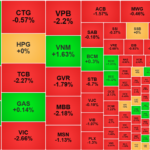

Despite the significant jitters in the underlying market as T+ stocks were dumped and the VHM pillar plunged by nearly 4%, the derivatives market displayed an enigmatic confidence by accepting a wide spread, especially during the ATC session.

The inertia of the upward trend continued in the first half of today’s morning session, helping many T+ stocks to yield decent profits. However, pressure started to build throughout the remainder of the day. The index was partly influenced by the deep decline of VHM, but the breadth confirmed that stocks were generally declining. This is an effect of momentum trading and is also quite predictable, as sentiment is not yet confident enough for longer-term holdings, and big money has not yet entered the market.

The price performance was diverse, mainly based on the ability to regulate liquidity and the supply-demand gap. Small-cap stocks showed relatively good resistance, while high-liquidity tickers experienced noticeable price suppression. In fact, for short-term trading, the range is the decisive factor for risk/return, and low-volume stocks are more likely to surge. With the pressure from VHM, the index was impacted, but small- caps were still able to maintain a slight decline and rebounded quite favorably.

Overall liquidity remains very low, with the two exchanges today matching just over 11.8 trillion VND (excluding negotiated deals). The upward momentum with confirmed liquidity did not attract much participation, a common occurrence when the market technically recovers but lacks sufficient signals to confirm a bottom.

I maintain the view that the market is in a short-term corrective trend, and the downward acceleration, as well as the weight of the selling volume, has weakened. This is only a necessary condition for the market to form a bottom. Either the market will transition to a state of liquidity exhaustion and move horizontally to form a bottom range, or it will require a large enough cash flow to “settle” once and for all those who want to cut losses. Under the current conditions, there is no sufficiently heavy information to stimulate an abrupt cash flow, so the more plausible scenario is for the market to gradually “land.”

Currently, many non-speculative stocks are also entering the “landing” phase earlier than the index. This process requires more time, but the signal needed is a small amplitude oscillation and low liquidity. Highly volatile speculative stocks are just a “side dish,” and one should not get too deeply involved in such trades.

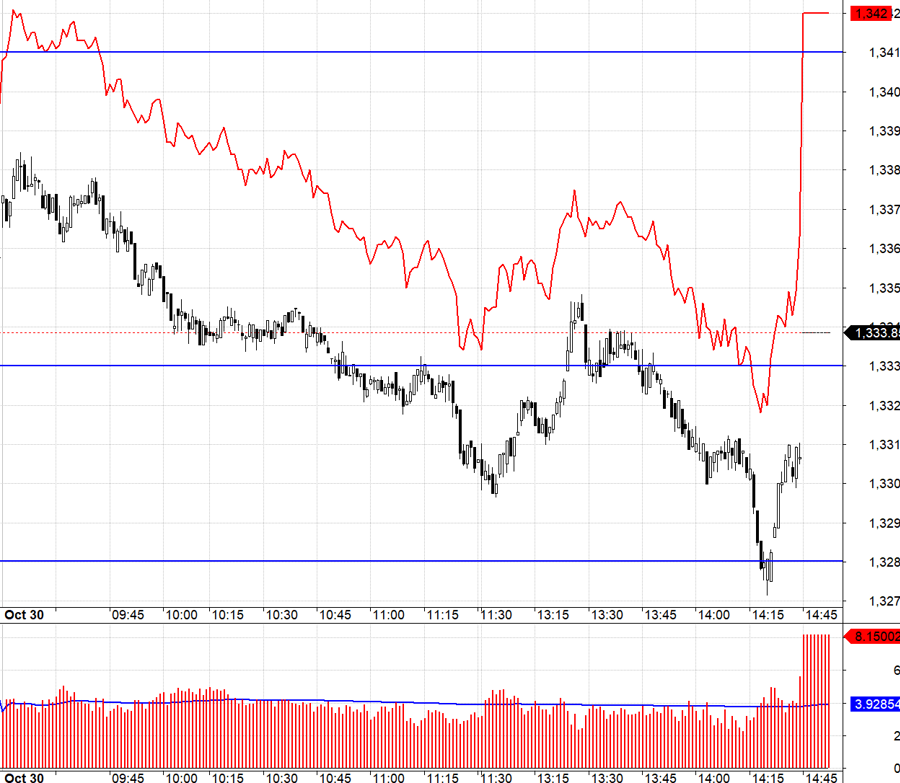

Today’s derivatives market did not predict the possibility of a strong selling rhythm in the underlying market. From the start, the F1 basis maintained a fairly wide positive spread. Even when the pressure to create an intraday slide was apparent, the basis remained relatively stable. This made Long opportunities non-existent, and in fact, only the ATC jump was unexpected, while Short setups within the session, although they might not have yielded much, offered a higher level of safety.

F1 opened with a basis of up to +8.1 points at the close due to the emergence of a large Long position of more than 11,200 contracts. This is likely Short cover rather than new Long. VN30 also changed as some pillars such as FPT, MSN, and HPG had a large volume pushed to the buy-side. This level of spread is rarely seen in the past few months and is likely just a temporary anomaly rather than reflecting any expectations for the underlying market.

Today’s first T+ profit-taking session showed that the pressure was not too significant, and there was money flowing in to support the deep price region. This phase is more suitable for exploratory accumulation trading, and when the price retreats, this demand will emerge. The strategy remains to buy stocks, Long/Short flexibility with derivatives.

VN30 closed at 1333.85, right at the mark. The nearest resistance for tomorrow is 1341; 1348; 1356; 1361. Support is at 1327; 1318; 1310; 1303.

“Stock Market Blog” is a personal blog and does not represent the views of VnEconomy. The opinions and assessments are those of the individual investor, and VnEconomy respects the author’s point of view and writing style. VnEconomy and the author are not responsible for any issues arising from the investment opinions and perspectives published.

Unveiling the Income of Novaland, Phat Dat, and Dat Xanh’s Leaders

The real estate company’s Chairman and CEO continue to earn high salaries, despite the challenging market conditions.

The VN-Index Plunges to a 12-Week Low: A Bold Move to Cut Losses and Look to the Future

The market suffered a brutal sell-off in the afternoon, with trading liquidity on both exchanges doubling from the morning session, and stocks plunging across the board. The VN-Index evaporated 1.06% (-13.49 points) and broke through the short-term bottom at the beginning of October, falling to 1257.41 points.