HoSE-listed Truong Thanh Wood Industry Corporation (code: TTF) has recently announced that Casadora Furniture JSC (a 60%-owned subsidiary of TTF) has received an investment certificate for Dubai. This move marks Truong Thanh Wood’s strategic expansion into the Middle East market with multiple upscale real estate projects.

Vietnam’s Ministry of Planning and Investment granted Casadora Furniture JSC an overseas investment registration certificate on June 5, 2024, with the name of the economic organization established abroad as Belmonte Design Services L.L.C. The investment capital is $500,000 (over VND 12 billion) from equity capital. The investment form will be to buy shares of the foreign economic organization to participate in managing that organization.

The operating objective is to engage in the business of designing world-renowned furniture brands and expanding the presence of furniture design in Vietnam under the names of major global brands in the Middle East region.

In terms of financial results for the third quarter of 2024, Truong Thanh Wood recorded net revenue of over VND 236 billion, a 39% decrease compared to the same period last year. The company incurred a net loss of over VND 21 billion, while in the same period last year, the loss was over VND 6 billion. Accumulated losses for the first nine months of the year amounted to nearly VND 27 billion, with cumulative losses as of September 30 reaching nearly VND 3,268 billion.

In its explanation, Truong Thanh Wood attributed the decline in export revenue to the challenges faced by major customers in their respective markets. Additionally, increased logistics costs and global transportation disruptions due to conflicts in certain regions have led customers to delay deliveries until the fourth quarter of 2024.

Furthermore, revenue from domestic projects decreased due to delays in real estate developers’ implementation schedules and the impact of natural disasters in the northern provinces, affecting the company’s profits.

To address these issues, Truong Thanh Wood is focusing on expanding and seeking new customers in the European, American, and Asian markets, with a particular emphasis on Dubai, Australia, and East Asia, to increase output in the fourth quarter. The company also plans to restructure its inefficient subsidiaries to allocate resources for the development of new business projects.

In the stock market, TTF shares are currently trading at VND 3,040 per share, equivalent to the price of a cup of iced tea. Compared to the beginning of the year, the stock has dropped by 28% in market value. While the market capitalization stands at approximately VND 1,200 billion, the charter capital exceeds VND 3,900 billion. TTF shares have been on the HoSE warning list since April 2022 due to accumulated losses.

The Foreign Sell-Off: Nearly $37 Million of Vietnamese Stocks Sold by Foreigners – What’s the Reason Behind this Massive Dump?

In the afternoon trading session, MSN stock witnessed intense selling pressure from foreign investors, resulting in a significant outflow of VND 169 billion.

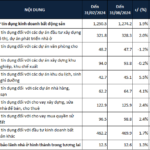

The Ultimate Guide to Unlocking the Mystery of $58.3 Billion in Real Estate Loans

In its Q3 2024 report on the housing and real estate market, the Ministry of Construction revealed that credit outstanding for real estate business activities stood at nearly VND 1.27 quadrillion as of August 2024.