Accessing immediate capital to boost business has always been a classic yet ever-relevant challenge. The involvement of major banks has affirmed a clear commitment to supporting this unique business segment.

BEST CAPITAL SOLUTION FOR SMALL BUSINESS OWNERS

From the beginning of the year, the cumulative monthly total retail goods sales and service revenue have been showing a decreasing trend, indicating a slowdown in consumer spending.

According to a McKinsey survey, due to income and savings losses, as well as concerns about rising costs and job insecurity, Vietnamese consumers will have to spend more wisely. The same organization also found that consumers are spending more on certain product categories while reducing spending on others, such as increasing spending on essential or frequently purchased items (groceries, fuel, vitamins, over-the-counter medications, and personal care products).

Activities such as dining out and external entertainment have been cut down. Notably, consumers are making intentional purchases and gradually increasing their spending on healthy, sustainable, and locally sourced products related to wellness.

As such, the decline in purchasing power over the past few months is expected to recover as Vietnamese rice and agricultural products fetch better prices, exports increase, and workers regain employment. Typically, the year-end market is more vibrant with higher demand and supply. However, the dilemma facing business owners and retailers is that if they want to import goods, they still have to borrow from banks or informal lenders at high-interest rates. So, the question remains: will consumer spending truly rebound, and if so, to what extent?

In the past, during the year-end business season, most small traders would seek working capital from informal organizations, even resorting to “flash loans” or borrowing from loan sharks. This familiar method provided them with immediate access to capital, with interest calculated daily, weekly, monthly, or in 10-day cycles. Small business owners often avoided banks due to the perceived complexity of paperwork and financial proof requirements…

However, since the middle of 2023, with the crackdown on loan sharks and the tightening of the informal lending market, small business owners have been pushed to seek alternative lending options.

Additionally, banks have streamlined their processes and digitized loan applications, making it easier for small business owners and traders to access capital and meet their year-end business needs. One of the critical solutions tailored for this unique segment is Techcombank’s ShopCash, a fully digital platform. With this innovative solution, small business owners can easily take control of their capital needs.

A FLEXIBLE CAPITAL SOLUTION THAT CATERS TO YOUR NEEDS

With the ShopCash overdraft solution (unsecured lending without collateral requirements) on the Techcombank Mobile application, customers can enjoy exclusive privileges designed for small businesses and traders. These include access to pre-approved credit limits of up to VND 500 million. Notably, there is no requirement for collateral, and no activation fees are charged. ShopCash allows for instant transfers or QR code payments from the overdraft account, providing a seamless experience for customers.

Additionally, with a low-interest rate of just 326 VND/1 million/day calculated on the actual amount and duration of usage, from the time of capital withdrawal to debt repayment, small business owners can benefit from easy access to capital and improve their operational efficiency.

“Since discovering the ShopCash solution, I feel like I’ve found the key to a treasure chest. When I need capital for importing goods, Techcombank provides me with a pre-approved limit, and I can use it according to my needs. Moreover, everything is done through digital banking, and I don’t have to visit a physical bank branch or submit any paperwork. It’s incredibly convenient.” shared Ms. Thanh Minh, owner of a household goods store in District 1, Ho Chi Minh City.

Moreover, since its introduction, this solution has been highly regarded for its flexibility in settling payments. “ShopCash doesn’t limit the number of withdrawals within the approved limit. This suits small business owners like us because we often import goods in small batches according to our sales needs. Additionally, we can repay the principal at any time without prepayment penalties through the banking app. This perfectly meets our business reality,” said Mr. Nguyen Anh, owner of a motorcycle equipment store at Cho Dan Sinh Market, Ho Chi Minh City.

With the overdraft lending format, store owners and small business owners can activate for free and utilize capital flexibly with a credit account that functions like a regular payment account. They can choose the amount to use and pay interest only on the actual amount, leveraging their revenue to optimize interest costs.

To check their eligibility for the ShopCash overdraft loan, small business owners can easily verify their status through their Techcombank Mobile account or contact the hotline 1800 588 822 or Techcombank’s financial advisors for guidance and consultation.

Evidently, by understanding the challenges faced by small business owners, Techcombank’s ShopCash solution has accurately addressed the market’s needs, providing practical value and supporting businesses for a vibrant year-end season and a strong start to the upcoming year 2025.

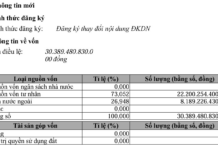

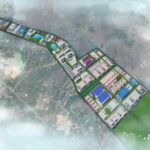

KBC Subsidiary Pours in Massive Capital for the Loc Giang Industrial Park Project

The Loc Giang Industrial Park spans an impressive 466 hectares and is strategically located in the communes of Loc Giang, An Ninh Dong, and Tan My, in Duc Hoa District, Long An Province. The mastermind behind this development is none other than Saigon Northwest Urban Development Joint Stock Company, a powerhouse in the industry.

Unlocking the Secrets to Effective Digital Transformation: A Comprehensive Guide to the DDCI Survey in Ho Chi Minh City, 2024

The upcoming DDCI survey, running until 15th December 2024, focuses on active businesses, investors with ongoing projects, cooperatives, and households engaged in business activities within the city.

Why Do Lending Institutions Hesitate to Finance Agriculture?

The Mekong Delta region is highly vulnerable to the impacts of climate change, including rising sea levels, saltwater intrusion, and flooding. As per Mr. Tran Viet Truong, Chairman of the Can Tho People’s Committee, these risks make lending institutions hesitant to provide loans as the agricultural sector in this region is heavily dependent on weather and nature.