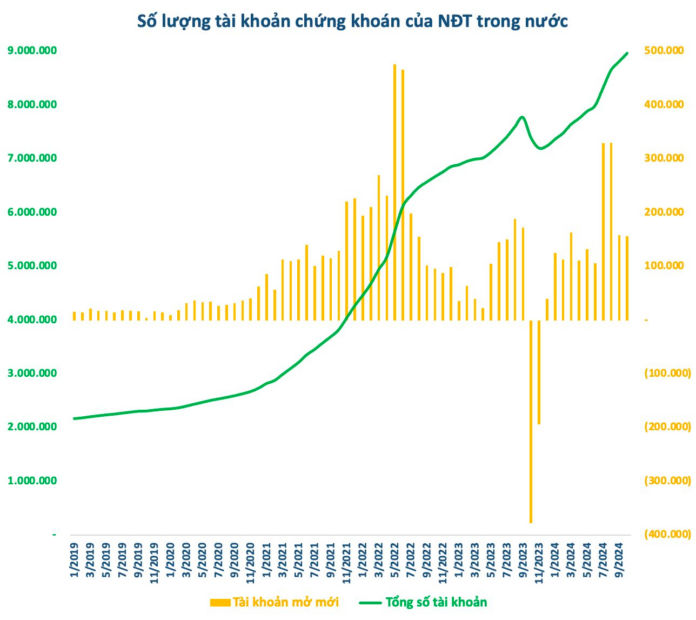

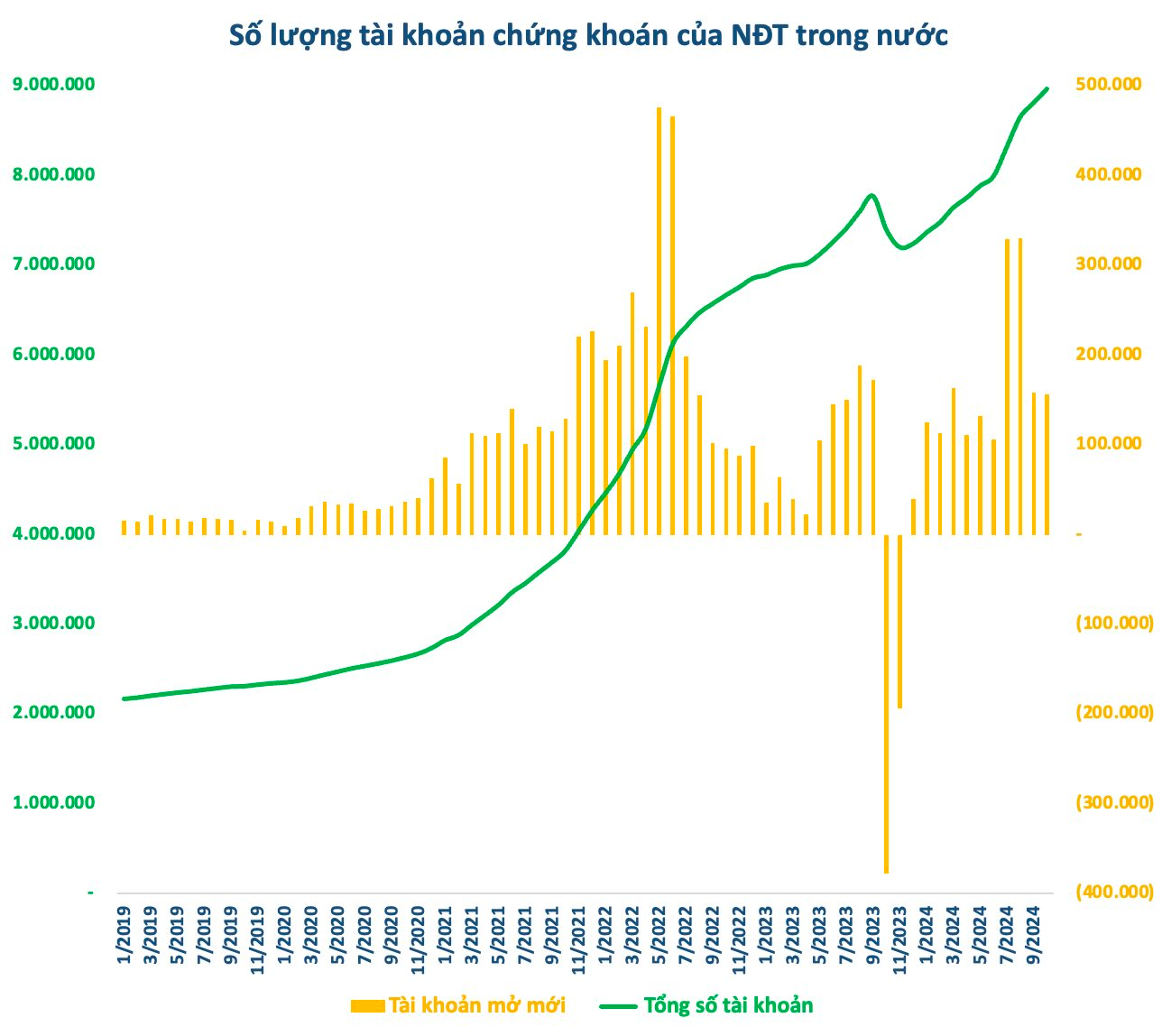

According to data from the Vietnam Securities Depository Center (VSD), the number of domestic investor accounts increased by nearly 157,000 accounts in October 2024, a slight decrease from the previous month. The majority of the increase came from individuals, while organizations only added 121 accounts.

Cumulatively, the number of domestic securities accounts has increased by 1.73 million so far this year. As of the end of October, individual investors held a total of nearly 9 million accounts, equivalent to about 9% of the population. Thus, Vietnamese securities have achieved the target of 9 million accounts ahead of the 2025 deadline and are now aiming for 11 million accounts by 2030.

The number of securities accounts slowed down as the market continuously struggled before the psychological resistance threshold of 1,300 points. The multiple failures to conquer this milestone have somewhat affected investor psychology. In addition, geopolitical instabilities in many regions of the world and major elections have also made investors cautious.

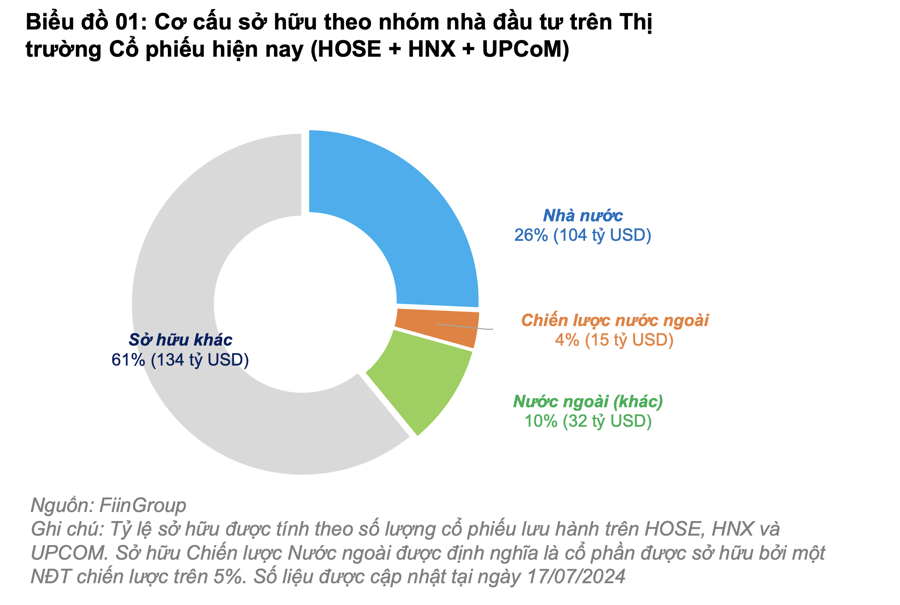

Notably, after a period of reduced selling, foreign investors returned to strong selling. In October, the net selling value on HoSE reached approximately VND 10,000 billion. The selling continued into the first days of November. The continuous outflow of foreign capital is partly due to the lack of attractive investment opportunities in Vietnamese securities.

Despite net selling, the number of foreign investor accounts in Vietnam continued to increase month by month. Specifically, the number of foreign accounts increased by 230 accounts in October, higher than the figure of 202 in the previous month. Individuals increased by 202 accounts while organizations increased by 28 accounts. The total number of foreign investor accounts now stands at 47,636.

Circular 68/2024/TT-BTC, which took effect on November 2, is expected to contribute to attracting foreign capital back to Vietnamese securities. Accordingly, foreign institutional investors are allowed to place buy orders for stocks without requiring sufficient funds. Securities companies will assess the payment risks of this group of investors to determine the amount of money required when placing buy orders for stocks according to the agreement between the two parties.

According to Mr. Barry Weisblatt David, Director of Analysis Division of VNDIRECT Securities Corporation, Circular 68 will positively improve market psychology and buying power of individual investors. In addition, foreign ETFs that mimic the Vietnamese market may increase their assets under management as investors in foreign markets look forward to the market’s upgrade to emerging market status. This could be an important event and help boost stock prices in the first quarter of 2025.

When Vietnam is officially upgraded by FTSE in September and Vietnamese companies are included in the emerging market indices, we can expect large capital inflows from emerging market ETFs. While there are varying estimates, I believe that a range of $500 million to less than $1 billion is reasonable. The beneficiaries may include businesses that currently dominate the FTSE FM index, including HPG, VHM, VCB, VIC, and VNM.

The Stock Market Week of October 28 – November 1, 2024: A Fragile Recovery

The VN-Index experienced a volatile week with alternating sessions of gains and losses. The cautious sentiment among investors is evident as trading volume remains below the 20-day average. Moreover, the continuous net selling by foreign investors will likely impact the growth trajectory of the VN-Index in the coming period.

The Foreigners’ Sell-Off: Unraveling the 1.3 Trillion VND Trade in Blue-Chip Stocks

The foreign transactions went against the positive trend of the market session, as they offloaded a net sell value of VND 1,631 billion across the market.