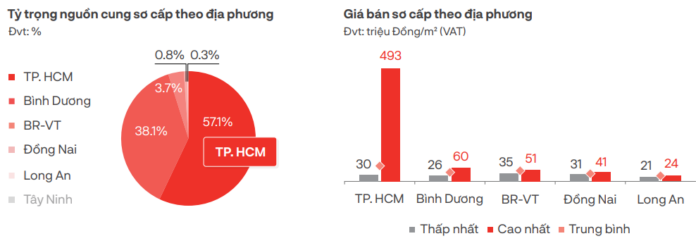

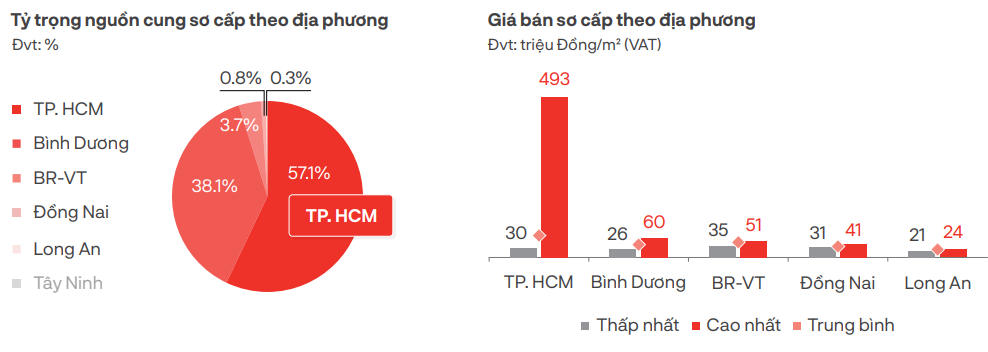

According to the Q3 2024 report on the Ho Chi Minh City residential real estate market and its vicinity by DKRA, the primary supply of apartments across the market stood at 13,408 units, a 17% decrease from the same period last year. The projects are mainly located in two markets: Ho Chi Minh City, accounting for 57%, and Binh Duong with 38%.

Sales reached 2,671 units, a 39% drop from the previous year, largely due to the lack of new project launches and buyers adopting a “wait-and-see” approach.

Transactions were concentrated in mid-range projects priced between VND 40-55 million/sqm in Ho Chi Minh City and VND 30-35 million/sqm in Binh Duong. These projects mostly had completed legal procedures and rapid construction progress. Notably, the primary selling price of apartments in Ho Chi Minh City peaked at VND 493 million/sqm, while the highest price in Binh Duong was only VND 60 million.

DKRA stated that primary selling prices remained high due to the pressure of development project input costs. At the same time, demand was stimulated by various policies, including quick payment discounts, principal grace periods, and interest rate subsidies. Secondary selling prices increased by 5-9% compared to the same period, focusing on projects that had been handed over, with favorable locations and convenient connections to the center.

Source: DKRA

|

With many projects in the pre-launch marketing phase, DKRA forecasts that new supply in Q4 will increase compared to Q3 2024, ranging between 4,000-6,000 units, mainly in Ho Chi Minh City and Binh Duong. The Class A apartment segment continues to dominate in Ho Chi Minh City, while the B and C segments lead new supply in the adjacent provincial markets.

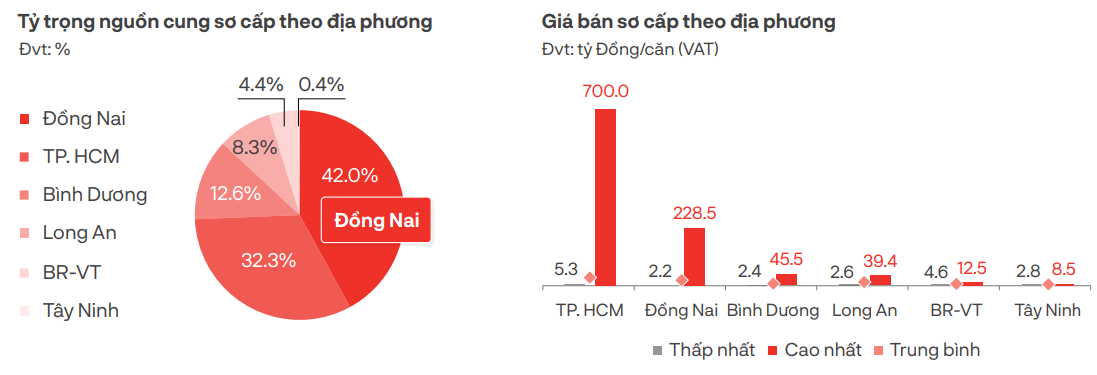

Regarding the villa – townhouse segment, in Q3 2024, the supply reached 5,363 units, a 16% increase, and primary consumption was 58 units, 6.8 times higher than the same period last year. Over 70% of the supply was allocated in Dong Nai and Ho Chi Minh City.

The market demand showed positive growth compared to the previous year. However, the overall consumption of the market remained low, with a rate of about 11% of the total supply.

The primary selling price of villas and townhouses in Ho Chi Minh City peaked at VND 700 billion/unit and the lowest at VND 5.3 billion. In contrast, Dong Nai’s highest price was VND 228.5 billion, and the lowest was VND 2.2 billion.

According to DKRA, the primary price level has not fluctuated much since the beginning of the year. Various policies, including discounts, launch day promotions, and bank support, have been widely applied to improve liquidity. Additionally, the secondary market prices increased by approximately 4% from the previous quarter, and transactions improved compared to the same period last year. However, significant short-term liquidity breakthroughs are not expected.

DKRA also predicts that new villa and townhouse supply in Q4 2024 will slightly increase from the previous quarter, reaching about 550-650 units, mainly in Ho Chi Minh City, Binh Duong, Dong Nai, and Long An. Positive economic growth, improved legal framework, and low-interest rates for real estate loans are expected to lay the foundation for the market’s recovery in the coming time.

Source: DKRA

|

Uni Complex Townhomes: Alleviating the Scarcity of Townhome Supply in Binh Duong

The wave of investment in Binh Duong is transformative, driving the growth of premium services and the demand for quality living spaces. Uni Complex is strategically located within the modern infrastructure of Binh Duong New City, offering an attractive proposition to customers with competitive pricing and the potential for future value appreciation.

Unlocking Public Investment Capital: No More Counting by Days!

Maintaining the economic growth target of at least 7% for 2024, Ho Chi Minh City is implementing a range of key solutions, with a particular focus on expediting the disbursement of public investment capital.

Unlocking Transit-Oriented Development: 11 Strategic Locations in Ho Chi Minh City

Introducing 11 Transit-Oriented Development (TOD) sites strategically located along the Metro 1 and Metro 2 lines, as well as the Ring Road 3 corridor. These sites offer unparalleled potential for integrated transportation and urban development, creating vibrant, connected communities. With easy access to rapid transit, these locations are primed for transformation into bustling hubs that seamlessly blend work, life, and play. Imagine vibrant neighborhoods where residents can effortlessly commute, enjoy convenient amenities, and experience a truly integrated urban lifestyle. These 11 TOD sites are the future of urban development, bringing together the best of connectivity, sustainability, and liveability.