The two leading chemical companies, Southern Basic Chemicals (Sochem – Code: CSV) and Viet Tri Chemicals (Code: HVT), recently announced their Q3/2024 financial reports, showcasing positive business results.

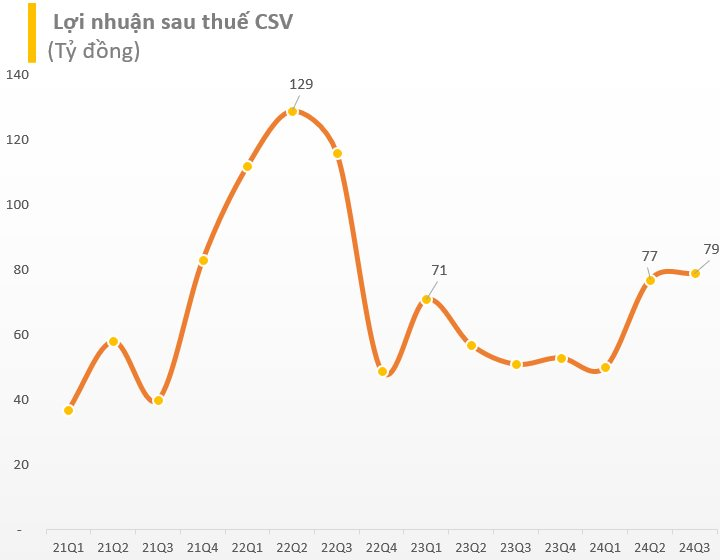

Sochem reports after-tax profit of nearly VND 79 billion, a 54% growth compared to the same period

According to the Q3/2024 report, Southern Basic Chemicals, a subsidiary of Vietnam Chemical Group (Vinachem) with a 65% stake, recorded a nearly 25% increase in net revenue to VND 508 billion. After deducting the cost of goods sold, Sochem’s gross profit surpassed VND 142 billion, a 53% surge year-over-year.

Additionally, financial revenue reached nearly VND 8 billion, a 26% decrease compared to the same period last year. Meanwhile, selling and management expenses grew by 45% and 18%, respectively, totaling over VND 31 billion and VND 19 billion.

As a result, Sochem announced an after-tax profit of nearly VND 79 billion, marking a 54% increase compared to the previous year and the highest profit in eight quarters. The company attributed this success to the increased sales volume and slight rise in average selling prices of their main products, including NaOH, HCl, liquid chlorine, H2SO4, Javel, and PAC. Additionally, the sales volume and price of yellow phosphorus at the subsidiary level increased by 80% and 3%, respectively.

Figure 1: Sochem’s financial highlights for Q3/2024 (in VND billion)

For the first nine months of the year, the chemical company recorded net revenue of VND 1,340 billion, a nearly 16% increase. After-tax profit reached VND 255 billion, surpassing the figure from the same period in 2023 by 14%.

In 2024, Sochem set ambitious targets, aiming for VND 1,640 billion in revenue and over VND 261 billion in pre-tax profit. With these impressive Q3 results, the company has already achieved 82% of its revenue target and is close to meeting its annual profit goal, having accomplished 98% of it.

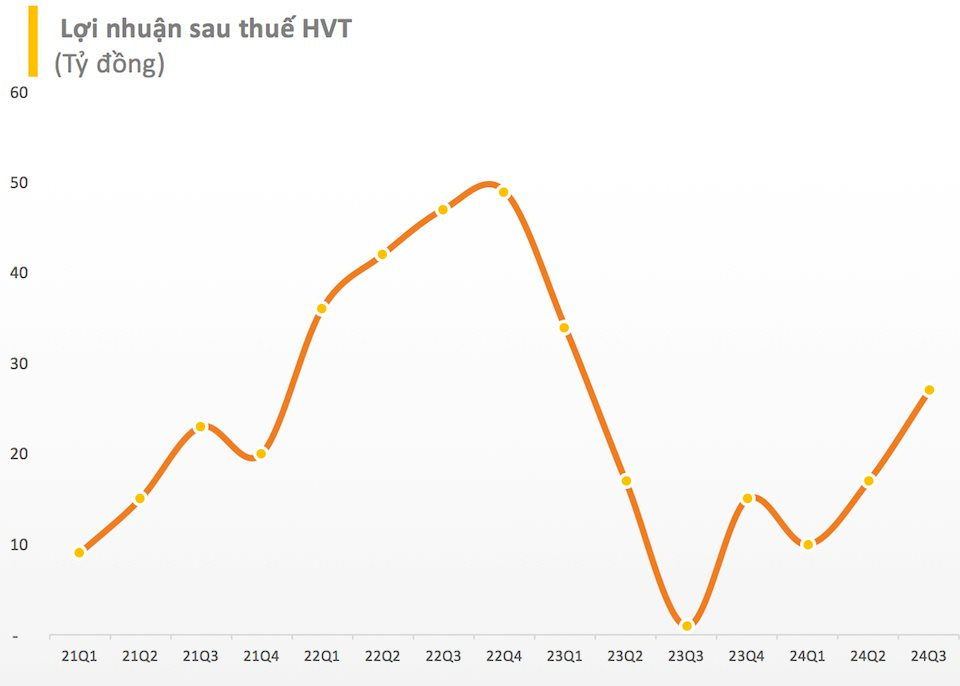

HVT’s after-tax profit surges to 22 times that of the previous year

Following a similar trajectory, Viet Tri Chemicals also witnessed remarkable growth in its financial performance. Specifically, the company’s net revenue climbed to VND 378 billion, a 25% increase compared to the same period last year. After accounting for expenses, their after-tax profit skyrocketed to nearly VND 27 billion, an astounding 22-fold increase from the low base in the previous year. This quarter’s profit also marked the highest in the past six quarters.

HVT attributed this significant improvement primarily to the growth in revenue, driven by higher selling prices for their products compared to the previous year. The introduction of their new disinfectant product, Vi-Chlorine, which has been well-received in the market, also contributed to the boost in revenue.

Figure 2: HVT’s financial highlights for Q3/2024 (in VND billion)

For the nine-month period ending in September, Viet Tri Chemicals recorded net revenue of VND 1,082 billion and pre-tax profit of over VND 67 billion, reflecting increases of approximately 15% and 2%, respectively, compared to the same nine-month period in 2023.

Looking at the full year, the company has set its sights on achieving VND 1,561 billion in revenue and VND 106 billion in pre-tax profit. With their impressive performance so far, they have already accomplished 75% of their revenue target and 64% of their profit goal.

Viet Tri Chemicals, formerly known as Vietnam Chemical Factory No. 1 Viet Tri, was established in 1959 and specializes in the production of basic chemicals, particularly caustic soda (NaOH). Vietnam Chemical Group (Vinachem) is the parent company, holding a stake of nearly 68.5%.

The Rise of the Securities Companies: Can Masan Reach its Audacious Target of 2,000 Billion VND Net Profit?

In the first nine months of 2024, Masan achieved a remarkable profit of 1.308 trillion Vietnamese dong after allocation of minority interests, surpassing its initial plans by a significant margin. With this impressive performance, the company is well on its way to achieving its ambitious full-year net profit target of 2 trillion Vietnamese dong, as per the positive scenario laid out.

The Mobile World Reports Q3 Profit of Over $33 Million, Far Surpassing Full-Year Plan

With impressive results, the company has achieved nearly 80% of its annual revenue target and surpassed its annual after-tax profit goal by 20%.

The Rising Cost of Goods and Expenses: Hoa Sen Group Reports Loss for the Quarter

The sharp rise in raw material and operating costs has resulted in Hoa Sen Group posting a post-tax loss of VND 186 billion, a 142% decline compared to the same period last year when they recorded a profit of VND 438 billion. Despite this setback, the company has managed to surpass its annual revenue and profit targets for the financial year.