On the afternoon of October 29, the National Assembly discussed the draft Law on Value Added Tax (amended) in the hall.

Earlier that morning, Le Quang Manh, Chairman of the Finance and Budget Committee, presented a report explaining, adopting, and editing the draft amended Law on Value Added Tax. The National Assembly Standing Committee would like to maintain the proposal of a 5% VAT rate for fertilizers as in the draft Law previously submitted by the Government to the National Assembly at the 7th session.

RISK OF FERTILIZER PRODUCERS STOPPING PRODUCTION DUE TO NON-OUTPUT VAT

Discussing in the hall, delegate Trinh Xuan An from Dong Nai province, thought that applying a 5% tax rate on fertilizers would benefit the State, businesses, and people, and would not cause any harm.

According to Mr. An, value-added tax must have a cyclical nature, and input and output must go hand in hand. There is no principle that output is not subject to tax, but input is deductible. Since we made the Law 71 to reduce the value-added tax from 5% to non-taxable, at that time we intended to include it, and then we would allow deductions for enterprises. Later, we were no longer allowed to deduct, which inadvertently put businesses at a disadvantage.

Now, if a business buys an input product for about 80 VND, they will have to pay 8 VND in value-added tax, and sell the fertilizer for 100 VND. If this amount is not deductible, in principle, they must include it in the cost and add it to the price, bringing the price to 108 VND. If we apply a 5% rate, the business will be able to deduct the 8 VND input and add another 5%, bringing the price down to 105 VND.

“When making prices, we must follow the principles of accounting and finance, and it is not a matter of course that we apply a 5% tax rate, and the price increases by 5%. We have to calculate the nature of the Law on Tax Treatment in this way,” Mr. An emphasized.

A delegate from Hoa Binh province said that during the period of surplus fertilizer supply in the world market from 2015 to 2020 before the Covid-19 pandemic, the price of fertilizer on the world market decreased sharply, making the production cost of domestic fertilizer unable to compete with imported prices. Domestic enterprises all had negative growth rates, and some units incurred losses, risking bankruptcy.

If this amendment to the Law on Value Added Tax does not address the above issue, the domestic fertilizer production industry will continue to be discriminated against compared to all other manufacturing industries as it falls outside the scope of value-added tax application. There is a risk of returning to the state of decline and cessation of production as in the 2015-2020 period. When fertilizers are subject to output VAT, enterprises will be able to deduct input VAT, thereby reducing investment pressure.

Therefore, if the value-added tax policy for fertilizers is changed from tax exemption to tax application, it will benefit the three parties: the State, enterprises, and farmers, reducing dependence on imported fertilizers.

Countries around the world apply value-added tax to the fertilizer industry. For example, China, the largest producer and consumer of fertilizers in the world, currently imposes an 11% value-added tax on fertilizers. Similarly, Russia, the world’s largest fertilizer exporter, also applies a value-added tax rate to the fertilizer industry to improve crop yield and quality, ensuring food security and sustainable agricultural development.

EMPATHIZE WITH FARMERS BUT DON’T FORGET BUSINESSES

Delegate Cam Thi Man from Thanh Hoa province shared the view that applying a 5% tax rate is, at the same time, a way to achieve the goal of expanding the tax mechanism, moving towards applying a single tax rate, and supporting domestic production recovery. In the long run, it will create sustainability and stability in the domestic fertilizer input supply, reducing dependence on imported fertilizers, thereby lowering fertilizer prices. As a result, both farmers and domestic manufacturing enterprises will benefit from this change.

Delegate Truong Trong Nghia from Ho Chi Minh City also fully agreed with the opinions of the delegates who supported and sympathized with the farmers. However, we should not forget about the businesses that employ millions of laborers and workers. If they cannot survive and go bankrupt, what will happen to these workers?

“Therefore, I offer a perspective to broaden our view, not just focusing on supporting farmers. When we become more self-reliant and autonomous in various fields, our government can exert more influence and find ways to reduce the burden on consumers,” said Mr. Nghia.

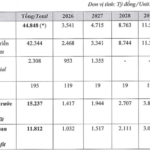

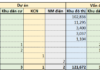

However, delegate Nguyen Truong Giang from Dak Nong province thought that through research on the dossiers and reports of the Government, it was found that if a 5% tax rate were applied to fertilizers, about 5,700 billion VND would be collected, and about 500 billion VND would be refunded to domestic fertilizer-producing enterprises.

A preliminary calculation based on the 27% market share of imported fertilizers out of the total 5,700 billion VND yields 1,500 billion VND in revenue from imported fertilizers for the state budget. Thus, after deducting 1,500 billion VND from the 5,700 billion VND, the remaining 4,200 billion VND is the amount that domestic fertilizers have to pay. If we refund 1,500 billion VND to enterprises, there is definitely room for a price reduction in the domestic market.

However, not all of the 4,200 billion VND will be refunded, but only 1,500 billion VND. This needs to be recalculated. Therefore, it is requested to report fully and accurately on the total domestic output and to have a tax refund mechanism that ensures fairness. It is suggested to apply a different tax rate, not 5%, but possibly half or 2%, to sufficiently refund taxes to domestic fertilizer-producing enterprises.

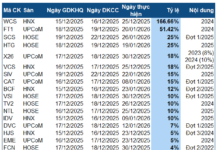

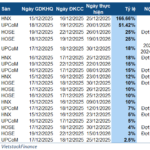

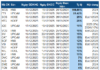

The Capital’s First Electric Vehicle Charging Station Unveiled by Energy Giant: A Peek into Q3 2024’s Impressive Five-Fold Profit Spike

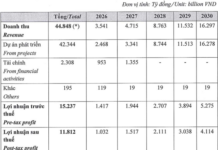

For the first nine months of this year, PV Power’s revenue reached VND 21,686 billion, with an after-tax profit of VND 1,111 billion, an increase of 1% and 26% respectively compared to the same period last year.

The Evolution of Safe High-Speed Rail: A Global Perspective on Accident-Free Networks.

The key advantage of the North-South high-speed rail network is its safety. A prime example is Japan’s Shinkansen, which has been operational since 1964 and has an impeccable safety record with zero accidents to date. This trend is echoed globally. High-speed electric railways are environmentally friendly and offer a safe and sustainable mode of transport.