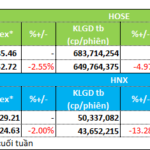

There was no negative news, but the market turned red as a habit, despite a brilliant reversal yesterday. The index gradually decreased and closed at 1,258 points, corresponding to a 3.15-point decrease, which was significantly better than some intraday lows. Breadth also deteriorated, with 210 stocks declining and 163 advancing.

Today’s performance was dominated by Vin stocks. VHM continued its downward trend, losing 3.74% and forming a Christmas tree pattern, while VIC closed 0.85% lower. These two stocks alone wiped out two points from the market. In contrast, some other real estate stocks performed well, with NVL, SIP, and QCG surging to their daily limits.

Financial services and materials sectors were also in the red. Securities stocks witnessed a significant number of decliners, with many falling over 1%, such as SSI, HCM, VND, VIX, and MBS. In the materials sector, fertilizer stocks reversed course as the 5% value-added tax on fertilizers is still being discussed in the National Assembly, with most opinions in favor. Steel stocks HPG and HSG lost their gains.

On the other hand, the banking group continued to diverge. While VCB and CTG lost steam, BID and TCB gained 0.32% and 1.05%, respectively. STB stood out with a notable increase of 2.2%, and VIB rose 1.33%. TCB, STB, BID, and VIB recovered nearly two points for the market.

Market liquidity on the three exchanges decreased to VND14,300 billion, a positive sign indicating no panic selling. Foreign investors’ net selling decreased significantly to VND152.3 billion, and their matched selling orders totaled VND261.0 billion.

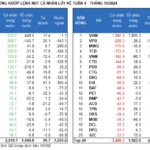

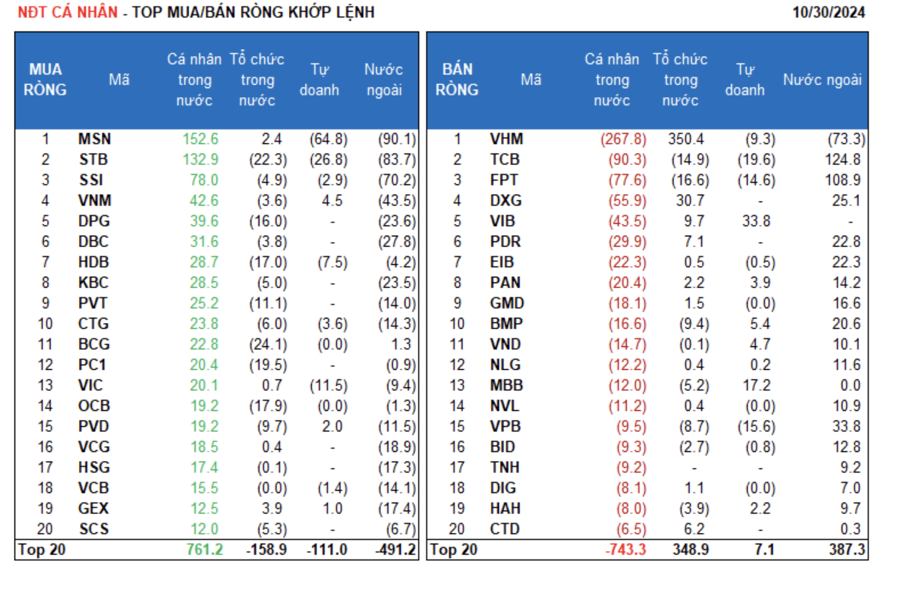

Foreign investors’ net buying on the matched orders side focused on Information Technology and Banking stocks. The top net bought stocks by foreigners on a matched basis included TCB, FPT, VPB, DXG, PDR, EIB, BMP, GMD, PAN, and BID.

On the other hand, their net selling focused on Food and Beverage stocks. The top net sold stocks by foreigners on a matched basis included MSN, STB, VHM, SSI, HPG, DBC, DPG, KBC, and VCG.

Individual investors net bought VND50.8 billion, with a net purchase of VND160.7 billion on matched orders. On a matched basis, they net bought 13 out of 18 sectors, mainly in the Food and Beverage industry. The top net bought stocks by individual investors included MSN, STB, SSI, VNM, DPG, DBC, HDB, KBC, PVT, and CTG.

On the net-selling side, they sold five out of 18 sectors, mainly in the Real Estate and Information Technology industries. The top net sold stocks included VHM, TCB, FPT, DXG, VIB, PDR, PAN, GMD, and BMP.

Proprietary trading accounted for net selling of VND101.1 billion, with net selling of VND130.0 billion on matched orders.

On a matched basis, proprietary trading net bought five out of 18 sectors. The top net bought sectors were Construction and Materials and Chemicals. The top net bought stocks by proprietary traders today included VIB, MBB, VCI, BMP, VND, VNM, VFG, PAN, ELC, and HAH. The top net sold stocks were in the Food and Beverage sector, including MSN, STB, TCB, VPB, FPT, VIC, VHM, HDB, FUEVFVND, and ACB.

Domestic institutional investors net bought VND200.4 billion, with a net purchase of VND230.3 billion on matched orders.

On a matched basis, domestic institutions net sold 13 out of 18 sectors, with the largest value in the Banking sector. The top net sold stocks included BCG, STB, PC1, OCB, HDB, FPT, DPG, TCB, HCM, and PVT. The largest net buying was in the Real Estate sector, with the top net bought stocks being VHM, HPG, DXG, MWG, VIB, PDR, REE, CTD, VJC, and FUEVFVND.

Today’s matched transactions totaled VND1,951.0 billion, down 73.1% from the previous session and contributing 13.7% of the total trading value.

Notable transactions today included SSB, with over 16.4 million shares worth VND273.5 billion traded between individual investors. Additionally, there was a matched transaction of nearly 8.2 million MBB shares (valued at VND219.3 billion) between foreign institutions.

The money flow allocation ratio increased in Banking, Securities, Construction, Agricultural & Seafood, and Food sectors while decreasing in Real Estate, Steel, Chemicals, Retail, Software, Warehousing & Logistics, Aviation, Plastics, Rubber & Fibers.

On a matched basis, the money flow allocation ratio increased in the large-cap VN30 and small-cap VNSML groups while decreasing in the mid-cap VNMID group.

The Market Beat: A Surprising Rebound Led by Banking and Real Estate Sectors

The VN-Index staged a strong recovery in the afternoon session, buoyed by gains in the banking and real estate sectors. It closed the day up 5.85 points, or 1.264.48%. The HNX-Index also turned green, rising 0.49 points to 226.36, while the UPCoM-Index edged slightly lower, falling 0.08 points to 92.38.