The VN-Index witnessed a strong rebound after plunging by 1,200 points, as bottom-fishing forces quickly stepped in. The market closed on November 20 with an increase of 11.39 points, reaching the 1,216-point mark. Liquidity on HOSE improved significantly, with a value of 17,800 billion VND.

Foreign trading was a downside, as they continued to sell off with a net value of 1,244 billion VND in the entire market, although it decreased slightly compared to the previous strong selling session.

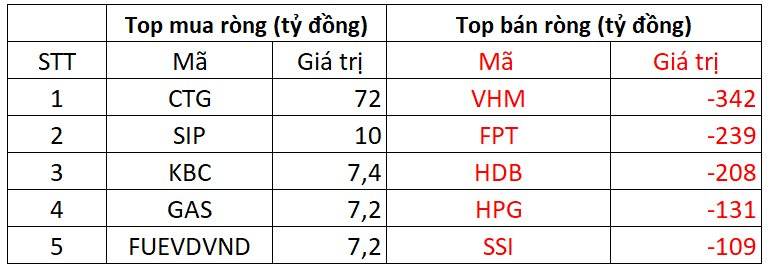

On HOSE, foreign investors net sold 1,208 billion VND, a decrease of 450 billion VND compared to the previous session.

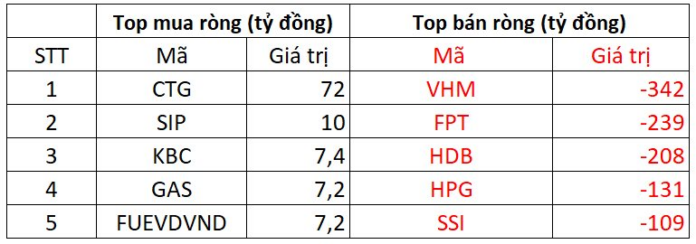

CTG shares were the focus of foreign buying, with a net value of 72 billion VND. Following CTG, SIP and KBC were the next two codes bought, with 10 and 7.4 billion VND, respectively. Additionally, GAS was also purchased for 7 billion VND.

In contrast, two banking stocks, VHM and FPT, faced the strongest selling pressure from foreign investors, with 342 and 239 billion VND, respectively, while HDB and HPG were also offloaded with net sales of 208 billion VND and 131 billion VND.

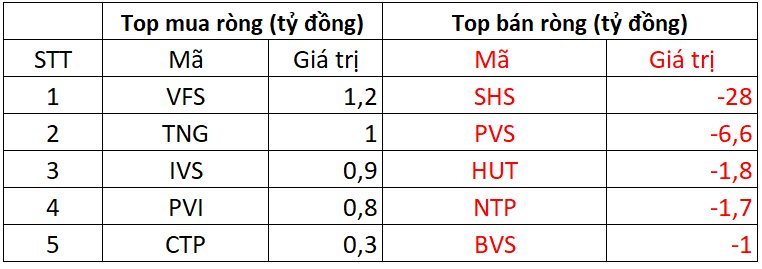

On the HNX, foreign investors net sold 53 billion VND.

In terms of buying, VFS witnessed the strongest net buying with a value of 1.2 billion VND. Additionally, TNG was the second most bought stock on HNX, with a net purchase of 1 billion VND. Foreign investors also spent a few billion VND to net buy IVS, PVI, and CTP.

On the opposite side, SHS faced net selling pressure from foreign investors, with a value of nearly 28 billion VND, followed by PVS, HUT, and NTP, which were sold off for a few billion VND each.

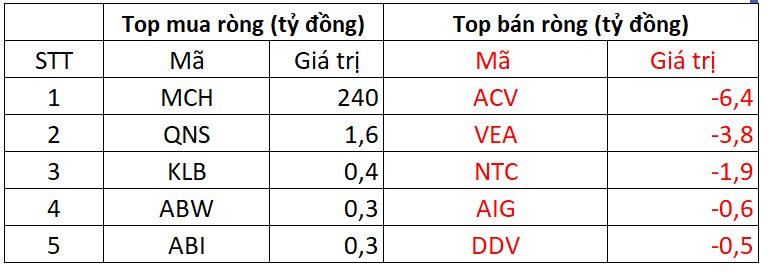

On UPCOM, foreign investors net bought 17 billion VND.

In terms of buying, MCH shares were purchased by foreign investors for 240 billion VND. Following MCH, QNS and KLB were also net bought by a few billion VND each.

Conversely, ACV was net sold by foreign investors for nearly 6.4 billion VND. Additionally, they also net sold VEA, NTC, and a few other stocks.

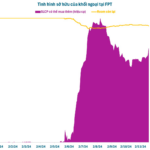

Unlocking Vietnam’s Largest Private Enterprise: Exploring Over 3% Foreign Ownership Potential

Foreign ownership of FPT has dipped below 46%, marking the lowest point in two months since mid-September.

Raising the Capital: Nam Long Investment Seeks to Mobilize 1,000 Billion VND in Bonds to Restructure Debt

Nam Long Investment is set to issue VND 1,000 billion worth of bonds in the fourth quarter of 2024 or the first quarter of 2025. The proceeds from the bond issuance are intended to be utilized for the company’s debt restructuring purposes.