Waiting for the 1,200-point region

According to experts from VPBankS, the current phase is a step back to move forward. The VN-Index has seen bottoms in November 2023 and November 2024, and smaller bottoms in April and August 2024, indicating a rising trend but in a sideway up direction.

Amid numerous challenges stemming from global information and capital flow fluctuations, numerous stocks remain anchored at their highest prices for the year. Therefore, the market needs to adjust to more attractive levels to entice mid- to long-term investors. Mr. Son anticipates that the 1,200-point region could be where investors time their purchases for the upcoming upswing.

In 2024, the banking group has already risen by approximately 20%, significantly outperforming the VN-Index’s 10% increase and serving as a pillar to prop up the index. If the banking sector index declines by another 5-7%, we can expect fresh capital to enter the market.

Mr. Son explains that while banking industry earnings reports have been impressive for some banks, stock prices have remained high even after the earnings season. Therefore, a slight adjustment in the banking sector index will attract new capital into the market.

Towards the end of 2024 and the beginning of 2025, with the cycle of decreasing interest rates and potential turbulence from President Donald Trump’s tax policies, any corrections present buying opportunities.

Foreign capital inflows are not likely to return soon

Foreign investors have been consistently selling, notably in MSN and VHM stocks. Mr. Son attributes this to the case of Korean funds divesting from MSN, which is a short-term impact specific to MSN. From a broader market perspective, international capital flows show signs of decreasing in Asia and Southeast Asia in the two weeks before and after Trump’s election victory.

Regarding the pressure on outflows through ETFs showing signs of abating in October, Mr. Son considers this a positive signal.

However, Mr. Son believes that foreign investors will resume net buying in the future rather than at present, as the USD remains high and capital flows into US stocks or digital currencies. Investors need to wait for the Trump effect to pass and for USD and US bond yields to cool down before capital flows into emerging markets and frontier markets become positive again.

Investors should prepare for the scenario of Donald Trump taking office as President in January 2025, and the potential impact on tariffs could begin as early as the start of 2025. This information may be reflected in advance in November-December 2024. Therefore, in the fourth quarter of 2024, there will be a bottom region due to the impact of foreign investors’ net selling, allowing investors to buy stocks for short-term opportunities and welcoming the rebound.

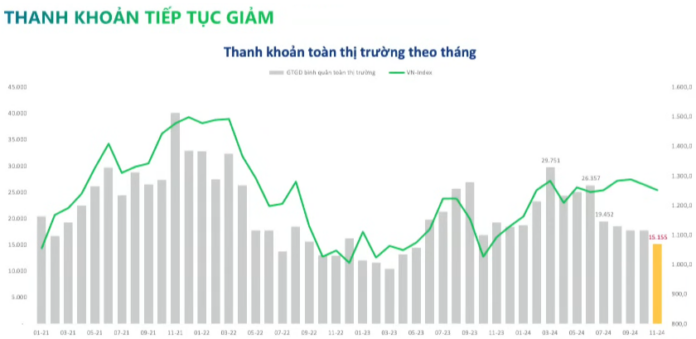

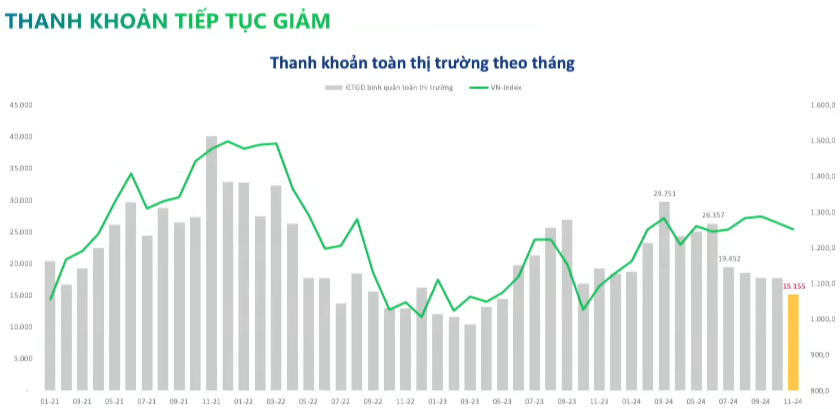

Why has liquidity decreased despite surpassing 9 million accounts?

October 2024 marked the first time the market surpassed 9 million accounts, but liquidity declined during this period. Commenting on this issue, Mr. Son attributed the decrease in liquidity to the absence of cheap money.

The reduction in liquidity is influenced by capital flow shifts, including outflows from Vietnam and Asia. Domestic individual investors acted as a support, preventing the market from plunging further when foreign investors net sold up to $3 billion.

From July-August 2024 until now, liquidity has also diminished due to a lack of investment opportunities and the need to service loan and bond payments.

Source: VTV Money

|

Nonetheless, when low liquidity combines with the index reaching a robust support region, it indicates the establishment of a new floor price and the onset of recovery. The most significant opportunities arise during the most pessimistic phases of the market. A review of November 2022 and October-November 2023 reveals that these periods marked the bottoms for both liquidity and index values.