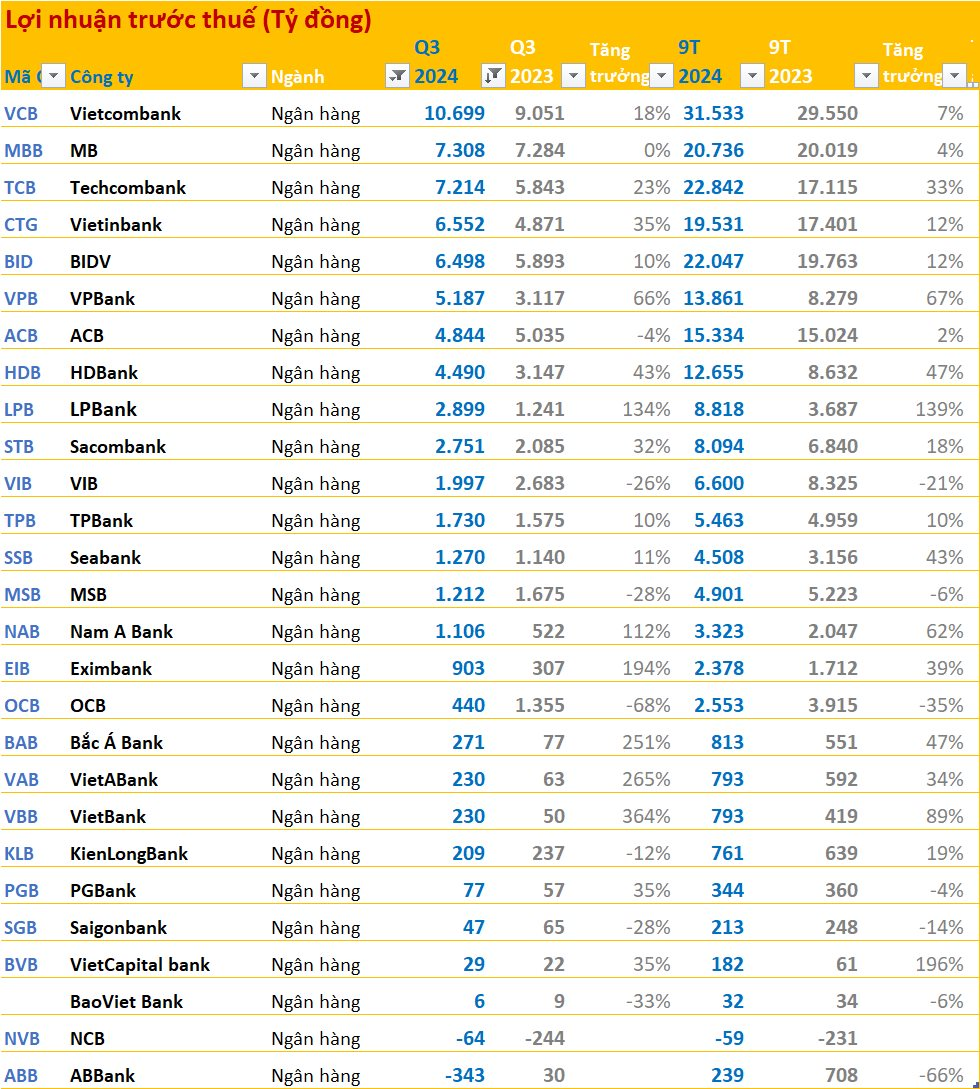

As of November 1st, the heavyweights of various industries have released their financial statements for Q3 2024, painting a comprehensive picture of their performance over the past nine months. Among them, banks, retail, and textile businesses mostly reported positive results.

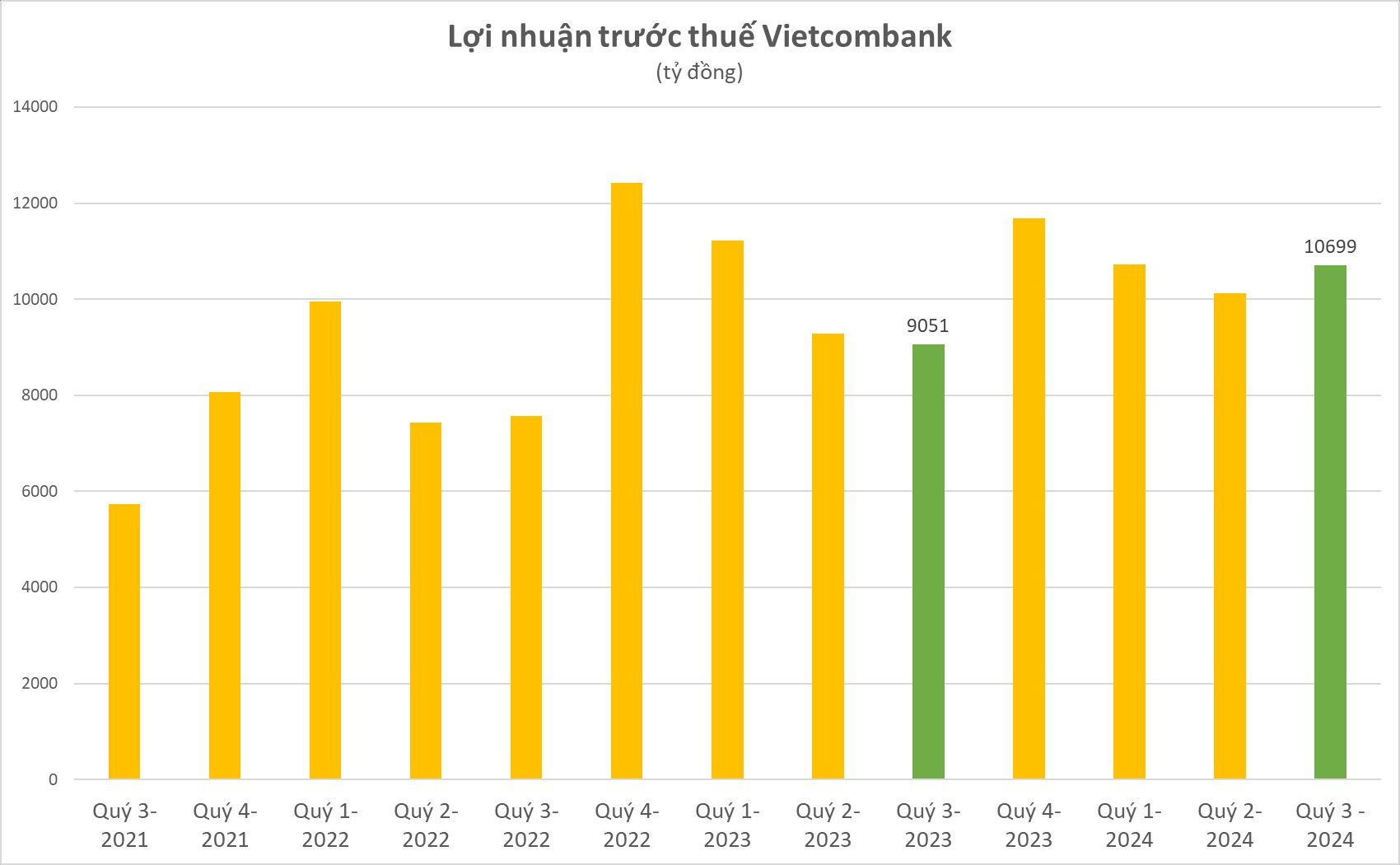

Vietcombank (VCB) took the top spot in the banking sector, reporting a remarkable pre-tax profit of VND 31,533 billion for the first nine months of the year, a 7% increase from the previous year, and achieving 75% of its annual plan. This impressive performance was driven by growth in net interest income and service profits, coupled with a significant reduction in risk provision expenses.

Following closely behind were MB, Techcombank, Vietinbank, and BIDV. The standout performer for the quarter was Vietbank (VBB), which reported a pre-tax profit of nearly VND 230 billion, a remarkable 3.6 times higher than the previous year.

While most banks reported growth, a few notable exceptions include ACB, VIB, and MSB, which experienced decreases in profits. Additionally, two banks reported losses for the quarter.

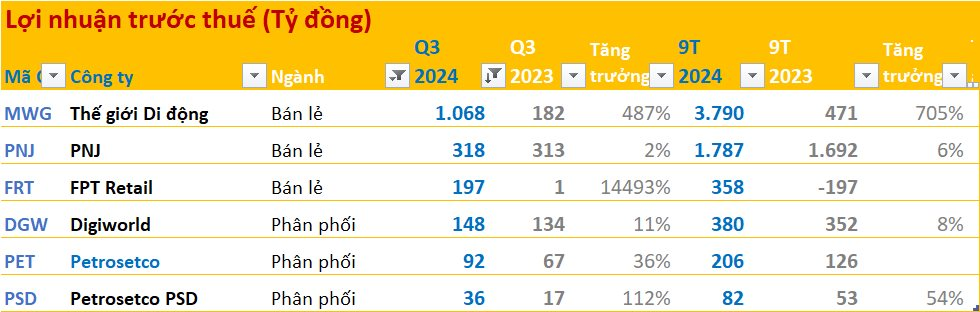

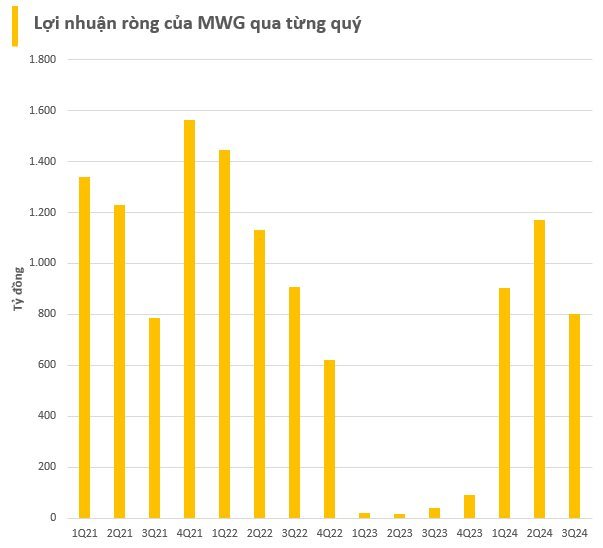

The retail and distribution sector stood out with impressive growth during the quarter, led by The Gioi Di Dong (MWG) which reported a pre-tax profit of VND 1,068 billion, nearly six times higher than the previous year.

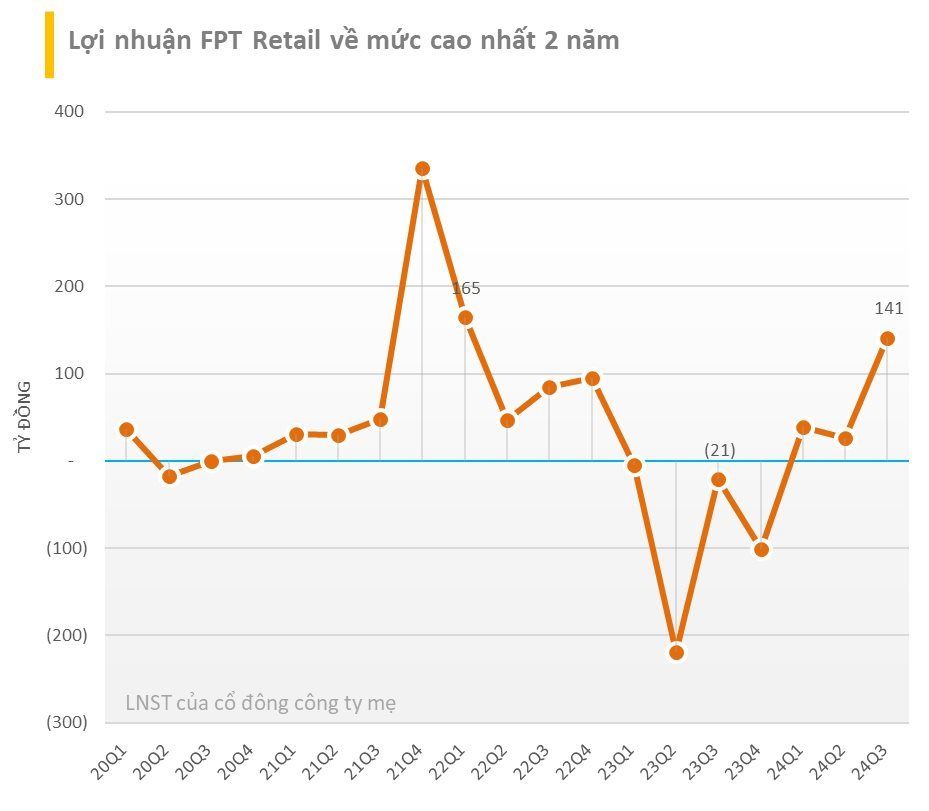

FPT Retail (FRT) was the star performer in this sector, achieving a remarkable 14,493% growth to VND 197 billion in profits. In Q3 2024, the company’s revenue reached VND 10,409 billion, a 26% increase year-on-year. While the pharmaceutical division continued its growth trajectory, the ICT chain’s recovery also contributed significantly to the company’s overall profit increase.

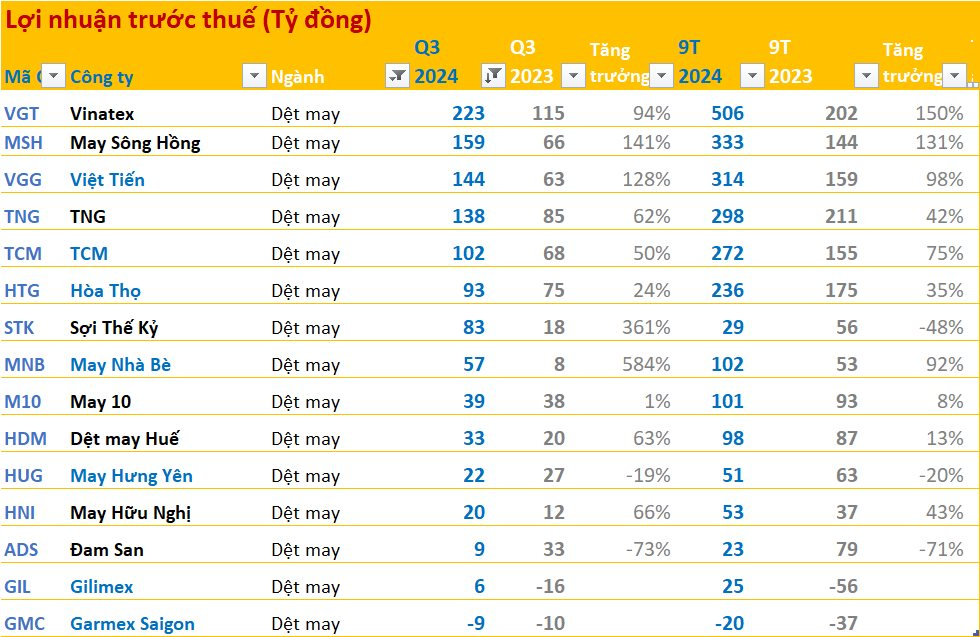

The textile industry emerged as a surprise package in Q3 2024, with several companies reporting significant growth. Vinatex, May Song Hong, Viet Tien, and TNG all announced impressive profit increases.

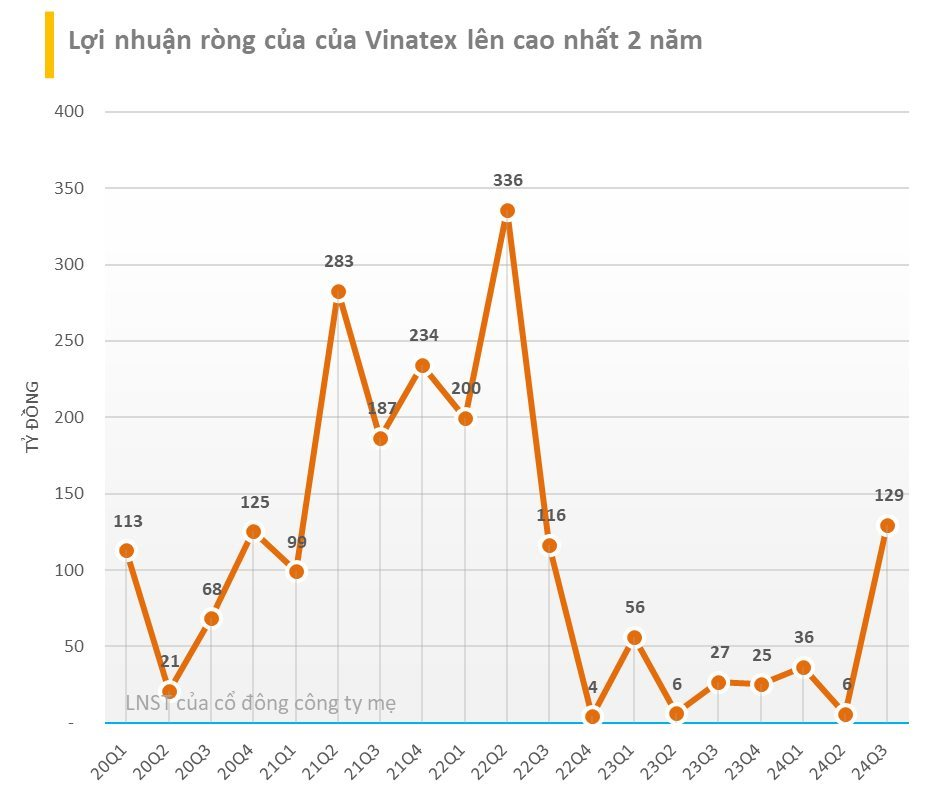

Vinatex, the industry leader, released its consolidated financial statements for Q3 2024, reporting a 12% increase in net revenue to VND 4,588 billion. After deducting expenses, the company’s post-tax profit stood at VND 230 billion, a remarkable 186% increase from the previous year, the highest in two years.

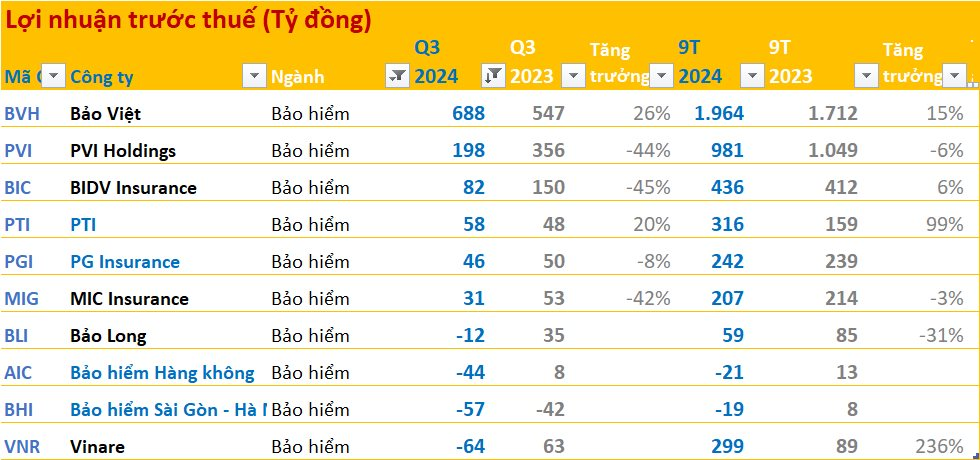

While some sectors continued their growth trajectory, others experienced noticeable declines. A notable example is the insurance industry, which faced challenges during the quarter.

Many insurance companies reported decreases in revenue and profits, and some even incurred losses. This downturn was largely due to the impact of Typhoon Yagi, which led to increased compensation costs.

The securities industry also witnessed a downturn, with several companies reporting decreases in profits after multiple prosperous quarters, and some even incurring losses.

Estimates suggest that the total pre-tax profit for the securities group in Q3 2024 reached VND 7,000 billion, unchanged from the previous year but a nearly 15% decrease from the previous quarter, breaking the chain of two consecutive quarters of positive growth.

Chứng khoán Kỹ thương (TCBS) retained its top position in the industry, reporting a pre-tax profit of VND 1,097 billion for Q3 2024, a slight 4% decrease from Q3 2023. This was the only billion-dollar profit reported by the securities group during this quarter.

The real estate sector stood out as the most intriguing group in the Q3 2024 financial reports. Several large-cap companies, including Khang Dien, Vinhomes, Phat Dat, Vincom Retail, and Dat Xanh Group, reported decreased profits.

On the other hand, companies like Quoc Cuong Gia Lai, Cen Land, Ha Do, Do thi Kinh Bac, Taseco Land, and Thu Duc House reported impressive profit increases, some even doubling their earnings.

In summary, the Q3 2024 financial reports presented a mixed bag of results across various industries. While some sectors thrived, others faced challenges. Overall, the Vietnamese economy continued to demonstrate resilience and dynamism, with many companies adapting to market changes and positioning themselves for future growth.

The Ultimate Banker: Techcombank and Another Private Bank Make the Top 10 Cut Across Key Metrics, Including Total Assets, Market Capitalization, CASA, ROA, ROE, and Asset Quality.

“While size may matter, it’s not the be-all and end-all when it comes to banking efficiency. Statistical data reveals that bigger isn’t always better – larger banks don’t necessarily equate to top-tier operational performance.”

The Hoard of ‘Staggering’ Evidence and Assets Seized in the Van Thinh Phat Group Case

As of now, the total amount held in the account of the Ho Chi Minh City Department of Civil Judgment Enforcement, transferred by the Ministry of Public Security’s Investigation Agency and deposited by individuals and organizations in the Van Thinh Phat case, stands at over VND 4,250 billion and USD 27 million (equivalent to VND 685 billion).

The Race to Reach a Capital Ownership Milestone: Vietnam’s Next Trillion-Dong Bank

As of the end of September, six Vietnamese banks boasted equity capital of over VND 100,000 billion: Vietcombank, Techcombank, VPBank, VietinBank, BIDV, and MB. These financial powerhouses have solidified their standing as the country’s preeminent lenders, each with a formidable war chest that underscores their dominance in the industry.

Weaving a Brighter Future: Vietnam’s Textile Industry on Track to Achieve $44 Billion Export Target

The Vietnam Textile and Apparel Association (Vitas) asserts that the textile industry’s export target of 44 billion USD by 2024 is well within reach. The association bases this optimism on the fact that the end of the year typically sees a surge in production orders for the festive season, encompassing both Christmas and New Year celebrations.