As of early November, some banks continued to make slight increases to their deposit interest rates, while others made reductions.

Bank for Investment and Development of Vietnam (BIDV) increased interest rates on deposits by 0.1-0.3 percentage points across all tenors effective from October 26, 2024. For savings deposits below VND 1 billion, the Bank offered an interest rate of 3.95% p.a. for 1-month tenor, 5.4% p.a. for 6-month tenor, and 5.8% p.a. for 12-month tenor.

Vietbank also made adjustments, raising interest rates on deposits with tenors of 6 months and below by 0.1-0.2 percentage points from October 22. The interest rate for 1 to 3-month tenor deposits was increased to 3.8% p.a., while the 6-month tenor enjoyed a rate of 5% p.a.

National Citizen Bank (NCB) made changes to their interest rates on October 24, with an increase of 0.1 percentage points for tenors below 12 months and a decrease for tenors above 12 months. Specifically, the 1-month tenor rate was raised to 3.8% p.a., the 3-month tenor to 4.1% p.a., and the 6-month tenor to 5.45% p.a., while the rate for tenors above 12 months was lowered to 5.7% p.a.

Techcombank followed a similar strategy, increasing interest rates on deposits with tenors of 1 to 3 months and reducing rates for tenors of 12 months and above from November 4. For regular customers, the Bank offered an interest rate of 3.2% p.a. for 1-month tenor, 3.5% p.a. for 3-month tenor, and 4.7% p.a. for tenors of 12 months and above.

Contrarily, LPBank decreased interest rates on deposits with tenors of 6 months and above by 0.2 percentage points, effective from October 24. The interest rate for 6 to 9-month tenor deposits was reduced to 4% p.a., while the 12-month tenor stood at 5.1% p.a., and tenors above 12 months were offered a rate of 5.4% p.a.

While private banks have been actively adjusting their interest rates, the state-owned bank group, including Vietcombank, VietinBank, BIDV, and Agribank, has remained stagnant for several months.

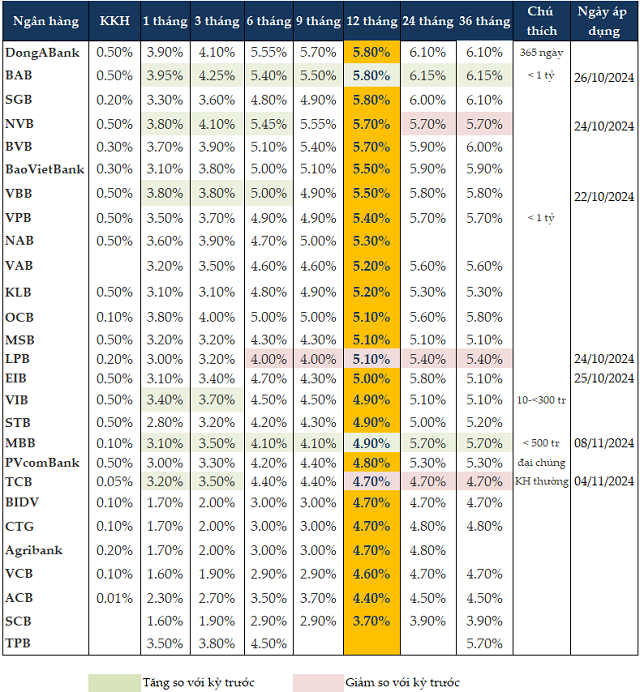

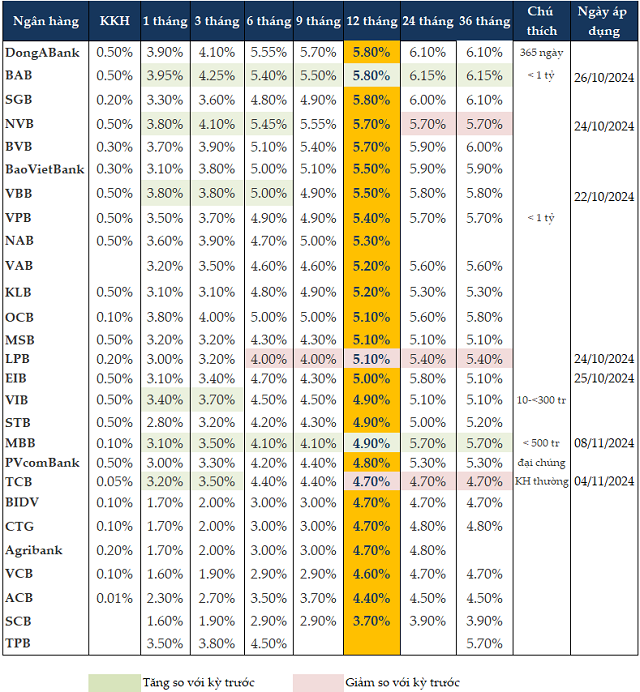

As of November 11, 2024, savings deposit interest rates for tenors of 1 to 3 months ranged from 1.6% to 4.25% p.a. across banks, while tenors of 6 to 9 months offered rates between 2.9% and 5.7% p.a. The 12-month tenor saw rates varying from 3.7% to 5.8% p.a.

For the 12-month tenor, BAB, Saigonbank, and DongABank offered the highest interest rates at 5.8% p.a., followed by BVB and NVB at 5.7% p.a.

DongABank maintained the highest interest rate for the 6-month tenor at 5.55% p.a., followed by NVB at 5.45% p.a.

In the case of the 3-month tenor, BAB provided the most attractive rate at 4.25% p.a.

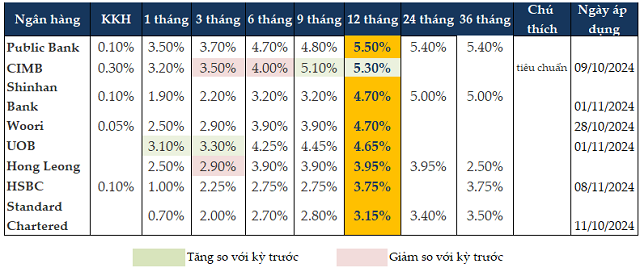

Foreign banks operating in Vietnam experienced similar dynamics, with Hong Leong Bank and CIMB reducing interest rates on certain tenors, while UOB continued to increase theirs. As of November 11, 2024, Public Bank offered the highest interest rate for the 12-month tenor at 5.5% p.a., and for the 6-month tenor at 4.7% p.a.

Interest Rate Pressures in the Year-End Season

The survey on business trends among credit institutions also revealed that the system-wide funding is expected to increase by an average of 3.2% in Q4/2024 and 7.9% for the full year of 2024. Credit institutions anticipate a system-wide credit growth of 4.8% in Q4/2024 and 13.2% for the entire year.

In Q4/2024 and for the full year of 2024, credit institutions forecast an improvement in the demand for banking services compared to Q3/2024 and 2023. The demand for loans is expected to improve more significantly than the demand for deposits and payments. Overall, for the year 2024, credit institutions estimate a decrease in the average price of products and services compared to 2023, including a reduction in both interest rate margins and service fees. However, there could be a slight increase in 2025.

According to PGS.TS. Nguyen Huu Huan, a lecturer at the University of Economics Ho Chi Minh City (UEH), the decision to increase or decrease interest rates depends on the liquidity of individual banks. Banks that can grow their credit will raise deposit interest rates, while those that struggle to boost credit growth towards the end of the year will find it challenging to increase interest rates. State-owned banks are expected to maintain better liquidity compared to smaller banks.

Mr. Nguyen Quang Huy, CEO of the Faculty of Finance and Banking at Nguyen Trai University, added that the upward trend in deposit interest rates is putting pressure on lending rates, making it more challenging to lower credit interest rates, especially during a period when the economy still needs financial resources to sustain its growth momentum in the year-end season.

The latest report from MBS Securities Joint Stock Company, dated November 5, indicated that banks continue to face pressure to increase deposit interest rates towards the end of the year due to credit growth outpacing the growth in mobilized capital by nearly twofold.

Based on this, MBS anticipated that the recovery of credit growth, along with accelerated production and investment in the last months of the year, would put pressure on the system’s liquidity and could lead to an increase in input interest rates.

On the other hand, low inflation and the Fed’s interest rate cut are expected to create room for monetary policy easing in Vietnam. MBS projected that the 12-month deposit interest rate of large commercial banks could rise by another 20 basis points, fluctuating around 5.1-5.2% by the end of 2024.

During the questioning session at the 8th session of the XV National Assembly on November 11, 2024, Ms. Nguyen Thi Hong, Governor of the State Bank of Vietnam (SBV), stated that the demand for credit capital is expected to continue rising, creating pressure on interest rates. Additionally, bad debts are a challenge that makes it difficult for commercial banks to further lower lending rates, as interest rates reflect the risks in the economy.

In the event of an increase in non-performing loans, the SBV will implement comprehensive measures to address difficulties, aiming to reduce both lending interest rates and operating costs for credit institutions. During this challenging economic period, the credit institution system has dedicated its financial resources to lowering interest rates for customers.

By Cat Lam

“HCM City Credit Up 6.87% in October 2024”

As of late October 2024, Ho Chi Minh City’s total outstanding credit reached an impressive VND 3,785 trillion, reflecting a steady growth of 0.98% from the previous month and a significant 6.87% increase compared to the end of 2023. This indicates a consistent expansion in the city’s credit activities over the past few months.

The Financial Currency Market: A Stable Investment Haven

According to a report by the Ministry of Planning and Investment, despite facing challenges and difficulties, the economy in October and the ten-month period showed a strong recovery. Economic and social activities rebounded quickly after natural disasters and floods. In October, several international organizations upgraded their growth forecasts for Vietnam in 2024, predicting it could be the highest among ASEAN+3.

The Bottom Line: 642 Businesses Report 17.8% Increase in Q3 Profits, Real Estate Sector Bounces Back.

The third-quarter post-tax profits of 642 enterprises rose by 17.8% year-on-year, a notable increase yet shadowed by the impressive 27.4% surge in the previous quarter. This slight dip can be attributed to the high comparative base. Notably, the real estate sector experienced a profit decline this quarter, indicating a downward trajectory and a potential bottoming-out phase.