Techcombank’s Q3 financial report revealed a significant increase in revenue from insurance services, with a nearly 30% year-over-year growth to 594 billion VND in the first nine months of this year. Techcombank and Manulife Vietnam had an eight-year partnership in insurance sales, which ended on October 14. Following this, the bank established its own non-life insurance company, Techcom.

Techcombank experiences a surge in insurance revenue.

KienlongBank also reported impressive growth in insurance, with a nearly 73% year-over-year increase, resulting in nearly 40 billion VND in revenue in Q3. VPBank demonstrated a notable recovery in cross-selling insurance, with a 52% increase in insurance revenue to 2,820 billion VND in the first nine months of the year. SeABank’s insurance agency services brought in over 87 billion VND, a rise of more than 14% compared to the previous year.

In 2022 and 2023, banks faced a crisis in insurance sales due to various issues, including complaints about savings accounts being turned into insurance policies and allegations of forced insurance purchases by loan customers. According to the Ministry of Finance’s inspection conclusions published in 2023, the cancellation rate of insurance contracts sold through banks was alarmingly high. For example, the cancellation rate after the first year for BIDV Metlife was 39.4%, MB Ageas was 32.4%, Prudential was 41%, AIA was 57%, and Sunlife ranged from 39-73% depending on the issuing bank.

However, the recent increase in insurance revenue through bank channels has prompted many banks to invest in non-life insurance companies. VPBank, already an exclusive partner of AIA Vietnam, acquired a 98% stake in non-life insurer OPES in November 2022. LPBank also entered the insurance market by acquiring Xuan Thanh Insurance and renaming it LPBank Insurance in February this year.

Techcombank holds an 11% stake in the non-life insurance company Techcom. Additionally, large banks such as Agribank, BIDV, VietinBank, and Vietcombank, among others, own one non-life insurance company each.

The 2024 Law on Credit Institutions strictly prohibits credit institutions, foreign bank branches, managers, executives, and employees of credit institutions and foreign bank branches from linking the sale of non-mandatory insurance products to the provision of banking products and services in any form.

Insurance expert Tran Nguyen Dan believes that bank channels are a common distribution and sales channel for life insurance companies worldwide, leveraging the strengths of both banks and insurers. However, recent market distortions in Vietnam have negatively impacted customer trust. As a result of lost confidence, life insurance premium revenue declined, making this collaboration less fruitful than before.

“The comprehensive solutions and coordinated supervision by the ministries and sectors will contribute to the healthy development of the bank distribution channel,” said Dan. “This is also an opportunity for banks and life insurance companies to review and adjust their terms to suit the new situation. When terminating the cooperation, the most important factor is for the life insurance company to ensure the maintenance of customer benefits as agreed in the signed contract,” he added.

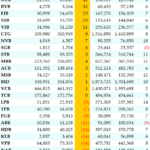

The Ultimate Banker: Techcombank and Another Private Bank Make the Top 10 Cut Across Key Metrics, Including Total Assets, Market Capitalization, CASA, ROA, ROE, and Asset Quality.

“While size may matter, it’s not the be-all and end-all when it comes to banking efficiency. Statistical data reveals that bigger isn’t always better – larger banks don’t necessarily equate to top-tier operational performance.”