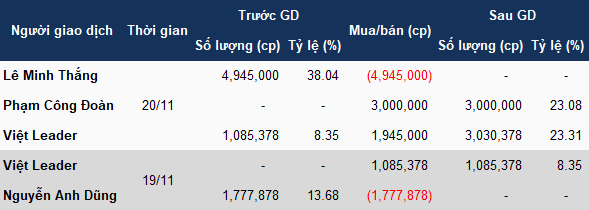

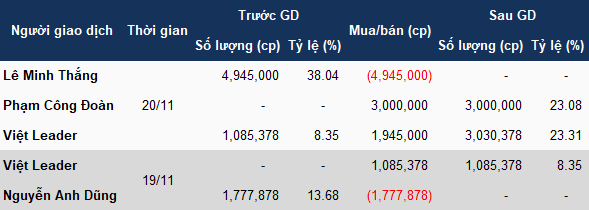

Starting from the 19th of November, Mr. Nguyen Anh Dung sold his entire holding of nearly 1.8 million AMP shares (13.68% stake); conversely, Viet Leader Investment Company bought nearly 1.1 million shares (8.35% stake).

During this session, AMP recorded nearly 1.7 million shares in matched transactions, valued at nearly VND 20 billion (VND 11,800/share), while only 98,000 shares were traded in the auction. It is likely that Mr. Dung and Viet Leader have traded the aforementioned large volume of shares between themselves.

The ownership structure of AMP continued to fluctuate on November 20th, when the largest shareholder, Mr. Le Minh Thang, sold his entire holding of nearly 5 million shares (38.04% stake). Conversely, the Chairman of the Board, Pham Cong Doan, and Viet Leader respectively purchased 3 million and nearly 2 million shares, totaling exactly the volume sold by Mr. Thang.

After the transaction, Mr. Doan, who previously held no shares, now owns 3 million shares (23.08% stake), while Viet Leader further increased its holding to over 3 million shares (23.31% stake). AMP still maintains the same number of major shareholders, with the remaining two being the Ministry of Defense holding 29% and Mrs. Nguyen Thi Huong holding 8.6%.

|

A large volume of AMP shares were traded on November 19th and 20th, 2024

Source: VietstockFinance

|

|

Mr. Pham Cong Doan (born in 1960) was elected to the Board of Directors of AMP for the term 2020-2025 at the Annual General Meeting of Shareholders in mid-June this year, after being nominated by a group of shareholders holding 54.65% of the capital, including Mr. Le Minh Thang and Mr. Nguyen Anh Dung as mentioned above.

Previously, Mr. Doan had served as a Member of the Board of Directors of Saigon – Hanoi Commercial Joint Stock Bank (HOSE: SHB) during the period of 2017-2022. The members then agreed to appoint him as Chairman, replacing Mr. Doan Manh Cuong.

Regarding Viet Leader Investment Company, this is a very new name in the market, established just 12 days before it started purchasing a large volume of AMP shares.

Viet Leader primarily operates in the real estate business, with its head office located in Kim Ma Ward, Ba Dinh District, Hanoi. At the time of its establishment, the company had a charter capital of VND 950 billion, with 3 founding shareholders: Dat Thanh Investment and Trading Company Limited (Dat Thanh Invest) holding 49.7%, Dai Tin Trading and Investment Company Limited (Dai Tin Invest) holding 49.5%, and Mr. Tran Quyet Thang (General Director and legal representative) holding 0.8%.

Of the 3 founding shareholders, Dat Thanh Invest and Dai Tin Invest have charter capital of VND 300 billion and VND 220 billion, respectively. Both companies were established on March 20, 2023, are headquartered in Hanoi, and also operate in the real estate business. Up to now, neither Viet Leader nor the two major shareholders have made any additional announcements regarding changes to their business operations.

Recently, Viet Leader also attracted attention when it purchased 1.25 million shares of Printing and Packaging Corporation (HOSE: MCP), equivalent to an 8.3% stake, becoming a major shareholder.

AMP was formerly known as the Military Medical and Pharmaceutical Equipment Company, established in 1996, specializing in the production and trading of pharmaceuticals and medical equipment. The company was equitized in 2010 with a charter capital of VND 130 billion, which has remained unchanged to the present.

The military-owned pharmaceutical company has a joint venture with a South Korean partner, establishing Vinahankook Medical Equipment Joint Stock Company (AMP holding 32.3% stake) – also chaired by Mr. Pham Cong Doan – specializing in the production of single-use plastic syringes, with an 80% market share in Vietnam.

Credit organizations must adhere to capital contribution and share purchases limits from 1/7/2025.

The State Bank of Vietnam (SBV) is currently drafting a Circular to regulate the establishment and implementation of a roadmap for compliance with capital contribution and share purchase limits of credit institutions and their subsidiaries.