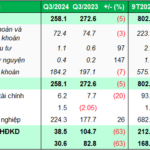

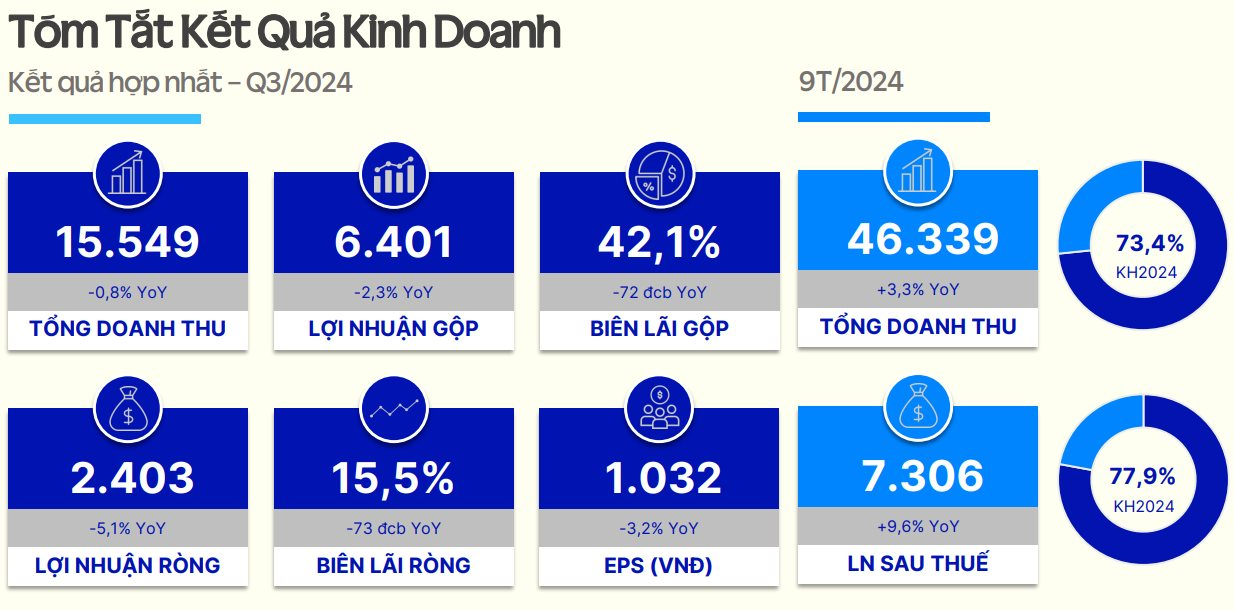

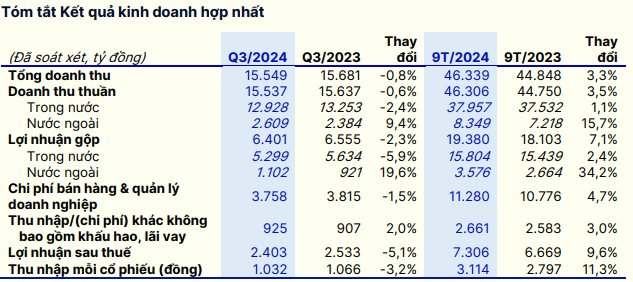

Vinamilk (Vinamilk, ticker: VNM), a leading Vietnamese dairy company, has released its financial statements for Q3 2024. This quarter, net revenue reached VND 15,549 billion, similar to the same period last year. Increased cost of goods sold led to a 2% decrease in gross profit for Q3, totaling VND 6,401 billion, with a gross margin of over 41%.

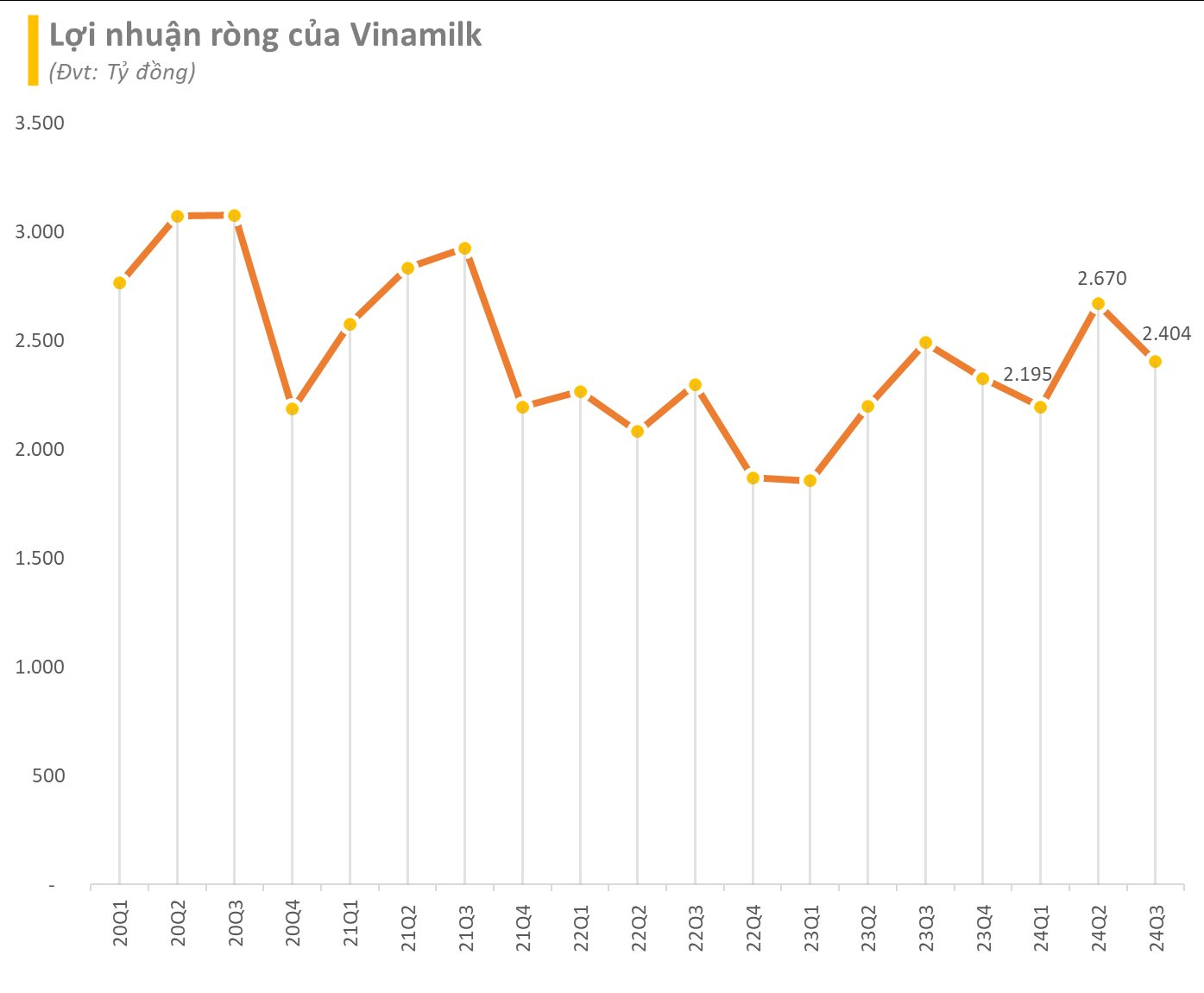

Compared to Q3 2023, both financial income and expenses decreased, while selling expenses and administrative expenses amounted to VND 3,336 billion and VND 422 billion, respectively. As a result, Vinamilk reported a 5.1% decline in after-tax profit, amounting to VND 2,403 billion. This figure also represents a 10% decrease compared to the previous quarter.

For the first nine months of 2024, Vinamilk’s net revenue and after-tax profit reached VND 46,306 billion (a 3.5% increase) and VND 7,306 billion (a 10% increase), respectively. With these results, the company has achieved nearly 78% of its full-year profit plan. According to Vinamilk, the gross margin for Q3 was impacted by domestic sales performance, but a positive trend was observed for the nine-month period, with a 140-basis point improvement year-on-year due to favorable shifts in sales structure and more stable import material costs.

During the first nine months of 2024, Vinamilk’s products maintained double-digit growth, attributed to effective marketing and market development strategies. Specifically, Probi drinking yogurt revenue increased by nearly 30% year-on-year. In the plant-based milk category, Green Farm fresh milk and plant-based milk products witnessed optimistic market share growth, claiming the top spot in the plant-based milk market (excluding soy milk). Revenue for these products also doubled compared to the same period last year.

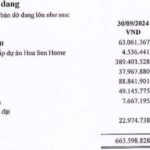

As of September 30, 2024, Vinamilk’s total assets stood at VND 57,677 billion, including VND 2,616 billion in cash and cash equivalents, over VND 6,100 billion in inventory, and nearly VND 26,000 billion in term deposits with banks. The company earned more than VND 1,041 billion in interest income from these term deposits during the first nine months of 2024.

The company’s total liabilities as of Q3 stood at VND 22,433 billion, of which over VND 8,400 billion was loan debt, primarily consisting of short-term loans. Retained earnings reached VND 2,870 billion.

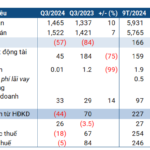

The Rising Cost of Goods and Expenses: Hoa Sen Group Reports Loss for the Quarter

The sharp rise in raw material and operating costs has resulted in Hoa Sen Group posting a post-tax loss of VND 186 billion, a 142% decline compared to the same period last year when they recorded a profit of VND 438 billion. Despite this setback, the company has managed to surpass its annual revenue and profit targets for the financial year.

“Declining Core Revenue and Soaring Expenses: Unveiling Dragon Capital’s Manager’s Earnings in Q3”

In Q3 of 2024, the financial results of Dragon Capital Vietnam Asset Management JSC (DCVFM) were significantly impacted by a decline in revenue from its two core business segments: advisory and fund management. While revenue from these key areas decreased, management expenses rose sharply, creating a challenging environment for the company.

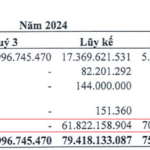

“Dropping Dividends: Pha Lai Thermal Power Reports First Loss in Three Years”

High production costs coupled with a significant decline in dividend income from subsidiaries resulted in a net loss for Pha Lai Thermal Power Joint Stock Company (HOSE: PPC) in Q3/2024, marking the first quarter of losses after twelve consecutive profitable quarters.

“A Stellar Performance: Sonadezi Achieves 87% of Profit Plan in 9 Months”

Sonadezi Corporation (Sonadezi, UPCoM: SNZ), a leading industrial development company, announced its third-quarter financial results, reporting a net profit of over VND 192 billion, an 8% decrease compared to the same period last year. Despite this quarterly decline, the company remains on a strong trajectory, having achieved 87% of its full-year net profit target in the first nine months of the year.