The VN-Index witnessed a surprising downturn towards the end of the explosive trading session on November 7th. At the close, the VN-Index dipped slightly by 1.53 points to 1,259.75. While liquidity improved, it remained low, with a matching value of approximately VND 11,400 billion on the HOSE floor.

In terms of foreign trading, the net selling trend continued as foreign investors offloaded over VND 419 billion during today’s session.

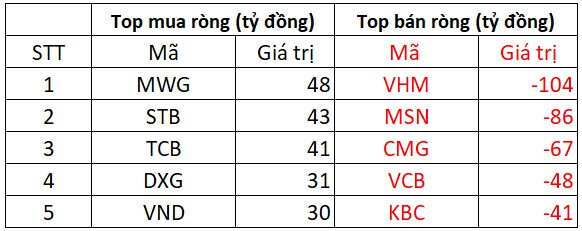

Foreign investors net sold a substantial VND 391 billion on HoSE

On the selling side, VHM experienced the most significant pressure from foreign investors, with a net sell-off of VND 104 billion. Additionally, MSN and CMG also faced net selling of VND 86 billion and VND 67 billion, respectively, while VCB and KBC witnessed net foreign selling of over VND 40 billion each.

Conversely, MWG, STB, and TCB emerged as the top stocks purchased by foreign investors on HOSE, with net buying values of VND 48 billion, VND 43 billion, and VND 41 billion, respectively. Foreign investors also net bought DXG and VND, with each stock attracting approximately VND 30 billion.

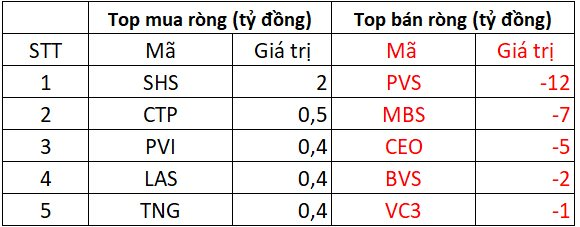

Foreign investors net sold approximately VND 26 billion on HNX

On the buying side, SHS witnessed the highest net buying, with a value of VND 2 billion. Following closely, CTP, PVI, LAS, and TNG attracted net buying in the range of VND 400-500 million each.

Conversely, PVS experienced the most substantial net selling, amounting to VND 12 billion. MBS, CEO, and BVS also faced net selling in the range of a few billion VND each.

Foreign investors net sold around VND 2 billion on UPCOM

On the buying side, BSR and VEA topped the list, with net buying values of VND 3 billion and VND 1 billion, respectively. Additionally, ABI, QNS, and KLB witnessed net buying in the range of a few hundred million VND each.

Conversely, QTP, ACV, MCH, and HNG experienced net selling by foreign investors, with each stock witnessing outflows of VND 2 billion. CST also faced minor net selling.

Why Did Vietnamese Stocks Soar Post US Presidential Election?

The VN-Index soared and closed at a record high right after the US Presidential election results were announced, surprising many investors.

The Market Beat: A Tale of Diverging Fortunes

The market ended the session in negative territory, with the VN-Index down 2.98 points (-0.23%) to 1,287.94 and the HNX-Index falling 0.8 points (-0.34%) to 234.91. Bears dominated as 436 stocks declined while 272 advanced. The large-cap VN30-Index was a mixed bag, with 19 decliners, 8 gainers, and 3 unchanged stocks.

“Vietstock Weekly: A Cautious Outlook for the Near Future”

The sharp dip over the weekend curtailed VN-Index’s upward momentum. This pullback prevented the index from breaching the middle line of the Bollinger Bands. Moreover, the trading volume is showing signs of waning and remains below the 20-week average, indicating heightened investor caution. Currently, the MACD indicator continues to trend downward, issuing a sell signal that reflects a short-term outlook that is not yet optimistic.