In Q3 2023, the average pig price in Vietnam plummeted from a peak of over VND 61,000/kg to below VND 50,000/kg by the end of September. In contrast, in Q3 2024, pig prices fluctuated around VND 65,000/kg, occasionally surging to nearly VND 70,000.

Overall, the price difference between the two periods ranged from 30-40%, which significantly impacted the financial performance of pig farming businesses in Q3.

|

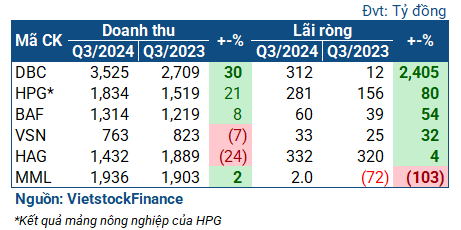

Financial performance of pig farming businesses in Q3 2024

|

Leading the growth was Dabaco (HOSE: DBC). In Q3, the company reported a net profit of VND 312 billion, 25 times higher than the same period last year. Despite the low comparison base, this is an impressive profit for Dabaco, almost on par with its performance during 2020-2021.

Dabaco attributed this performance to stable prices of raw materials for animal feed production (both domestic and imported) and an increase in domestic pig prices. Additionally, the complex development of the African Swine Fever (ASF) created pressure on supply, but the company managed to control the disease and maintain its herd, resulting in increased pig sales volume.

| Dabaco’s profit surge on a low base |

BAF, a company specializing in “vegetarian pigs,” also had a strong quarter with a net profit of VND 60 billion, a 54% increase year-on-year. This was partly due to a 2.3-fold increase in pig sales revenue to VND 856 billion, accounting for 65% of total revenue, thanks to a significant rise in pig sales volume (163,000 pigs). Additionally, BAF’s ability to self-produce animal feed while raw material prices were lower kept its cost of goods sold in check. Similar to Dabaco, BAF effectively managed the impact of diseases and benefited from sustained high pig prices.

| BAF’s strong performance due to increased sales volume and controlled costs |

Hoa Phat’s agriculture segment also reported favorable results, with a 21% increase in revenue to over VND 1,800 billion and a 80% surge in net profit to VND 281 billion compared to the same period last year.

HAG, on the other hand, had a slightly different story. In Q3, the company owned by Bau Duc posted a net profit of VND 332 billion, a modest 4% increase year-on-year. However, a significant portion of its revenue came from fruit sales (bananas and durians). Additionally, its revenue decreased by 24% to VND 1,400 billion, with the steepest decline in pig sales, which dropped by 52% to VND 234 billion. Fruit sales contributed VND 912 billion, a decrease of 11%, and accounted for 64% of total revenue.

| HAG’s profit surge driven mainly by fruit sales |

Two companies in the processing segment also achieved relatively good results. Vissan (UPCoM: VSN) reported a 32% increase in net profit to VND 33 billion due to effective cost control. Meanwhile, Masan Meatlife (UPCoM: MML) turned a profit for the first time after two consecutive years of losses. The company attributed this turnaround to the growth in revenue from chilled meat and processed meat products, along with optimized production costs, particularly in its chicken farm segment and reduced feed costs.

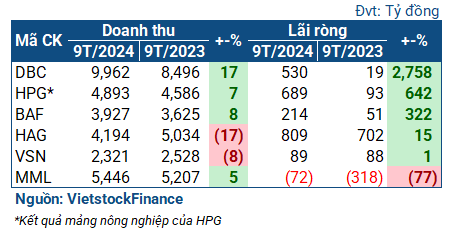

For the first nine months of 2024, the cumulative performance of the pig farming group did not show significant changes. Dabaco led the way with a net profit of VND 530 billion, 28 times higher than the same period last year, followed by BAF with a net profit of VND 214 billion, four times higher. Hoa Phat’s agriculture segment saw a more than sevenfold increase in net profit, reaching VND 689 billion. While MML still incurred a loss of VND 72 billion, it represented a significant recovery from a loss of VND 318 billion in the previous year. Moreover, as the company aims for a net loss of VND 400 billion in 2024, this result can be considered a success.

|

Financial performance of pig farming businesses in the first nine months of 2024

|

What about Q4?

As of November 8, the average pig price in Vietnam hovered around VND 61,500/kg. Although lower than in Q3, it remained generally higher than the average price in Q4/2023. The sustained high pig prices compared to the previous year present an advantage for businesses in the industry.

Pig supply in Q4 is likely to be constrained due to the impact of ASF. In a discussion with investors, BAF’s CFO, Ngo Cao Cuong, mentioned that ASF forced many farms to sell their pigs prematurely, temporarily increasing supply but leaving them without pigs for repopulation. This impact was exacerbated by Typhoon Yagi in late September, as flooding increased the risk of disease outbreaks.

Additionally, many farms in the North were inundated for extended periods, resulting in damaged equipment and even collapsed buildings. The recovery process will take considerable time, ranging from six months to over a year for reconstruction, excluding the time required for pig repopulation. Consequently, there will be a shortage of pig supply in the upcoming period, potentially driving up pig prices and creating opportunities for industrial pig farming companies to protect their herds and achieve breakthroughs.

Chau An

“Techcombank Offers 15% Equity Stake: Seeking Strategic Partnership in Tech”

Vietnam Technological and Commercial Joint Stock Bank (Techcombank, HOSE: TCB) is gearing up to welcome a new strategic partner on board by considering the sale of a 15% stake, as per an update from CEO Jens Lottner.

PLX – A Fair Valuation Stock for Long-Term Investors

As the leading retailer in the Vietnamese petroleum industry, Petrolimex (HOSE: PLX) is an attractive prospect for investors seeking long-term opportunities. The stock is currently trading at a reasonable price, as indicated by our valuation metrics, making it a compelling option for those looking to diversify their portfolios.