Joint Stock Securities Company KAFI will seek shareholder approval in writing to increase its charter capital to a maximum of VND 5,000 billion. This plan replaces the method previously approved by the Annual General Meeting of Shareholders in July 2024.

To obtain written approval from shareholders, the Company finalized the list of shareholders on November 18, 2024, and sent out voting papers and draft documents on the same day. The deadline for shareholders to submit their responses is November 28, 2024.

Previously, Kafi had approved a plan to raise capital by offering shares to existing shareholders through the exercise of purchase rights. The number of shares offered was 250 shares, equivalent to a ratio of 1:1. The offering price was VND 10,000/share.

The capital increase aims to expand the scale and network of the Company’s business operations. It will also provide additional capital for licensed business activities such as brokerage, investment advisory, proprietary trading, and underwriting. Furthermore, investments will be made in information technology systems, security and safety systems, and the development of digital products and services to enhance the quality of services offered.

On October 17, 2024, Kafi’s Board of Directors passed a resolution to implement the capital increase plan. The resolution outlined the expected allocation of funds across different business areas, with 45% for proprietary trading, 45% for margin lending, and 5% for securities brokerage.

With the upcoming shareholder vote, Kafi may introduce changes to its capital increase plan.

| History of Kafi Securities’ Capital Increase |

Kafi Securities, formerly known as Hoang Gia Securities, started with a charter capital of VND 20 billion. In 2019, the Company changed its name to Globalmind Capital Securities. In 2022, it became Kafi Securities, with its charter capital increased to VND 1,000 billion.

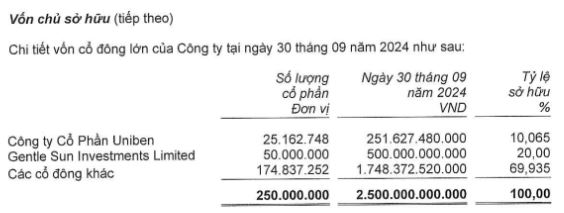

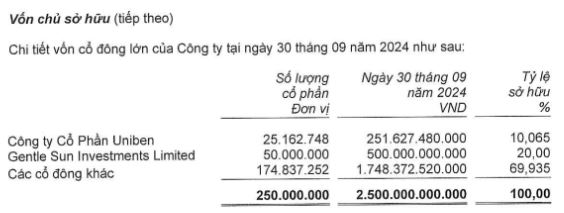

As of the third quarter of 2024, the Company’s charter capital reached VND 2,500 billion. At this time, the shareholder structure included two major shareholders: Ubiben Joint Stock Company and Gentle Sun Investments, holding 10.065% and 20% of the capital, respectively.

Source: Kafi Financial Statements

|

Uniben, the owner of Mi 3 Mien and Boncha honey tea, has connections with VIB. After multiple purchases and sales of VIB shares, according to the list of shareholders owning 1% or more of VIB’s charter capital published on September 27, Uniben held 116.2 million VIB shares, equivalent to 3.901% of the capital in the bank. This represents an increase from the 2.617% holding disclosed earlier in August 2024.

The Savvy Investor: Pouring Money into the Market, a Smart Strategy?

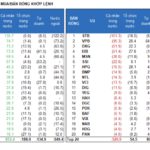

Individual investors today bought a net amount of 353.8 billion VND, of which their net buying value via matched orders was 603.9 billion VND.

“A Significant Spike in Margin Lending: DNSE’s Third-Quarter Report Shows a 65% Surge in Margin Debt Since the Start of the Year.”

In Q3 2024, DNSE Securities’ margin lending outstanding balance witnessed a remarkable 65% year-to-date surge, significantly contributing to the firm’s robust financial performance. This quarter, DNSE reported a 12% increase in revenue, totaling VND 193.7 billion, along with a 10% rise in net profit, amounting to VND 44.3 billion, compared to the same period in 2023.