Illustration

In its latest industry update for the banking sector for the first nine months of 2024, Vietnam Investors Service (VIS Rating) noted that liquidity risks are increasing for small and medium-sized banks due to their reliance on short-term market funding, especially amid slow deposit growth and recent spikes in interbank lending rates.

According to VIS Rating, the industry-wide ratio of non-term deposits (CASA) remained stable at 19% of total customer loans at the end of September. The loan-to-deposit ratio (LDR) for the industry also remained high at 106%.

Notably, small and medium-sized banks, such as BVBank, ABBank, LPBank, Nam A Bank, and MSB, have had to incur higher funding costs to maintain deposits and increase short-term interbank borrowing.

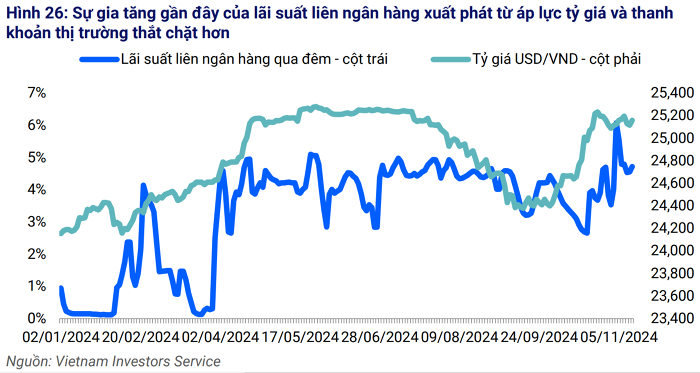

Interbank lending rates have risen sharply in recent months due to exchange rate pressures.

Since mid-October, the overnight interbank lending rate has surged by approximately 3.5 percentage points, reaching an average of about 6% due to exchange rate pressures and tighter market liquidity. As of November 19, the overnight, one-week, and one-month interbank lending rates stood at 5.31%, 5.34%, and 5.11% per annum, respectively. At the beginning of November, the overnight interbank lending rate even breached the 6% mark.

Therefore, VIS Rating believes that if interbank lending rates remain elevated in the near future, liquidity risks for small and medium-sized banks will increase.

VIS Rating warns of increased liquidity risks for small and medium-sized banks due to their reliance on short-term market funding and the recent surge in interbank lending rates.

As previously reported, VND interbank lending rates have soared since mid-October, reaching a 19-month high at the beginning of November.

In tandem with the rise in interbank lending rates, the system’s liquidity has also tightened as more banks have turned to the State Bank of Vietnam’s (SBV) collateralized lending facility in recent weeks.

Consequently, from the session on November 4 to November 19, dozens of credit institutions participated in the SBV’s collateralized lending auctions, with winning bid amounts ranging from 10,000 to 20,000 billion VND per session. Meanwhile, banks have shown less interest in the SBV’s bill issuance channel, with winning bid amounts of only a few hundred billion VND per session, despite the interest rate increase to 4% per annum.

In line with the tighter liquidity signals in the secondary market, many banks have also raised deposit interest rates in the retail market. After a two-month hiatus, a series of banks, including large banks such as Agribank, Techcombank, and MB, have increased savings interest rates in recent days.

Since the beginning of November, 13 banks have raised their deposit interest rates, including BaoViet Bank, HDBank, GPBank, LPBank, Nam A Bank, IVB, Viet A Bank, VIB, MB, Agribank, Techcombank, ABBank, and VietBank. Notably, some banks have adjusted their interest rates twice since the beginning of the month.

These new developments in the monetary market coincide with the peak credit growth period at the end of the year, and the SBV is implementing dual measures to curb exchange rate volatility.

According to SBV data, credit growth as of October 31 increased by 10.08% compared to the end of 2023. In the same period last year, credit growth was only 7.4%.

Meanwhile, as the USD exchange rate at banks has continuously hovered near the ceiling for almost a month, increasing by 4.3% since the beginning of the year, the SBV has had to simultaneously employ two tools: issuing bills and selling foreign currencies to stabilize the foreign exchange market. The SBV’s interventions are expected to curb the sharp rise in exchange rates but will likely impact the VND liquidity of the banking system to some extent.

In a recent report, MBS stated that the surge in interbank lending rates signals a liquidity shortage. According to MBS, the SBV’s bill issuance and the State Treasury’s withdrawal of over $4.5 billion from three major banks in the third quarter of 2024 contributed to the heightened liquidity pressure.

“Although the SBV has taken strong measures, such as injecting money through the OMO channel, the overnight interest rate remains above 5%, indicating significant pressure in the system,” MBS assessed.

MBS believes that this development is a factor prompting banks to continue adjusting deposit interest rates upward to attract new capital and ensure liquidity. MB’s analysts forecast a slight increase of 0.2 percentage points in deposit interest rates by the end of this year.

The CASA Race Heats Up!

As per the financial reports of banks for the first half of 2024, there has been a shuffle in the pack when it comes to demand deposit accounts (CASA) ratios. Notably, MB has surged ahead to claim the top spot with an impressive CASA ratio of 38.83%, attributing its success to its vast customer base and robust digital transactions. Despite maintaining a substantial CASA balance of over VND 180 trillion with a ratio of 37.4%, Techcombank finds itself in the second position.