Xây Dựng Hòa Bình Joint Stock Company (HBC) recently released its Q3/2024 financial statements with notable figures.

Specifically, HBC’s Q3/2024 net revenue was nearly VND 975 billion, a 49% decrease compared to the same period last year. However, thanks to a 51% reduction in cost of goods sold, gross profit increased by 52% to nearly VND 61 billion.

Financial income was negative at over VND 22 billion, while the same period last year recorded nearly VND 31 billion.

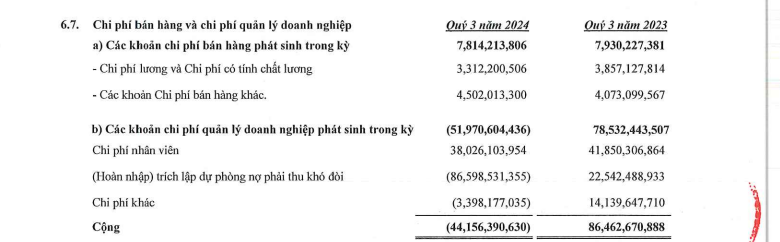

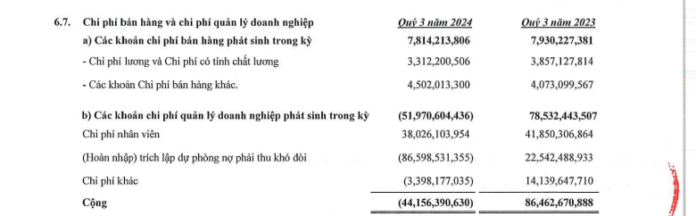

Financial expenses improved from VND 145 billion to over VND 72 billion, mainly due to reduced interest expenses. Selling expenses slightly decreased from VND 7.9 billion to VND 7.8 billion.

Notably, management expenses were negative at nearly VND 52 billion. According to the financial statements, this expense was negative due to the company’s reversal of allowance for doubtful accounts of nearly VND 87 billion and other expenses of over VND 3 billion.

Source: HBC’s Q3/2024 Financial Statements

Thanks to reduced cost of goods sold and the reversal of allowance for doubtful accounts, HBC recorded a net profit of nearly VND 12.7 billion in Q3/2024, while the same period last year recorded a net loss of over VND 170 billion.

For the first nine months of 2024, Hòa Bình Construction reported net revenue of VND 4,787 billion, a 10.6% decrease compared to the same period last year, and a net profit of VND 842 billion, while the same period last year recorded a net loss of VND 884 billion.

As of September 30, 2024, HBC’s total assets increased slightly from the beginning of the year to VND 15,303 billion. Cash and cash equivalents decreased by 62.8%, to VND 144.5 billion. Inventories also decreased significantly from VND 2,278 billion to VND 1,787 billion.

HBC’s Q3/2024 financial statements recorded the value of real estate inventory as of September 30, 2024, at over VND 220 billion. Of this, 16 Gamuda Land apartments accounted for the largest proportion with an original value of nearly VND 107 billion, a land lot in the Hòa Quý – Đồng Nai riverside urban area in Đà Nẵng city at nearly VND 41 billion, and 3 Léman apartments at nearly VND 35 billion.

Long-term production and business expenses in progress were recorded at nearly VND 742 billion for the real estate project, while no such expense was recorded at the beginning of the year.

On the other side of the balance sheet, payables decreased by 10% to VND 13,658 billion, mostly short-term. This includes VND 4,090 billion in short-term accounts payable and nearly VND 3,746 billion in short-term financial lease liabilities.

In other news, HBC has recently undergone several changes in its senior management. Specifically, the company appointed Mr. Nguyễn Kinh Luân as Deputy General Director, effective November 1, 2024.

Mr. Luân will be directly managed by the General Director of the company, performing the assigned responsibilities and authorities, complying with the company’s regulations and current policies, and adhering to relevant laws regarding the assigned position.

Previously, Hòa Bình Construction decided to relieve Mr. Nguyễn Hùng Cường from his position as Deputy General Director at his request, effective September 21, 2024.

It is known that Mr. Nguyễn Kinh Luân used to hold the position of Deputy General Director of Searefico Joint Stock Company and was relieved from this position on June 1, 2024.

Hòa Bình Construction also decided to relieve Ms. Phan Thị Cẩm Hằng from her position as Chief Accountant, effective November 1, 2024. Ms. Hằng is responsible for handing over all relevant tasks, documents, and records to the concerned departments in writing.

At the same time, the company appointed Ms. Lê Thị Thu Trang as the new Chief Accountant, effective November 1, 2024. Ms. Trang will be directly managed by the Chief Financial Officer, performing the assigned responsibilities and authorities, complying with the company’s regulations and current policies, and adhering to relevant laws regarding the assigned position.

The Young and Dynamic Leadership of FECON: Unveiling the New CEO and 80s-born Vice President.

Introducing FECON’s newly appointed CEO, Mr. Nguyen Thanh Tung, who assumed his role on July 5th. With a wealth of experience and a deep understanding of the industry, Mr. Tung is poised to lead FECON towards new heights of success. Stay tuned for exciting developments as his vision and expertise steer the company forward.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)