The proposed draft of the Law on Special Consumption Tax Amendments is expected to be submitted to the National Assembly for feedback during the 8th session.

One of the key additions to the draft is the expansion of the tax base, which includes a provision to “include sweetened beverages with more than 5g of sugar per 100ml according to Vietnamese standards in the objects subject to special consumption tax.” Simultaneously, the draft proposes a 10% tax rate for this new category.

TAX IMPOSITION: MANY GOALS UNACHIEVED

Regarding this regulation, the Ministry of Health believes that a 10% tax rate is insufficient to change consumption behavior and reduce the prevalence of overweight, obesity, and non-communicable diseases. They propose a higher tax rate of 40%. According to a study conducted by HealthBridge Canada, imposing the aforementioned tax rate could result in approximately 17.4 trillion VND in budget revenue.

On the other hand, the Ministry of Finance recommends maintaining the original proposal of a 10% tax rate to encourage businesses to produce and import beverages with lower sugar content, raise awareness, and modify consumer behavior.

According to the Ministry of Finance, “the expansion of the scope to comprehensively cover needs to be carefully studied based on evidence and convincing arguments suitable for Vietnamese conditions.”

However, there are also opinions that both the expected increase in tax revenue and the improvement in consumer awareness and behavior will not be achieved due to various reasons. Therefore, it is suggested that reconsideration is needed regarding the inclusion of this item in the draft Law on Special Consumption Tax.

First, imposing a special consumption tax on sweetened beverages will not increase budget revenue as expected and will negatively impact the entire economy. A recent study by the Central Institute for Economic Management (CIEM) on the economic impact of imposing a special consumption tax on beverages indicated that if a 10% special consumption tax were applied to sweetened beverages, indirect tax revenue (special consumption tax) in the first year (2026) would increase by approximately 8,507 billion VND. However, direct tax revenue would decrease by about 2,152 billion VND.

From the following years (starting in 2027), both indirect and direct tax revenues would begin to decline at a rate of -0.495%/year, corresponding to an estimated reduction of approximately 4,978 billion VND/year. This leads to a decrease in value-added, production value, and profits, subsequently reducing the total budget revenue in subsequent cycles.

Additionally, the report evaluating the application of this special consumption tax policy highlighted that it would not only directly impact the beverage industry but also have a ripple effect on 25 other sectors in the economy, resulting in a decline of approximately 0.448% of GDP, equivalent to 42,570 billion VND. Consequently, CIEM proposes postponing the implementation of the special consumption tax on sweetened beverages.

If a higher tax rate is applied (for example, 40%), the impact on businesses in the industry and those in the sweetened beverage supply chain would be more significant, and budget revenue would also decrease as VAT and corporate income tax revenues from these businesses diminish due to reduced consumption of sweetened beverages.

Second, the application of the special consumption tax policy on sweetened beverages may not alter consumer behavior and has not proven effective in reducing overweight and obesity rates and other non-communicable diseases.

Imposing a high tax rate, such as 40%, on sweetened beverages will significantly increase the retail price of these products. While the price increase may lead to reduced consumption, there is no guarantee that overweight and obesity rates will decrease, as consumers can still opt for other sugary foods and beverages that are not subject to the special consumption tax, such as street drinks and self-prepared beverages.

The World Health Organization (WHO) and the Ministry of Health have identified multiple causes of overweight and obesity, including nutritional imbalance, high consumption of calorie-dense foods, genetic factors, and lack of physical activity. According to a Nielsen Vietnam survey on the nutritional composition of food, the average calorie content from sweetened beverages (44 kcal/100ml) is significantly lower than that of other popular foods, especially other sugary foods like milk, cakes, and candies…

INFLATION RISK

International experiences show that while some countries that imposed taxes on sugary drinks may have observed a decrease in consumption, the prevalence of overweight and obesity continued to rise. For example:

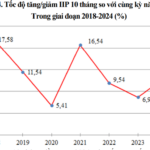

- The Philippines implemented a special consumption tax on sugary drinks in 2018, but the rate of overweight and obesity increased from 31.1% in 2015 to 37.2% in 2019 and 38.6% in 2021-2022.

- Thailand introduced a consumption tax on sugary drinks in 2017, yet the rate of overweight and obesity rose from 28.7% in 2014 to 33.2% in 2019.

- India started imposing a special consumption tax on sugary drinks in 2017. The prevalence of overweight and obesity among women increased from 20.6% in 2015-2016 to 24% in 2019-2021, while the rate among men rose from 18.9% in 2015-2016 to 22.9% in 2019-2021. The proportion of overweight children also increased from 2.1% to 3.4%.

- Mexico began applying a special consumption tax on sugary drinks in 2012. While consumption of taxed drinks decreased in the first two years, the rate of overweight and obesity continued to climb. Specifically, obesity among men increased from 26.8% in 2012 to 31.8% in 2021, and obesity among women rose from 37.5% in 2012 to 41.1% in 2021.

- Chile imposed a special consumption tax on sugary drinks in 2014. A year after the tax was implemented, although the consumption of taxed beverages decreased by 22%, there was no change in the total consumption of beverages. Meanwhile, the prevalence of overweight and obesity continued to rise, from 19.2% in 2014 to 30.3% in 2017 for men and from 30.7% to 38.4% for women.

- Belgium introduced a special consumption tax on sugary drinks in 2016. Obesity among men increased from 13.9% in 2014 to 17.2% in 2019, while obesity among women rose from 14.2% in 2014 to 15.6% in 2019.

- Finland has had a special consumption tax in place since 1940. During 2012-2013, beverage consumption decreased by 3.8%. For taxed fruit juices, consumption dropped by 15% to 35% in 2011-2012. Nonetheless, obesity rates continued to climb, with obesity among men reaching 21.8% in 2017, up from 18.9% in 2014.

These examples illustrate that reducing the consumption of sweetened beverages does not necessarily lead to a decrease in overweight and obesity rates. If consumers, especially children, continue to consume high-calorie foods and engage in insufficient physical activity, the issues of overweight and obesity will persist even with the imposition of a special consumption tax on sweetened beverages.

Currently, businesses in the beverage industry are facing challenges due to increasing production and operating costs, coupled with declining consumer demand. Moreover, the recovery and development of production and business activities in the beverage industry are being negatively affected, not only by socio-economic factors but also by newly issued policies.

Specifically, the Land Law 2024, which came into effect on August 1, 2024, allows for the publication of new land prices closer to market values, applicable from January 1, 2026, with annual adjustments. Experts predict that this new regulation will cause land prices in localities to increase by two to seven times compared to the current rates, leading to a corresponding rise in businesses’ annual land lease costs.

The Environmental Protection Law and guiding documents on the Law on Responsibility for Recycling, Inventory, and Greenhouse Gas Emission Reduction, along with various environmental fees, will significantly increase compliance and operating costs for businesses in the beverage industry.

The price of sugar, a key input for the beverage industry, has increased due to the VAT rate on sugar rising from 5% to 10%.

The draft Law on Corporate Income Tax Amendments also proposes the elimination of tax incentives for items subject to special consumption tax. Therefore, when these laws come into effect in 2026, beverage businesses will no longer be eligible for tax incentives if sweetened beverages fall under the category of items subject to special consumption tax.

With the increasing production and operating costs due to policy changes mentioned above, beverage industry businesses will be compelled to raise product prices to maintain revenue and cost balance. This could potentially contribute to inflation, as beverages are included in the group of goods and services used to calculate the CPI.

Facing rising production and operating costs and declining consumer demand, businesses in the beverage industry, particularly small and medium-sized enterprises, are already vulnerable and will incur further losses compared to other sectors. Therefore, experts, businesses, and associations propose that the issuance or amendment of existing policies should be comprehensively assessed for their impact, especially on the affected entities, to consider the appropriateness of the regulations and their timing of implementation.

The Journey of Nghi Son: Aspiring to Become a Key Urban-Industrial Hub

Resolution No. 58-NQ/TW dated August 5, 2020, of the Politburo on “Building and Developing Thanh Hoa Province by 2030, with a Vision to 2045” affirms: “Continue to invest synchronously and complete essential infrastructure projects in the Nghi Son Economic Zone, soon turning this area into one of the key coastal urban-industrial-service centers of the country.”

A Sugary Proposal: The Taxing Question of Sweet Drinks

The proposed Special Consumption Tax Law (amended) will be presented to the National Assembly for opinions at the 8th Session, taking place in November 2024. One of the novel points of this draft law is the proposed tax on sugary drinks. However, as this is the first time that a special consumption tax on sugary drinks has been proposed in such a law, it has sparked much debate and controversy.

The Heavy Rains Dampen Quang Binh’s Tourism and Service Industry

As we move into October, the shift in weather brings an abundance of rain, significantly impacting the tourism industry in Quang Binh. The demand for sightseeing and travel tours has diminished, leading to a notable decline in revenue for not only tourism but also a range of other service industries compared to previous months.