The stock market witnessed a mixed session following a positive opening. The VN-Index closed slightly lower on November 27, losing 0.16 points to end the day at 1,241. Trading volume remained low, with the value of transactions on HOSE exceeding VND 11,300 billion.

Foreign investors remained net buyers for the fourth consecutive session, with a net purchase value of VND 359 billion across all markets.

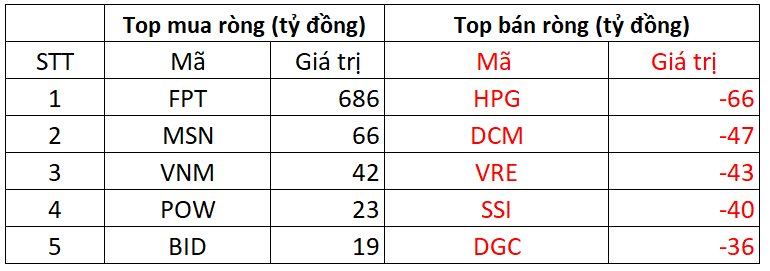

On HOSE, foreign investors net bought VND 355 billion.

FPT was the most purchased stock by foreign investors on HOSE, with a net purchase value of over VND 686 billion. This was followed by MSN and VNM, which saw net purchases of VND 66 billion and VND 42 billion, respectively. POW and BID were also bought, with net purchases of VND 23 billion and VND 19 billion, respectively.

On the other hand, HPG and DCM faced the strongest selling pressure from foreign investors, with net sales of nearly VND 47 billion and VND 43 billion, respectively. SSI and DGC also witnessed net selling of VND 40 billion and VND 36 billion, respectively.

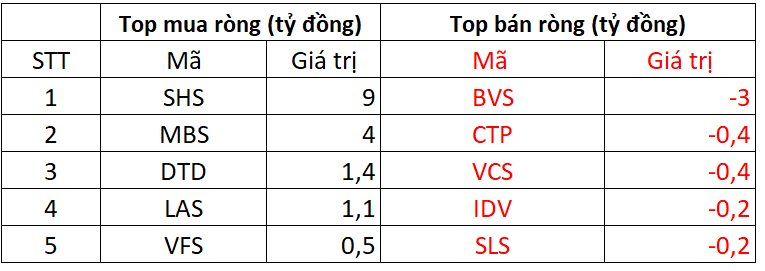

On HNX, foreign investors net bought VND 13 billion.

SHS was the most bought stock on HNX by foreign investors, with a net purchase value of VND 9 billion. MBS followed closely with net purchases of VND 4 billion. Additionally, foreign investors also net bought DTD, LAS, and VFS, investing a few billion VND in each stock.

Conversely, BVS faced the highest net selling pressure from foreign investors, with a net sale value of nearly VND 3 billion. CTP, VCS, and IDV also witnessed net selling of a few billion VND each.

On UPCOM, foreign investors net sold VND 9 billion.

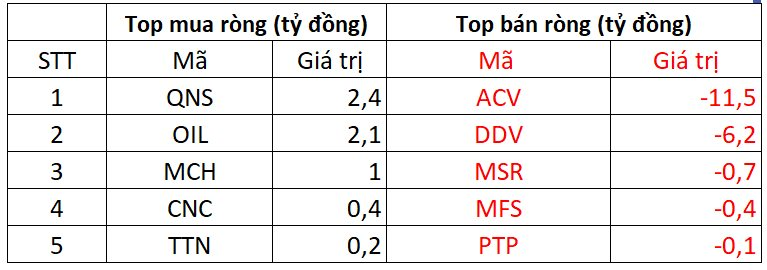

In terms of purchases, QNS was the most bought stock by foreign investors, with a net purchase value of VND 2 billion. OIL and MCH also saw net purchases of a few billion VND each.

Conversely, ACV faced the highest net selling pressure from foreign investors, with a net sale value of VND 11 billion. Foreign investors also net sold DDV, MSR, MFS, among others.

The Heat is On: Foreign Investors Turn to Selling

The VN-Index continued its upward trajectory throughout the morning session, but the gains are gradually diminishing. Trading volume on the HoSE remained similar to yesterday’s morning session, and large-cap stocks showed resilience, maintaining their stability.

The Market Beat: Rising Pressure Wipes Out VN-Index’s Early Gains

The market remained under pressure during the afternoon session, with indices retreating from reference levels. At the close on November 28, the gains were modest, with the VN-Index edging up 0.14 points to 1,242.11, the HNX-Index climbing 0.47 points to 223.57, and the UPCoM-Index advancing 0.38 points to 92.35.