Inside a textile spinning mill. Illustration

|

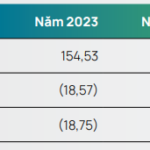

In the first ten months of 2024, Sợi Phú Bài’s total revenue increased by over 7% year-on-year to more than VND 1,039 billion. Pre-tax profit improved to VND 12 billion, while in the same period last year, the company suffered a loss of nearly VND 43 billion.

Estimated for the full year 2024, total revenue is expected to exceed VND 1,240 billion, and pre-tax profit is projected at VND 15.2 billion, surpassing the annual plan by 18% and 52%, respectively.

The leadership of Sợi Phú Bài attributed the improved profits to the positive recovery of the market, increased consumer demand, and favorable selling prices, coupled with optimized costs. As a result, the company returned to profitability in the third quarter of 2024, earning nearly VND 1 billion, compared to a loss of VND 26 billion in the same quarter last year.

For the first nine months of 2024, Sợi Phú Bài’s net profit exceeded VND 10 billion, while in the same period in 2023, the company incurred a loss of nearly VND 45 billion. Although the company has returned to profitability, it has only helped reduce the accumulated loss as of September 30, 2024, to VND 22 billion, mainly due to the record loss of VND 40 billion in 2023, which erased the achievements of previous years.

Not only SPB but also other enterprises in the fiber industry have significantly reduced their losses in the third quarter, thanks to positive shifts in the market, including Sợi Thế Kỷ and Vicotex…

Fiber enterprises are on the path to recovery

In other news, the Board of Directors of Sợi Phú Bài approved the 2025 business plan, with a total revenue target of VND 980 billion, down 21% from the estimated performance in 2024. However, pre-tax profit is expected to increase by more than 18% to VND 18 billion.

In contrast to the recovering business results, SPB’s share price plummeted 26% in just one week, reaching VND 17,700 per share in the morning session on November 11, but still 7% higher than at the beginning of the year.

| SPB Share Price Movement since the beginning of 2024 |

PV Power’s Electrifying October: A $2.2 Billion Turnover Triumph

Let me know if you would like me to continue crafting compelling content for your project!

PV Power, a leading energy company listed on the Ho Chi Minh Stock Exchange (HOSE: POW), has released its business performance report for October 2024.

The Race to Surpass: HSC Aims High with a Proposed Capital Increase to Over VND 10 Trillion

The Ho Chi Minh City Securities Corporation (HSC) is planning to offer its existing shareholders a treat. According to the company’s recent extraordinary general meeting documents, the board of directors is seeking approval for a share sale proposal. The offer price? A tempting 10,000 VND per share, equivalent to the par value. And the timing? Well, HSC is eyeing 2025 for this enticing opportunity.

“Foreign Ownership Limit Increased to 70% for TNH, Attracting Big Players to Take a Bite”

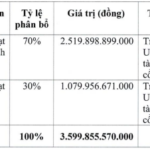

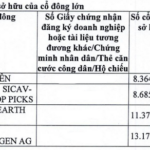

The Joint Stock Company TNH Hospital Group (HOSE: TNH) has successfully concluded its public offering of 15.2 million shares, achieving a 100% subscription rate. Following this issuance, foreign investors now hold a substantial 47.74% stake in the company, highlighting the strong confidence and interest from the international investment community.