I. MARKET ANALYSIS OF STOCKS ON 11/12/2024

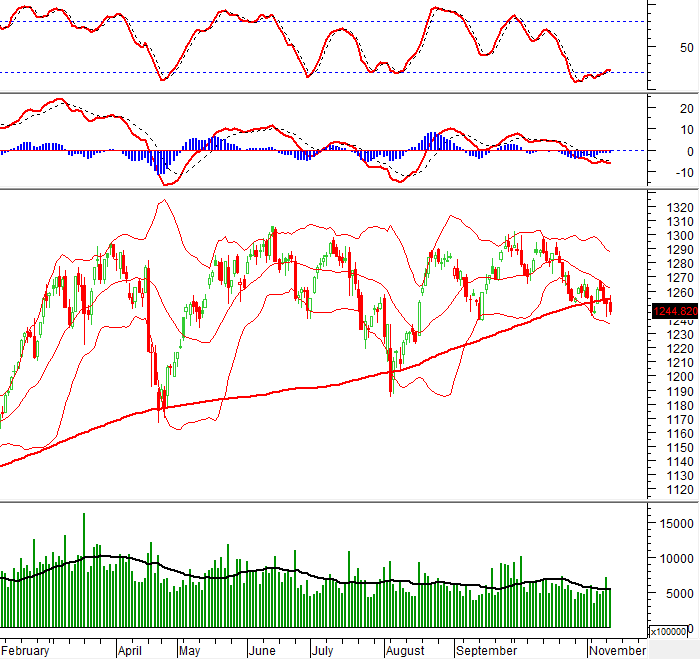

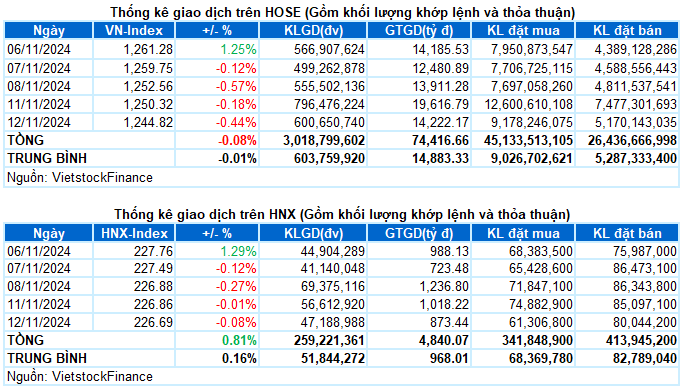

– The main indices decreased during the trading session on November 12th. The VN-Index closed 0.44% lower at 1,244.82 points, while the HNX-Index ended at 226.69 points, a 0.08% decrease compared to the previous session.

– The trading volume on the HOSE reached over 516 million units, a 27.5% decline from the previous session. On the HNX, the trading volume decreased by 22.4%, reaching over 38 million units.

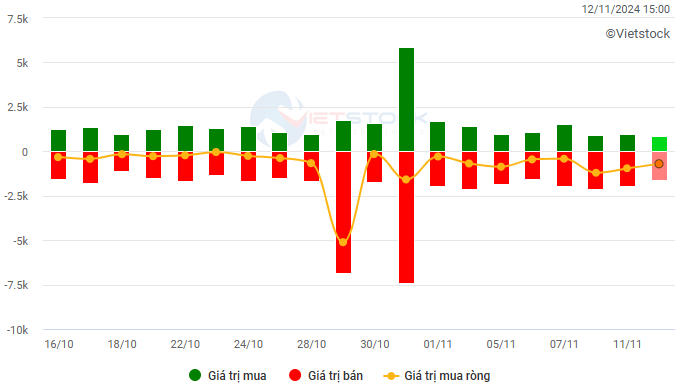

– Foreign investors continued to sell heavily on the HOSE, with a net sell value of nearly VND 680 billion, and also net sold more than VND 17 billion on the HNX.

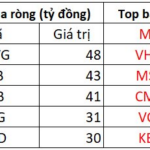

Trading value of foreign investors on the HOSE, HNX, and UPCOM on November 12, 2024. Unit: VND billion

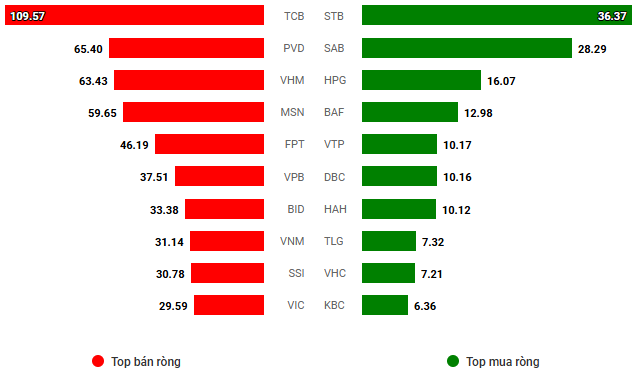

Net trading value by stock code. Unit: VND billion

– The positive effect of the previous session’s late rebound helped the market open quite positively today. However, the buying momentum quickly weakened as money flow was not strong enough to sustain the upward movement. Trading volume returned to a dull state, and the VN-Index gradually fell back below the reference level by the end of the morning session. In the afternoon session, the market situation did not show any signs of improvement. Selling pressure continued to increase, causing the red color to spread. The VN-Index closed the trading day on November 12 at 1,244.82 points, a decrease of 5.5 points compared to the previous session.

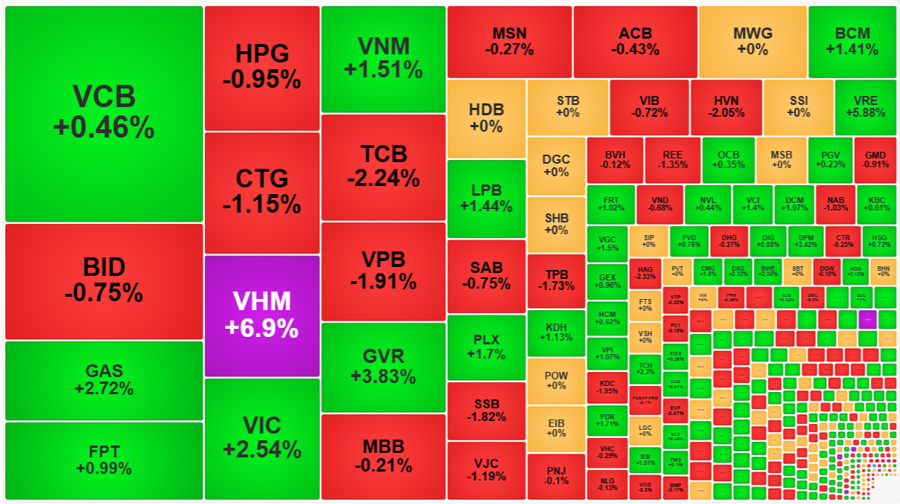

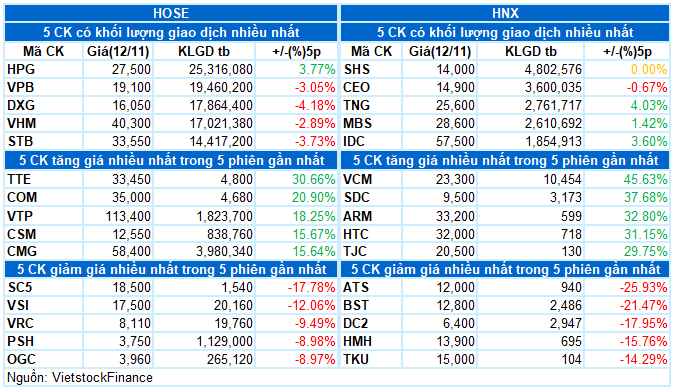

– In terms of impact, large-cap stocks continued to put heavy pressure on the overall market. 9 out of 10 stocks with the most negative influence today belonged to the VN30 group, led by MWG, CTG, and FPT, which took away nearly 2 points from the VN-Index. On the other hand, SAB, VTP, and HAG were the most positive influences, but they only helped the index increase by less than 1 point.

– The VN30-Index closed 0.65% lower at 1,301.95 points. Sellers dominated with 20 decreasing stocks, 5 increasing stocks, and 5 stocks remaining unchanged. Among them, MWG faced the strongest selling pressure, plunging 3.5%. This was followed by GVR, MSN, CTG, BVH, and FPT, which also decreased by more than 1%. In contrast, SAB was the most prominent highlight in the basket, ending the session with a 2.4% increase. The remaining stocks that managed to stay in the green were HDB, VIB, BCM, and PLX.

Red dominated most industry groups. The energy group was at the bottom of the market with a 1.62% decrease. This was mainly influenced by the pressure from large-cap stocks in the industry, such as BSR (-1.44%), PVS (-0.79%), and PVD (-4.54%). Following were the information technology and non-essential consumer groups, which decreased by nearly 1%. Red dominated a wide range, notably FPT (-1.08%), ITD (-1.38%); MWG (-3.49%), GEX (-1.27%), DGW (-1.39%), TNG (-1.16%), and PET (-2%)…

On the other hand, the telecommunications group, thanks to the significant contributions of VGI (+2.59%) and CTR (+1.39%), led the market with a nearly 1.5% increase. However, many other stocks in the industry were still dominated by sellers, such as FOX (-3.26%), VNZ (-0.61%), ELC (-0.57%), and FOC (-0.93%)… The essential consumer group also had a similar performance. Many stocks in this group were bright spots in today’s session, including HAG, which hit the ceiling price, MCH (+2.04%), SAB (+2.35%), DBC (+1.62%), BAF (+2%), and HNG (+2.08%). Meanwhile, large-cap stocks like MSN, VNM, VHC, and MPC remained in the red.

The VN-Index continued to decrease for the fourth consecutive session as it fell below the 20-day SMA. This indicates a negative shift in the market sentiment. Additionally, the trading volume falling below the 20-day average indicates a heightened cautious attitude among investors. At present, the MACD indicator continues to decline after giving a sell signal, suggesting that the short-term outlook remains pessimistic.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Falling below the 20-day SMA

The VN-Index continued its downward trend for the fourth consecutive session, falling below the 20-day simple moving average (SMA). This indicates a rather pessimistic market sentiment. Additionally, the trading volume dropping below the 20-day average highlights the increased caution among investors.

At present, the MACD indicator continues to trend downward after issuing a sell signal, suggesting that the short-term outlook remains bearish.

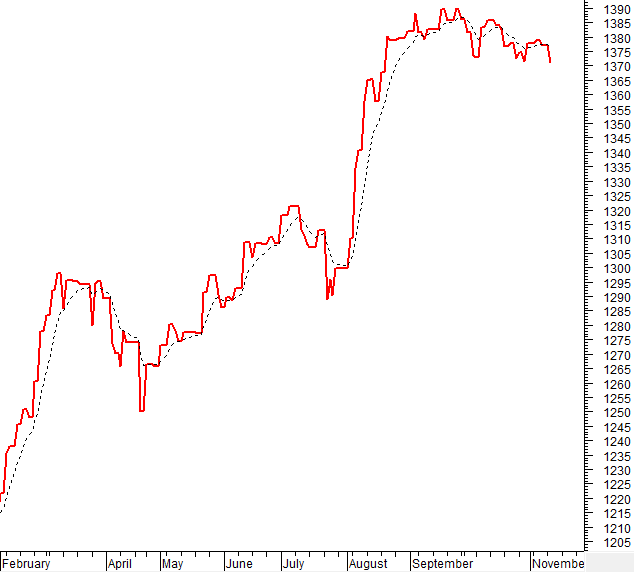

HNX-Index – Formation of a High Wave Candle pattern

The HNX-Index witnessed a slight decline with the formation of a High Wave Candle pattern. Meanwhile, the trading volume remained below the 20-day average, reflecting investors’ indecisiveness. However, the index is still maintaining its position above the Middle Band of the Bollinger Bands, indicating that the situation is not overly pessimistic.

Currently, both the Stochastic Oscillator and MACD indicators are providing positive buy signals. If these signals are sustained in the upcoming sessions, the risk of further declines may not be significant.

Analysis of Money Flow

Changes in Smart Money Flow: The Negative Volume Index indicator of the VN-Index dropped below the 20-day exponential moving average (EMA). If this state persists in the next session, the risk of a sudden downturn (thrust down) will increase.

Changes in Foreign Investor Flow: Foreign investors continued to net sell in the trading session on November 12, 2024. If this trend continues in the coming sessions, the market sentiment will become even more pessimistic.

III. MARKET STATISTICS ON 11/12/2024

Economy and Market Strategy Analysis Department, Vietstock Consulting

Why Are Bank CEOs Still Buying and Selling Stocks in a Bear Market?

(NLĐO) – The stock market remained gloomy on November 5, but the banking sector witnessed a positive trend as a flurry of insider activities signaled potential buying opportunities.

The Foreign Selling Spree: Unraveling the 7/11 Session’s Massive Sell-off of Over VND 400 Billion

The aforementioned stocks, MWG, STB, and TCB, witnessed robust buying activity from foreign investors on the HOSE exchange. The foreign buying interest in these stocks was evident, with respective net buying values of 48 billion, 43 billion, and 41 billion VND.