In the latest transaction, CTS‘s ownership in KHS decreased from over 1.32 million shares (a 10.92% stake) to nearly 1.12 million shares (a 9.25% stake). The trading session on November 22 also witnessed a more than 5% surge in KHS shares, reaching VND12,100 per share. Based on this closing price, CTS is estimated to have earned approximately VND2.4 billion.

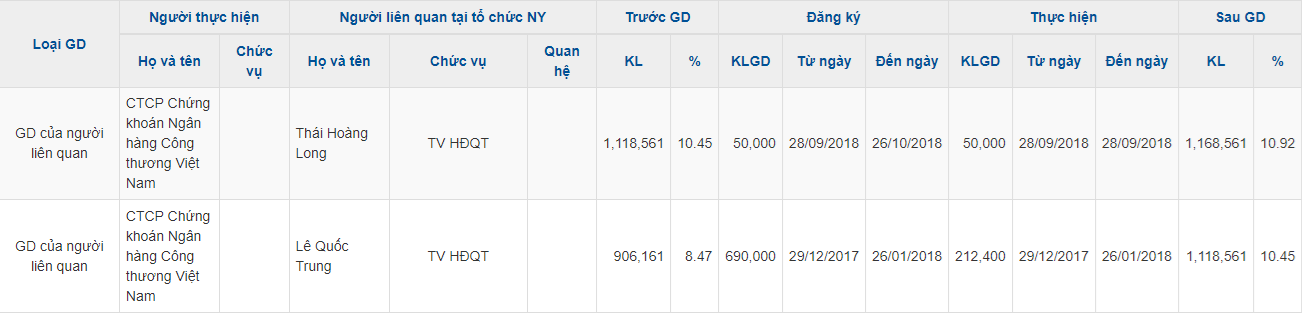

Notably, CTS had maintained a 10.92% stake in KHS since September 2018, after purchasing an additional 50,000 shares, bringing its total holdings to nearly 1.17 million shares. Subsequently, in September 2019, KHS officially listed nearly 1.4 million additional shares following a capital increase at a ratio of 13%, leading to CTS‘s increased ownership in KHS to over 1.32 million shares while maintaining the same ownership percentage.

|

Two historical KHS share purchases by CTS

Source: VietstockFinance

|

In reality, CTS has been accompanying KHS even before its official listing on the HNX in December 2017. At the time of the IPO, CTS was introduced as one of the top five shareholders of KHS, holding an 8.47% stake. CTS also served as the listing advisor for KHS.

Over the seven years of listing on the HNX, KHS shares have witnessed significant volatility, with a peak in February 2022, surpassing the VND32,000 per share mark, followed by a swift downward trend.

| Performance of KHS shares since its listing |

In recent years, the seafood company’s business performance has declined compared to the pre-2021 period. For the first nine months of 2024, KHS recorded nearly VND502 billion in net revenue, a 9% decrease year-on-year, but managed to turn a profit of nearly VND19 billion, while the previous year incurred a loss of over VND22 billion during the same period.

Despite being profitable, KHS‘s subsidiary, Aoki Seafood Company Limited, incurred losses and was subject to a bankruptcy proceeding initiated by the People’s Court of Kien Giang Province.

| Decline in KHS’s business performance in recent years |

The Golden Ring’s Price Surge: A Sudden Jump

This morning (November 16th), gold ring prices rebounded with some brands seeing increases of up to half a million VND per tael. Meanwhile, SJC gold prices remained stagnant, and USD exchange rates showed no signs of cooling off.