On November 13th, the Ho Chi Minh City Real Estate Association (HoREA) hosted an event connecting several Japanese companies and groups, including the Japan Housing Finance Organization (Japan Housing Finance-JHF), Sekisui Heim Japan, Thai SCG – Heim Japan, and prominent Vietnamese real estate companies.

Mr. Le Hoang Chau, Chairman of HoREA, mentioned that Vietnam has embarked on a mission to develop 1 million social housing units, with a particular focus on eradicating temporary housing and rehabilitating 400,000 substandard homes. According to initial surveys, Ho Chi Minh City requires 200,000 social housing units, and 60% of immigrants, workers, and laborers aspire to long-term rentals.

Japanese corporations and Vietnamese real estate companies networking at the event.

Between 2016 and 2020, Ho Chi Minh City achieved nearly 70% of its planned target, and in the 2021-2025 period, it reached only 2.9%. Currently, the city is executing eight social housing projects, offering almost 6,400 units. Many immigrant workers and laborers reside in rented accommodations. The city has over 61,000 boarding houses, providing shelter for approximately 1.4 million people across 560,000 rooms.

In 2020, Ho Chi Minh City introduced nearly 17,000 affordable housing units to the market. However, in the subsequent three years, the focus shifted primarily to luxury housing developments.

Representing SCG Heim (Japan), Mr. Ryuji Saimon expressed his company’s keen interest in collaborating with Vietnam to develop affordable and social housing. Currently, his company specializes in prefabricated homes. Their Thai factory employs modern techniques, enabling them to export houses to Vietnam, with 80% of the structure pre-assembled, leaving only 20% to be completed on-site.

However, according to Mr. Le Hoang Chau, this model is more suitable for rural areas and the government’s ongoing initiatives to eradicate temporary housing and rehabilitate substandard homes. Nonetheless, cost remains a critical consideration.

Mr. Le Hoang Chau emphasized that foreign investors currently benefit from substantial tax incentives, including a reduction of up to 50% in corporate income tax and value-added tax. HoREA is advocating for an increase in this reduction to 70% for social housing projects. Additionally, preferential credit terms are available, offering rates as low as 4.8% for tenors of 10 to 15 years for investors and up to 20 years for homebuyers.

Regarding land access, there are no restrictions on area as long as the project aligns with the city’s master plan. The government has instructed Ho Chi Minh City to allocate suitable land parcels for social housing initiatives, which is expected to attract more businesses to participate.

Mr. Le Hoang Chau affirmed that Vietnam is committed to engaging private entities and corporations in the development of social and affordable housing. To that end, the government is actively facilitating the resolution of challenges and obstacles faced by 60 ongoing projects in this sector.

The Electric Revolution: Vietnam’s Chance to Lead or Fall Behind in the New Era.

The CEO of Dat Bike shed light on two pivotal trends: the shift from gasoline to electric vehicles and the move to diversify manufacturing away from China. These trends, when intersecting, present a unique opportunity to forge a new industry.

The Fashion Brand Lep’ Shuts Down: A CEO’s Heartfelt Letter on the Reasons for Closing After 8 Years

The fashion brand, Lep’, has just announced via their Facebook fan page that they will be closing all their stores. This surprising news has left many fans of the brand shocked and saddened. As Lep’ has built a strong reputation for its unique and trendy designs, this abrupt announcement has certainly caught the attention of the fashion industry and its loyal customers.

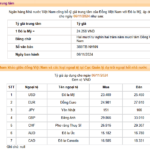

The Greenback’s Fate: USD/VND Rates Ahead of the US Presidential Election Outcome

The US Presidential election results will pave the way for varying trade policy scenarios, which will have a significant impact on the global economy and, more specifically, on Vietnam.