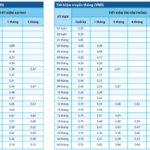

Since the beginning of November, 14 banks have raised their deposit interest rates for various terms, including Eximbank, BaoViet Bank, HDBank, GPBank, LPBank, Nam A Bank, Indovina, Viet A Bank, VIB, MB, Agribank, Techcombank, ABBank, and VietBank.

Today (November 23rd), Eximbank significantly increased its 12-month term deposit interest rate to 5.6%/year. Moreover, the 15-month term witnessed an even higher increase of 0.6%/year, reaching 6.3%/year.

Notably, the interest rates for terms ranging from 18 to 36 months were adjusted upwards by 0.1%/year, settling at 6.4%/year.

Nam A Bank currently offers the highest interest rate for the 3-month term deposit, standing at 4.7%/year.

For the 6-month term, Bac A Bank offers the market’s highest interest rate of 5.6%/year.

Deposit interest rates at banks are entering a new phase of increases (Photo: Nhu Y)

For the 12-month term, Saigonbank and ABBank offer the highest interest rates at 5.8%/year, while Bac A Bank leads the market for the 24-month term with a rate of 6.35%/year.

Referring to the wave of deposit interest rate hikes at banks, a report by MBS Securities Company stated: “Not only in November, but this trend is expected to continue until the end of this year as credit growth is accelerating, almost doubling the growth rate of capital mobilization.”

According to MBS experts, the system’s on-balance sheet bad debt had increased by 4.55% compared to the end of 2023 by the end of September this year, nearing the level at the end of 2023 and doubling the 2% recorded in 2022. These factors contribute to the banks’ decision to adjust deposit interest rates upwards to attract new capital and ensure liquidity.

The recovery of credit growth in the context of accelerating production and investment in the last months of the year will also put some pressure on the system’s liquidity and may lead to an increase in input interest rates. As of the end of October, credit growth had reached 10.08%, higher than the 7.4% recorded in the same period last year.

On the other hand, low inflation and the US Federal Reserve’s interest rate cuts are expected to create room for monetary policy easing in Vietnam. MBS experts forecast that the 12-month term deposit interest rates of large commercial banks may inch up by another 20 basis points, fluctuating around 5.1-5.2%/year by the end of this year.

At a recent press conference of the State Bank of Vietnam, Mr. Dao Minh Tu, Deputy Governor of the State Bank, shared that by the end of September, the credit balance of the entire system reached VND 14,700 trillion, while capital mobilization reached VND 14,500 trillion (credit was VND 200,000 billion higher than capital mobilization). Therefore, to meet the capital demands from now until the end of the year, banks are actively ramping up capital mobilization efforts.

According to the State Bank, credit growth is expected to reach an estimated 15% for the whole year. This implies that in the last two months of the year, credit growth will be around 2%/month, equivalent to more than VND 500,000 billion being injected into the economy.

In a conversation with Tien Phong newspaper, economist Nguyen Tri Hieu stated that from now until the end of the year, the economy will witness more positive developments with many bright spots in production and business, hence the need for banks to prepare capital to promote credit growth during this period.

“In the last months of the year, businesses require a substantial amount of capital to boost production and trade to meet domestic and foreign market demands. This is a very dynamic period and represents the bright spots of the economy,” said Mr. Hieu.

Mr. Hieu believes that increasing deposit interest rates will help banks mitigate liquidity risks, ensure capital for lending activities, and maintain stability in the financial system. In addition to the need for credit growth, the rise in deposit interest rates is also a strategy for banks to compete with other investment channels.

“Eximbank Shareholders Revolt: A Call to Action Against the Discharge of the Chief Controller.”

A group of major shareholders in Eximbank have raised concerns over the removal of Mr. Ngo Tony from his position as Chief Controller. They believe that the decision to terminate his role was made in violation of legal procedures and have voiced their opposition to this move.

“Eximbank Launches Exclusive Credit Package for Import-Export Businesses”

Eximbank has just launched an exceptional credit promotion program tailored for import-export businesses, featuring an attractive interest rate starting from 3.7% per year and a range of service fee waivers. This program is specially designed for SMEs and customers who have not previously had a credit relationship with Eximbank.