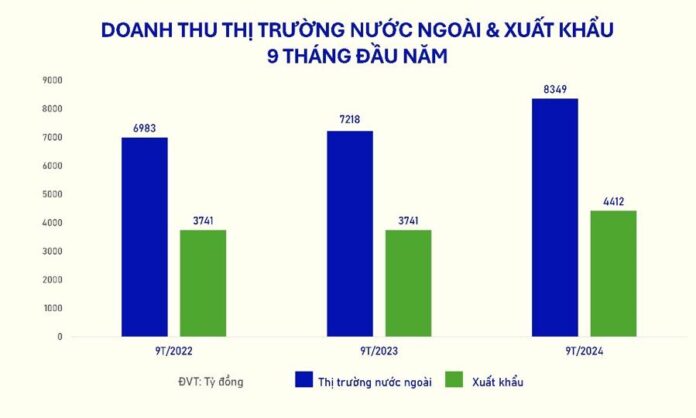

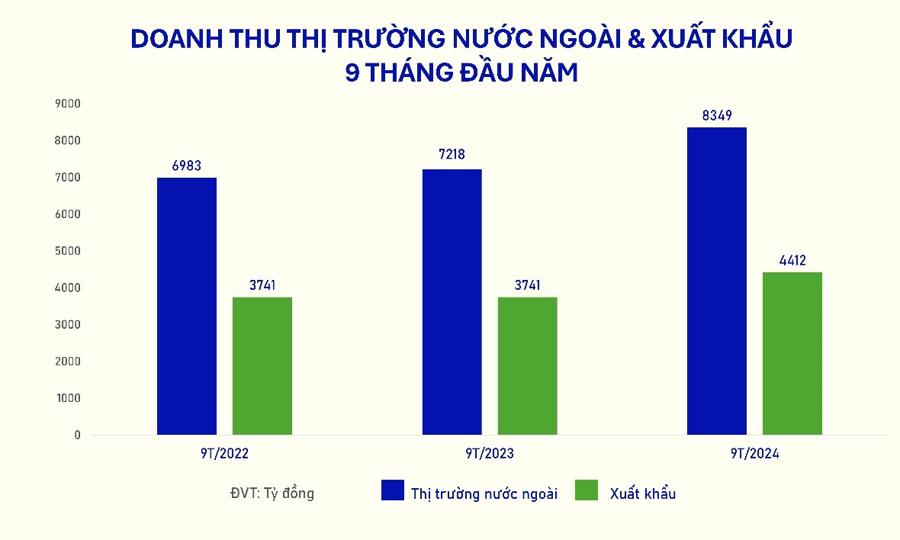

OVERSEAS MARKET REVENUE RISES BY 15.7%, MAINTAINING GROWTH MOMENTUM

In Q3 2024, revenue from the export market continued its fifth consecutive quarter of positive growth, remaining a key growth driver for Vinamilk. Specifically, revenue from exports increased by 10.3%, and overseas branches (such as in the US and Cambodia) rose by 8.5%. Cumulatively, for the first nine months of 2024, overseas market revenue reached VND 8,349 billion, an impressive 15.7% increase compared to the same period last year.

To expand its exports, Vinamilk remains focused on emerging markets, leveraging free trade agreements, and building strategic partnerships. Vinamilk representatives shared that they are witnessing positive signals from premium markets with large Vietnamese communities, resulting in higher demand for Vinamilk products such as condensed milk and yogurt. The company is also diversifying its approach to market penetration by engaging more deeply with international retail, distribution, and supply chains.

In addition to dairy products, Vinamilk is developing “non-dairy” products for export, such as Vinamilk Cocofresh coconut water, currently exported to the US, Canada, Japan, and Taiwan. In Taiwan, in addition to condensed milk, fresh milk, and yogurt, Vinamilk has introduced a new product, 100% pure CocoFresh bottled coconut water, which is expected to gain traction as the second and third orders will be shipped by the end of this year. While it does not contribute significantly to revenue, this direction expands the market, affirms production capacity, and demonstrates product quality.

Vinamilk has also leveraged its “green” initiatives, aligned with sustainable development trends, as a competitive advantage in exports to create a “fresh breeze.” In Australia and New Zealand, by meeting stringent requirements for environmentally friendly packaging, Vinamilk has been able to join the supply chains of the region’s largest international supermarket systems, including Costco, Woolworths, and Foodstuff. In these two markets, Vinamilk recorded revenue growth of over 50% compared to the previous year. The company is also actively expanding its exports to South America and Africa.

According to the latest report, despite domestic business challenges due to the impacts of Typhoon Yagi, the company’s cumulative revenue for the first nine months reached VND 46,339 billion, a 3.3% increase compared to the same period last year. In addition to maintaining business operations, Vinamilk is also one of the companies that has provided significant support to flood-affected residents, with nearly 1.8 million essential nutritional products, equivalent to nearly VND 10 billion, contributed by Vinamilk, its employees, and customers through various programs.

PRODUCTS: INNOVATIVE PACKAGING, DIVERSE FLAVORS, AND REDUCED SUGAR

In Q3, Vinamilk introduced a series of innovations in product packaging, aligning with its new brand identity, and launched new products. Notable products include: 100% fresh coconut milk, premium low-sugar yogurt with blueberry, pomegranate, and aloe vera flavors, and Vinamilk Probi live yogurt drink with new packaging.

Notably, these products have performed well in the market. This indicates that Vinamilk’s changes are heading in the right direction and positively impacting the market.

Vinamilk Probi live yogurt drink is gaining traction with its colorful new look and diverse flavors. According to a brand health assessment research, the “Diversity of Flavors” preference index for Probi soared impressively from 80% in 2022 to 94% in 2024. The product’s revenue for the first nine months also increased by nearly 30% compared to the previous year.

The innovations introduced by Vinamilk also align with the growing consumer trend toward reduced sugar intake. For example, in the yogurt category, Vinamilk currently offers 17 different flavors, with half of the products in the low-sugar range.

In addition to its core product lines, Vinamilk has revamped the packaging for its nut milk, ice cream, and beverage lines. Notably, Vinamilk’s nut milk, introduced shortly ago, has claimed the market’s leading position in market share (excluding soy milk), with revenue for the first nine months doubling compared to the same period last year.

These innovations and improvements, along with upcoming product launches in Q4, are expected by Vinamilk’s leadership to be essential drivers of future growth. In the Q3 investor newsletter, Ms. Mai Kieu Lien, CEO of Vinamilk, shared that the company is implementing various plans to stimulate the domestic market in the year’s final quarter while maintaining high growth in overseas markets to achieve the set business goals for 2024.

Vinamilk maintains its total revenue target of VND 63,163 billion for the year. The company identifies growth drivers as recovering consumer spending in the domestic market and sustaining export market growth while optimizing production costs.

Additionally, a notable development is the listing of the “VNM19” depository receipts on the Stock Exchange of Thailand. This derivative product is based on the underlying VNM securities and issued by Yuanta Securities (Thailand). VNM19 allows Thai investors to trade VNM securities in their local currency and existing brokerage accounts, offering improved liquidity and potentially broadening the investor base, enhancing corporate governance, and aligning with international standards.

The Ultimate Guide to Exporting Fresh Coconut from Tien Giang Province: Unlocking 49 Codes to Success in the Chinese Market

To meet the demands of exports and enhance the value of fresh coconuts, the General Administration of Customs China (GACC) has approved a list of region codes and packing facility codes for fresh coconuts from Tien Giang Province. Notably, 40 region codes have been assigned to coconut-growing areas, with the Cho Gao Coconut Cooperative alone receiving 10 codes. Additionally, 9 packing facility codes have been granted.

“Revolutionizing Logistics for the New Era”

Ranking 43rd in the Logistics Performance Index, within the top 5 ASEAN countries in 2023, Vietnam’s logistics industry is rapidly developing, thanks to its strategic geographical location and production capabilities. However, it’s not just about relying on existing potential and advantages; a transformative leap is necessary to thrive in this new era.

The Rising Cost of Goods and Expenses: Hoa Sen Group Reports Loss for the Quarter

The sharp rise in raw material and operating costs has resulted in Hoa Sen Group posting a post-tax loss of VND 186 billion, a 142% decline compared to the same period last year when they recorded a profit of VND 438 billion. Despite this setback, the company has managed to surpass its annual revenue and profit targets for the financial year.