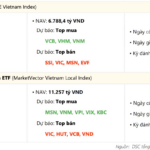

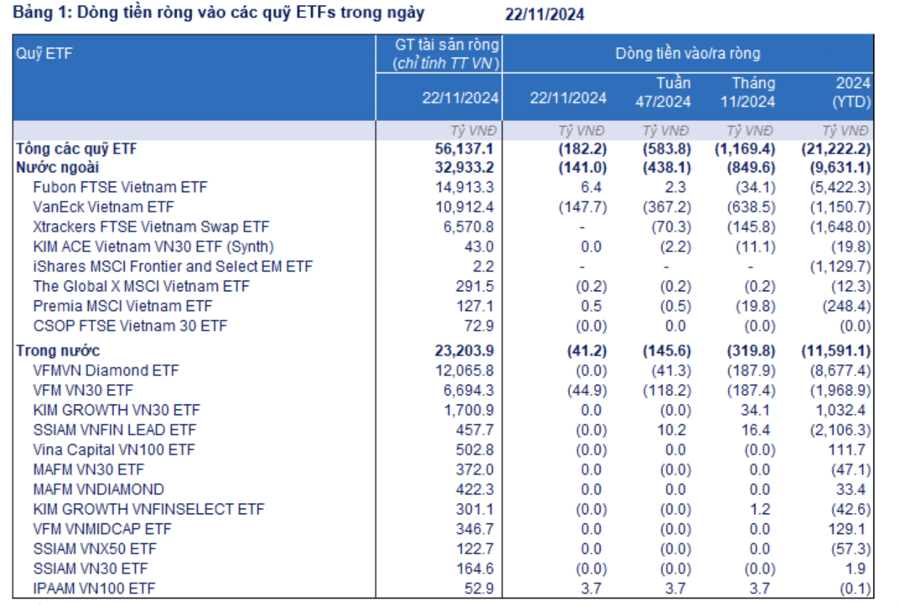

For the trading week of November 18–22, ETFs investing in Vietnamese stocks experienced a net outflow of over VND 583 billion, marking the sixth consecutive week of negative fund flows. According to FiinTrade, the outflow value surged threefold compared to the previous week.

This latest outflow brings the cumulative net outflow for the year 2024 to over VND 1,800 billion. The majority of the outflows during this period were from the VanEck Vietnam ETF.

In November 2024, the total net outflows reached nearly VND 1,700 billion. As a result, the year-to-date net outflows from ETFs have surpassed VND 21,200 billion, a significant increase compared to the total net outflows of VND 1,500 billion in 2023. This amount also corresponds to 27.2% of the net selling by foreign investors since the beginning of 2024.

The combined net asset value of foreign and domestic ETFs stood at VND 56,100 billion for the week of November 18–22, a decrease of 0.69% from the previous week. It is important to note that this figure represents the total net asset value specifically for the Vietnamese market.

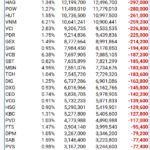

Foreign ETFs witnessed net outflows of more than VND 438 billion, largely driven by outflows from the VanEck Vietnam ETF (VND 367.4 billion). This US-based fund focused its selling on stocks such as VHM, VIC, and HPG. Meanwhile, the Xtrackers FTSE Vietnam ETF experienced outflows of over VND 70 billion. In contrast, the Fubon FTSE Vietnam ETF saw a slight net inflow of VND 2 billion.

Domestic ETFs also faced net outflows of over VND 145 billion, mainly from the VFM VN30 ETF (VND 118.2 billion). The top stocks sold by this fund included FPT, TCB, and ACB. Similarly, the VFM VNDiamond ETF experienced net outflows of over VND 41 billion. Conversely, the SSIAM VNFIN LEAD ETF recorded a net inflow of over VND 10 billion. There were no significant changes in fund flows for the other domestic ETFs.

Additionally, Thai investors withdrew capital through DR sales in the VFM VN30 ETF, managed by Dragon Capital. During the week of November 18–22, investors sold 2.86 million depositary receipts (DRs), equivalent to VND 64.2 billion. They also sold 3.8 million DRs in another fund, amounting to nearly VND 128 billion.

On November 25, 2024, the Fubon FTSE Vietnam ETF experienced a net outflow of VND 7 billion, with no buying or selling activity in stocks. Meanwhile, the VFM VNDiamond ETF faced net outflows of nearly VND 121 billion, while the VFM VNDiamond ETF saw a slight net inflow of over VND 2 billion.

The Foreign Block: Investing Inflows and the Liquidity Conundrum

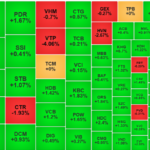

Liquidity in the afternoon session unexpectedly dropped by 22% compared to the morning session, despite the overall breadth remaining favorable. The upward momentum showed signs of weakening. This development reflects the caution among buyers as the market enters a resistance zone, where stronger profit-taking may occur.

When Will the $100 Million ETF Stop Selling?

The period from November 18-25 marked yet another week of net selling for the VanEck Vectors Vietnam ETF (VNM ETF), as the fund offloaded Vietnamese stocks for the fifth consecutive week amidst robust foreign net selling. However, with foreign investors showing signs of returning to the market, is the fund’s selling spree finally coming to an end?

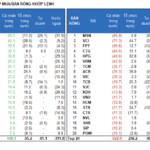

The Foreign Block: Ending the Sell-Off, Going Long on Retail and Bank Stocks

Foreign investors bought a net amount of 116.2 billion VND, and for matched orders, they bought a net amount of 189.1 billion VND.

The Market Pulse: Adjustment Pressures Linger

The VN-Index closed with a slight decline amid a volatile session that saw significant fluctuations. The index also formed a High Wave Candle pattern, indicating investor indecision. The Stochastic Oscillator and MACD indicators continue to trend downward after generating sell signals, suggesting that the short-term outlook remains bearish.