What’s Driving Real Estate Credit?

According to the State Bank of Vietnam (SBV), credit to the real estate sector grew by 9.15% year-to-date as of Q3 2024, surpassing the overall economic credit growth of 9%. Real estate credit outstanding balances have now reached VND 3.15 quadrillion, accounting for over 20% of the economy’s total outstanding credit, as shared by the SBV Governor recently.

This development is quite surprising, given the economic challenges and the subdued real estate market, which has yet to recover to the vibrant levels of previous years. In 2023, real estate credit growth was 11.8%, lower than the overall economic growth of 13.8%.

Several factors could explain the strong growth in real estate credit. Firstly, borrowing rates remain low, and many banks have been offering extremely attractive home loan programs with introductory rates, stimulating stronger demand for home loans. Currently, preferential home loan rates have dropped to as low as 5-6% per year at some banks.

Additionally, with signs of soaring apartment prices, prospective homebuyers may have felt a sense of urgency and decided to borrow more from banks to make purchases, fearing that prices would continue to rise. In reality, many real estate brokers, while advising clients, urged and warned buyers about the potential for price increases if they didn’t buy immediately, pushing transaction prices higher than actual values.

The Ministry of Construction attributes the localized price increases in some major cities like Hanoi and Ho Chi Minh City to the continued limited supply of new apartments and the small number of new projects entering the market. The scarcity of mid-range and affordable housing over the past period has contributed to price increases in projects, and there are also concerns about price manipulation by speculators. The recent decision by a developer to cancel purchase agreements with hundreds of customers and accept penalty interest due to a sharp rise in new price levels reflects the market’s heat.

Notably, the recent proposal to tax second properties may have influenced investors’ psychology, leading to earlier purchases and more speculative investments if the proposal is officially legislated. This could also contribute to the increased demand for home loans. For instance, in major cities like Beijing, Shanghai, and Shenzhen, buyers of a second property must make a down payment of 60-85% of the apartment’s value, and the tax also heavily impacts the second and subsequent properties…

Are Potential Risks Accumulating?

However, the reality shows that the growth of real estate consumer credit has been modest, with the main driver being business real estate credit. Specifically, since 2017, the SBV has separately tracked business real estate credit (lending to real estate businesses) and consumer credit (individuals buying or renovating homes). The results for 2017-2023 also show strong growth in business real estate credit.

For instance, in 2023, business real estate credit growth reached 35.38%, significantly higher than the overall credit growth in the real estate sector and the overall economy. In contrast, consumer real estate credit increased by a meager 1.08%. In the first half of 2024, real estate credit grew by 4.6%, with business real estate credit increasing by 10.29%, while consumer real estate outstanding balances rose by only 1.15%.

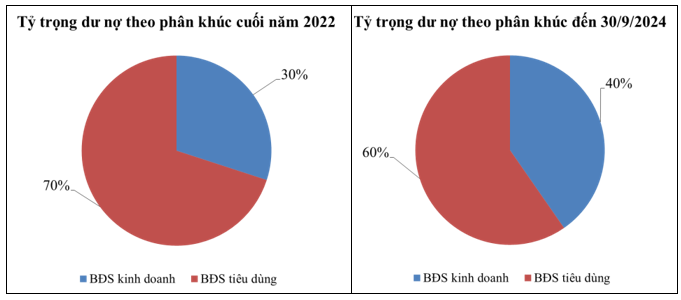

According to the latest data as of Q3 2024, business real estate credit growth reached 16%, far surpassing the 4.62% growth in consumer real estate credit. With such a significant growth divergence, the proportion of business real estate credit in total real estate credit has increased to 40% from 30% at the end of 2022, while consumer real estate credit decreased from 70% to 60% during the same period.

|

Strong Growth in Business Real Estate Credit since 2023

|

According to the SBV, the decrease in credit for self-use purposes while business real estate credit surges is noteworthy. The declining trend in credit demand for real estate purchases somewhat reflects the softening market demand compared to previous periods. In reality, outstanding balances for projects investing in urban area development, housing development, office projects, industrial parks, hotels, and restaurant construction and repair for sale or lease have all increased. In contrast, lending for land-use rights purchases and tourism resort project investments has decreased.

Analysts suggest that, during 2021-2022, individuals leveraged financial instruments to invest in real estate excessively. When the market encountered liquidity challenges and rising interest rates, many investors were forced to cut losses. Therefore, the demand for real estate investment loans has decreased, and only those with a genuine need for a home are willing to borrow from banks.

The robust growth in business real estate credit could be attributed to the following factors. Firstly, with the enactment of three laws—the Housing Law 2023, the Real Estate Business Law 2023, and the Land Law 2024—legal issues in the real estate market have been addressed, giving developers more confidence to borrow from banks to initiate projects.

| According to the latest data for the first nine months of 2024, business real estate credit growth reached 16%, far surpassing the 4.62% growth in consumer real estate credit. This significant divergence has shifted the proportion of business real estate credit in total real estate credit to 40%, up from 30% at the end of 2022, while consumer real estate credit decreased from 70% to 60% during the same period. |

Secondly, with the corporate bond market still facing challenges, real estate businesses cannot easily raise funds through bond issuances as they did in previous years, prompting them to turn back to bank credit. Some eligible enterprises may even proactively borrow from banks to repurchase their previously issued bonds.

Additionally, many real estate businesses are still struggling with large stagnant projects, challenging product sales, and significant negative cash flow, impacting their ability to service bank debts. Therefore, it is possible that banks have had to restructure these customers’ debts by capitalizing interest, thereby increasing the outstanding balances and impacting the growth of business real estate credit.

Nevertheless, with the increase in real estate credit outstanding balances concentrated on the supply side of the market (developers) and the lower growth on the demand side (homebuyers), there could be potential risks. As supply continues to grow while demand remains weak, loans to project developers and restructured debts may become non-performing in the future, a concern that cannot be overlooked.

The Soaring Property Prices: Mortgage Lending Faces Challenges

The impetus for credit growth is heavily reliant on the real estate sector, particularly on housing loans. While real estate credit has increased in the first seven months, housing loans have lagged, despite banks offering attractive interest rates.

The Rising Tide of Mortgage Rates: Navigating the Shifting Landscape

The era of cheap money might be coming to an end as several banks have started to increase their fixed-rate and floating-rate mortgage promotions. These banks are now offering rates that are 0.5-1% higher than before for the first 1-3 years of a mortgage. This has sparked concerns among homeowners and potential buyers alike, who fear that the days of easily accessible and affordable loans may soon be over.

Does Cooling Loan Interest Rates Fuel the Real Estate Market?

The banking sector has loosened its grip on mortgage lending, providing a much-needed boost to the stagnant real estate market. However, this has not translated into a significant increase in transactions. Both investors and genuine homebuyers remain cautious, adopting a wait-and-see approach. This hesitancy in the market underscores the need for a strategic shift in how we approach and communicate with potential buyers.