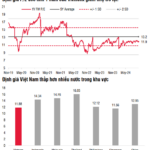

The market once again failed to break through the 1,300 threshold in October 2024 and reversed course. The VN-Index declined almost throughout the month, losing 1.8% compared to the previous month, closing at 1,264.5 points on October 31st.

Factors hindering the market’s upward momentum to higher levels included geopolitical risks, short-term exchange rate fluctuations, and the Q3 2024 earnings season, which continued to recover as expected but without significant surprises.

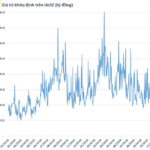

Foreign investors net-sold VND 9.8 trillion on the HOSE, including VND 7 trillion through the matching transaction channel (mainly recorded at VIB and MSN with VND 5.4 trillion and VND 1.2 trillion, respectively) and VND 2.8 trillion in matched orders. Cumulatively, in the first ten months of the year, the net withdrawal value widened to VND 76 trillion. This move partly stemmed from concerns about exchange rate fluctuations and portfolio restructuring ahead of the US elections.

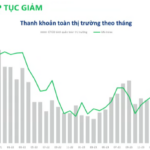

Liquidity was generally low compared to the average since the beginning of the year. The market lacked momentum as domestic individual investors’ supporting force became limited while absorbing a large sell-off from foreign investors. Overall, domestic individual investors net bought a total of VND 4.1 trillion in October and over VND 71 trillion since the beginning of the year.

The capital flow allocation maintained a preference for large-cap stocks, with the weight ratio hovering around the peak since the beginning of the year, partly due to large matching transactions. Circular trading took place as banks’ performance slowed and capital shifted to other pillar groups.

November: Short-term volatility presents buying opportunities

The market is likely to remain volatile in November, influenced by external factors such as the US presidential election and the 8th session of the National Assembly, which will discuss laws and policies in the real estate sector. Additionally, potential interventions by the SBV to ease exchange rate pressure may also impact the market.

However, SSI Research identifies several positive factors supporting the market in the coming period:

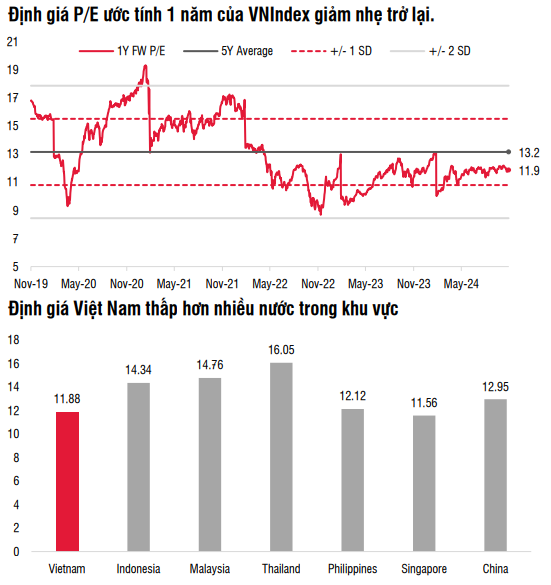

First, the estimated one-year VN-Index P/E ratio slightly decreased to 11.9x at the end of October from 12.1x at the beginning of the month, indicating that the market was under selling pressure and did not reflect the Q3 2024 positive developments.

Second, Q3 profit growth continued to expand across many sectors, with several industries achieving growth rates above 30%.

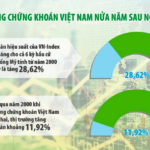

Third, Circular 68, along with amendments to the Securities Law, raises expectations that foreign investment funds may consider increasing their allocations to Vietnam.

Source: SSI Research

|

According to SSI Research, while the market may experience short-term fluctuations, these present opportunities to buy potential stocks at reasonable prices to build a long-term investment portfolio. Investors should prioritize companies with strong and sustainable profit growth, as this is expected to be the main factor driving stock prices in 2024 and 2025.

At the same time, investors should diversify their portfolios to mitigate the impact of unpredictable fluctuations. Along with policy changes from the US, domestic interest rates and exchange rate volatility are two macro factors that need to be closely monitored in the risk management process.

“SSI Research: Short-Term Volatility Presents Buying Opportunities for Long-Term Investors”

“November 2024’s SSI Securities’ strategic report suggests that while the market may experience short-term volatility, it presents an opportunity for investors. SSI Research believes that this is the time to buy potential stocks at reasonable prices to build a robust long-term investment portfolio.”

When Will a Market Correction Be an Opportunity?

“Market Update: Seeking Attractive Opportunities for Long-Term Investors”

Renowned market strategist and VPBank Securities’ Market Strategy Director, Tran Hoang Son, shared his insights on the current market landscape on the November 4th episode of ‘Khớp lệnh’. He suggested that a market correction is necessary to create more appealing entry points for mid to long-term investors.

Why Are Bank CEOs Still Buying and Selling Stocks in a Bear Market?

(NLĐO) – The stock market remained gloomy on November 5, but the banking sector witnessed a positive trend as a flurry of insider activities signaled potential buying opportunities.