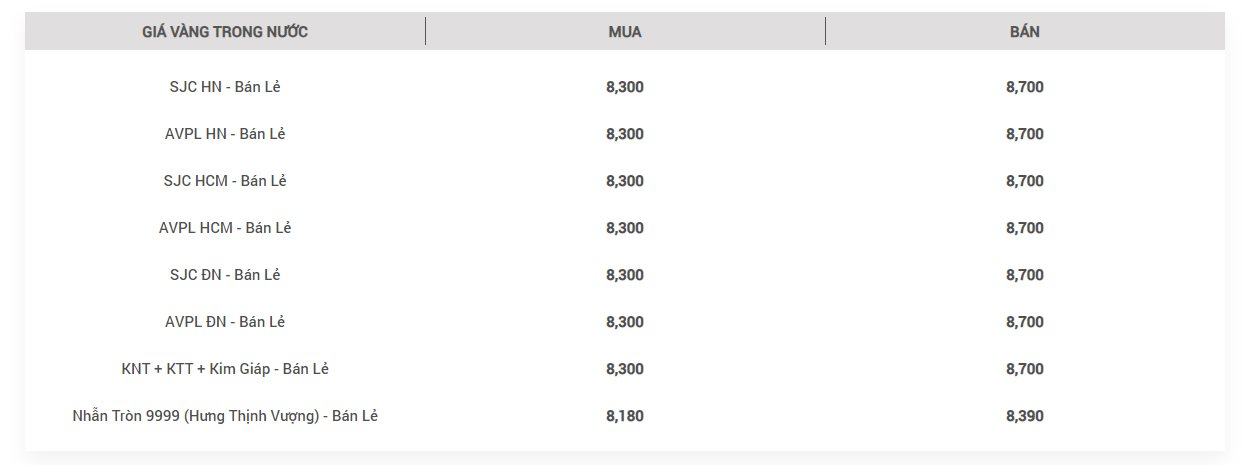

As of 4:00 pm, gold prices continued to fall, with SJC gold trading at just 81.0-85.5 million VND per tael. Since the opening, this gold type has lost 6 million VND per tael on the buying side and 3.5 million VND per tael on the selling side.

Those who bought SJC gold yesterday and sold it today could face losses of up to 8 million VND per tael.

With gold prices fluctuating wildly, many gold owners rushed to sell their holdings. However, selling gold proved more challenging than expected. Due to the large number of sellers, many gold shops stopped buying, leaving customers frustrated.

Gold prices plummet, many gold shops stop buying

In the global market, gold prices unexpectedly rebounded, rising from $2,641 to $2,662 per ounce. However, this recovery is modest compared to the previous loss of $100 per ounce.

When converted at the current VND/USD exchange rate, the world gold price is equivalent to 82 million VND per tael, excluding taxes and fees.

——————-

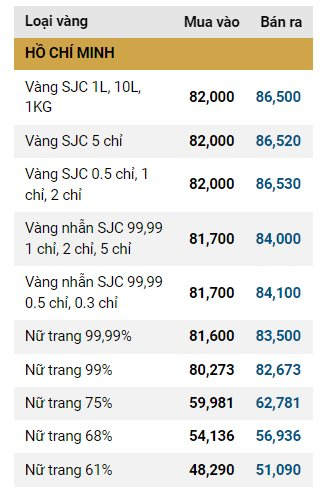

As of 2:00 pm, gold prices continued their downward trend. SJC gold is now trading at 82.0-86.5 million VND per tael, a decrease of 5 million VND per tael on the buying side and 2.5 million VND per tael on the selling side since the opening.

Gold ring prices also underwent adjustments, surprising many investors. Within just a few hours, this type of gold lost millions of VND per tael.

Gold ring prices continue to adjust downward

Specifically, DOJI listed the price of 9999 gold rings at 81.5-83.8 million VND per tael, while PNJ applied a rate of 82.9-84.0 million VND per tael.

Meanwhile, SJC listed gold ring prices at 81.7-84.0 million VND per tael, and Bao Tin Minh Chau adjusted their rates to 81.5-84.0 million VND per tael.

Gold ring prices drop on November 7 at SJC

——————-

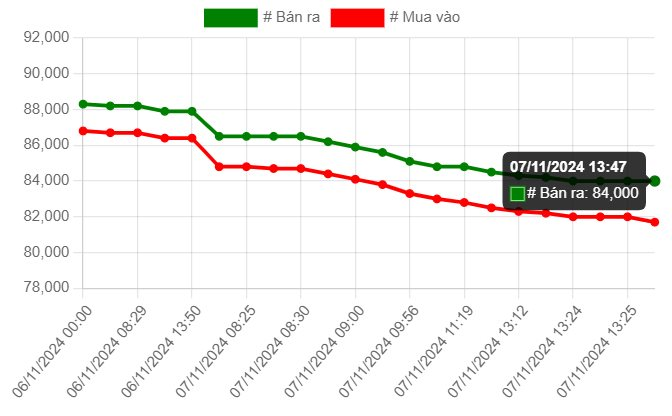

At noon on November 7, at 12:45 pm, domestic gold prices continued to plunge, with the daily decline reaching 5-6 million VND per tael.

SJC gold is now quoted at 83.0-87.0 million VND per tael, a decrease of 4 million VND per tael on the buying side and 2 million VND per tael on the selling side.

Gold ring prices have once again slipped below the 85 million VND per tael mark. SJC applied a rate of 82.5-84.6 million VND per tael, a decrease of 5 million VND per tael since the morning. As a result, those who bought gold yesterday and sold it today could face losses of up to 5-6 million VND per tael.

Some places adjusted their gold prices below 84 million VND per tael, with DOJI reducing their rate to 81.8-83.9 million VND per tael.

Gold ring prices drop below 84 million VND per tael

——————-

On the morning of November 7, domestic gold prices plummeted, with declines of up to 1.5-2 million VND per tael.

Specifically, at 9:00 am, SJC gold prices dropped by 2 million VND per tael on the buying side and 1.5 million VND per tael on the selling side, reaching 85.0-87.5 million VND per tael.

Gold ring prices in the market also fell by about 2 million VND per tael, falling far below the 87 million VND per tael mark. SJC listed this type of gold at 84.7-86.6 million VND per tael, while DOJI applied a rate of 85.4-86.8 million VND per tael. Bao Tin Minh Chau quoted 87.0-89.0 million VND per tael, and PNJ applied a rate of 85.6-86.9 million VND per tael.

Gold prices drop sharply on November 7 morning

In the international market, gold prices plunged on the night of November 6 (Vietnam time), losing more than $100 per ounce. As of 9:00 am on November 7, the spot gold price stood at $2,646 per ounce.

The precious metal tumbled after the Republican candidate, Donald Trump, won the US presidential election. Trump’s victory was a surprise, as polls had predicted a close race, and there were no protests or disturbances following the announcement of the results. This led investors to abandon safe, long-term gold investments. Additionally, a stronger US dollar and higher US Treasury bond yields put downward pressure on gold prices.

Gold prices plunge as the US dollar strengthens

The US Dollar Index surged to its highest level since July, while yields on 10-year US Treasury bonds also rose sharply. The yield on the 10-year US Treasury bond is currently at 4.4%. Trump’s victory has led experts to predict higher inflation, which could make the Fed more hawkish.

While gold prices crashed, Bitcoin prices surged by more than $5,000 to a record high, also due to Trump’s victory. During his campaign, Trump declared his support for Bitcoin.

Another important event to note is the Federal Open Market Committee (FOMC) meeting of the Federal Reserve (Fed), which will take place this week. The meeting starts on Wednesday morning and concludes on Thursday afternoon with a statement from the FOMC and a press conference by Fed Chairman Jerome Powell. Most analysts believe the Fed will cut the key interest rate by another 0.25%, especially after the weak US jobs report released last Friday.

The Great Gold Crash: Investors Panic, Sending Prices Plummeting.

On the evening of November 6, investors rushed to offload gold, furiously dumping the precious metal and canceling long-term transactions.