securities The momentum of accumulation at lower price levels re-emerged towards the end of the session, accompanied by a reversal signal from some blue-chip stocks, indicating a temporary balance. While this is not a very positive development, it leaves room for a potential expansion of the index’s recovery. With the dominant sideways trend, investors are recommended to reduce trading positions and lower their holdings to a safe level as the index approaches resistance zones. SHS Securities In the short term, the market is relatively balanced around the 1,250-point level, with positive differentiation among stocks with strong fundamentals and sustained business growth, offering better trading and accumulation opportunities. Investors are advised to maintain a reasonable portfolio ratio. Below-average ratios may consider selective investment in stocks with strong fundamentals and positive growth in the third quarter, with expectations of continued growth in the final quarter. Yuanta Securities The market is expected to experience short-term recovery sessions. Investors should closely monitor exchange rates and the SBV’s monetary policy moves. Consider investing when clear confirmation of the recovery trend emerges, accompanied by trading volume. Investors can continue to hold a low stock ratio of 30-40% in their short-term portfolios and may buy selectively at a low ratio to test the short-term trend. At the same time, investors are advised to refrain from selling in the current phase.

The King of Stocks: VN-Index Surges by Almost 6 Points

The VN-Index ended in the green on a busy day for the stock market king, with market-wide liquidity reaching over VND 19,000 billion, a significant surge compared to the previous session.

The VN-Index Plunges to a 12-Week Low: A Bold Move to Cut Losses and Look to the Future

The market suffered a brutal sell-off in the afternoon, with trading liquidity on both exchanges doubling from the morning session, and stocks plunging across the board. The VN-Index evaporated 1.06% (-13.49 points) and broke through the short-term bottom at the beginning of October, falling to 1257.41 points.