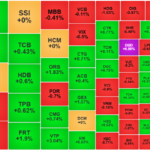

Liquidity this afternoon remained very low despite a slight increase of nearly 6% compared to the morning session. Stable trading, even better breadth than in the morning. VN-Index closed down just 0.16 points, reflecting a balance that has not been broken. The market has not yet seen any significant large sell-off pressure.

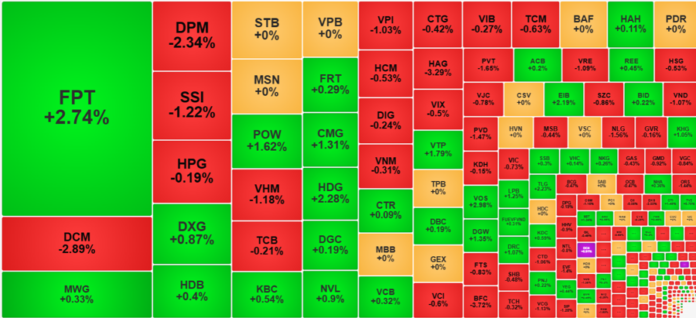

The blue-chip basket this afternoon also improved. VN30-Index ended up 0.14% with 9 gainers/14 losers, better than the morning session (5 gainers/19 losers). The further weakening of some pillars such as VHM, VIC, GAS, and even VCB did not have much impact. The group of improved prices this afternoon not only had more but also had pillars. FPT edged up 1 step price but the leading impact is still significant. This stock is in the Top 3 market cap of VN-Index and the 2.74% increase brought in 1.32 points. BID escaped the morning reference, up 0.22% at the close. POW had a booming afternoon session, up 2.45%, reversing the reference by 1.62%…

The price improvement even took place in many other stocks. The breadth of the HoSE floor at the end of the morning session recorded 95 gainers/254 losers but ended with 125 gainers/236 losers. HoSE floor liquidity this afternoon reached 4,757 billion VND, up slightly by 5.5% compared to the morning session. Thus, selling pressure did not appear negatively but, on the contrary, buyers seemed more positive and pushed up prices in many codes.

Of course, the market cannot be uniform, there are still some individual stocks that are sold off more than the rest, even dumped. DCM was heavily pressured, liquidity soared to more than 344 billion VND and the closing price decreased by 2.89% (down only 1.58% in the morning session). DPM also weakened, closing down 2.34% with a liquidity of 232.1 billion. SSI also surprised with heavy selling, the price decreased by 1.22% with 227.6 billion VND. VPI, HAG, PVT, BFC… are some other codes that have seen significant new selling pressure and deeper price cuts than in the morning session.

However, the group of sharp declines did not dominate. The HoSE floor had 60 stocks down by 1% or more, with liquidity accounting for 18.5% of the floor. In fact, the total trading volume of this group was just a little higher than that of FPT. The stocks that fell the most often had very poor trading, sometimes only a few hundred million VND to around 1 billion VND.

On the rising side, in addition to FPT, POW, CMG, and HDG can be mentioned. POW had a sudden increase in the first 30 minutes of the afternoon session, with price fluctuations of up to +4.12% within one beat. This stock closed up 1.62%, meaning a very strong intraday reversal. HDG also had a strong afternoon session, up 2.82% and rising continuously. HDG closed above the reference by 2.28%. CMG had a rather bland afternoon session, but made up for the good morning gain, closing up 1.31%. All 3 codes attracted strong liquidity and traded in the hundreds of billions of VND.

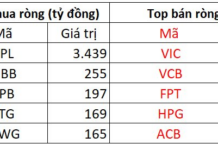

Foreign investors in the afternoon also made a strong impression by net buying an additional 272.2 billion VND on the HoSE floor. FPT alone was bought for more than 400 billion VND. This pillar was net bought for 686.4 billion, but with a large agreement. MSN was also bought a lot, reaching a net value of 65.6 billion VND; VNM was about 42.4 billion net. In total for the whole session, foreign investors net disbursed 354.7 billion. This is the second consecutive session that this group has returned to strong buying after net buying 245 billion in the previous session. The selling streak of foreign investors ended last weekend and net buying is gradually getting stronger.

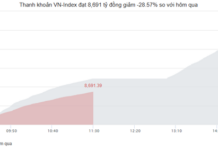

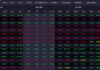

VN-Index closed today at 1,241.97 points, fluctuating within the session reflecting a tug-of-war and HoSE matching liquidity fell to 9,264 billion VND, down 18% from yesterday. In fact, this liquidity level was thanks to FPT, which increased trading by 2.4 times compared to yesterday. If we exclude the trading of this stock, the rest of the market today fell by 26%, a very large drop.

Stock Market Pre-Trading: The “Takeover” Wave of Subsidiaries and Small Companies?

Many listed companies have divested, “acquired” or sold controlling stakes in their subsidiaries or smaller companies.

The Vinhomes Record-Breaking Deal: Unveiling the Biggest Transaction in Stock Market History

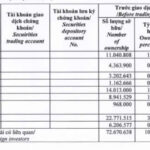

The recent repurchase of approximately 247 million VHM shares has resulted in a significant shift for Vinhomes. The number of voting shares has decreased from over 4.35 billion to nearly 4.11 billion, leading to a consequent reduction in the company’s chartered capital. This decrease is reflected in a change from over VND 43,544 billion to just over VND 41,000 billion.

Stock Market Blog: Are Bottom-Fishing Stocks a Thing of the Past?

The upward momentum significantly stalled in today’s session, yet the market managed to maintain a delicate balance between supply and demand. The volatility was relatively subdued, with narrow fluctuations in both indices and individual stocks. Notably, the combined trading volume of the two exchanges once again dipped below the 10 trillion dong threshold, indicating that investors are holding onto their stocks rather than engaging in short-term trading.