Before the vote, the National Assembly listened to the report presented by Le Quang Manh, Chairman of the National Assembly’s Finance and Budget Committee, on the absorption, explanation, and editing of the draft Law on Public Investment (amended).

The electronic voting results showed that 441 out of 448 deputies participated in the vote, accounting for 92.07% of the total number of deputies. Thus, the National Assembly has passed the Law on Public Investment (amended).

National Assembly votes to pass the Law on Public Investment (amended)

|

The Law on Public Investment (amended) consists of 7 Chapters and 103 Articles, regulating state management of public investment; management and use of public investment capital; rights, obligations, and responsibilities of agencies, units, organizations, and individuals related to public investment activities. This Law applies to agencies, units, organizations, and individuals involved in or related to public investment activities, management, and use of public investment capital.

The Law on Public Investment has provisions for classifying public investment projects. The competent authority, when approving the investment policy for national target projects, Group A, Group B, and Group C projects, has the right to decide whether or not to separate compensation, support, resettlement, and site clearance into independent components.

The Law also stipulates the criteria for classifying national target projects, Group A projects, Group B projects, and Group C projects. National target projects are independent investment projects or clusters of closely linked works that meet at least one of the following criteria: Utilizing public investment capital of VND 30,000 billion or more; Having a significant impact on the environment or potential for serious environmental impact; Requiring land use involving the conversion of paddy land for two or more crops with an area of 500 hectares or more; Involving the relocation of 20,000 people or more in mountainous areas or 50,000 people or more in other regions; Projects that require special mechanisms and policies to be decided by the National Assembly.

One notable new feature of the Law on Public Investment (amended) is the decision-making authority for investment policies of Group B and Group C projects. The decentralization of authority to the People’s Committees at all levels to decide on investment policies for Group B and Group C projects managed by local authorities is a significant shift from the authority of the HĐND at the same level. To ensure rigor, the Law has added the responsibility of “reporting to the People’s Council at the same level at the nearest session” along with the authority to “decide on investment policies.”

In the spirit of innovation and to enhance flexibility in managing and implementing the medium-term public investment plan, the Law on Public Investment (amended) has entrusted the Prime Minister with the decision-making power to adjust the medium-term public investment plan for central budget capital in certain cases. These include adjusting the medium-term public investment plan for central budget capital between ministries, central agencies, and localities without exceeding the total amount of medium-term capital decided by the National Assembly, ensuring efficient use of capital, and reporting to the National Assembly at the nearest session; Adjusting the medium-term public investment plan for central budget capital within and between sectors, fields, and programs of ministries, central agencies, and localities within the total amount of medium-term capital of each ministry, central agency, and locality decided by the National Assembly.

Regarding the 20% limit for projects spanning two medium-terms in Article 93, the Law on Public Investment (amended) maintains this provision while adding specifications. It continues to uphold the 20% limit while introducing additional regulations for national target programs and national target projects implemented according to National Assembly resolutions. It also addresses projects utilizing capital from legitimate sources of state agencies and public non-business units, as well as those employing ODA and preferential foreign loans. Moreover, the Law permits exceeding the 20% limit under specific conditions: “The competent authority reports and is permitted to decide to exceed the limit, but not more than 50% of the capital plan for the previous medium-term public investment phase.”

The Law also incorporates the experimental and specific mechanisms authorized by the National Assembly, such as separating compensation and resettlement into independent projects; Assigning a single People’s Committee of the provincial level as the managing agency for projects passing through the administrative boundaries of two or more provincial-level units; Allowing the Provincial People’s Council to allocate local budget capital to entrust the implementation of credit policies through the Social Policy Bank.

The Legislative Body Confirms Key Appointments

On November 28, the National Assembly elected a member of the National Assembly Standing Committee and the Secretary General of the National Assembly for the 15th term. They also approved the Prime Minister’s proposal to appoint the Minister of Finance and the Minister of Transport for the 2021-2026 term. Additionally, they endorsed the Chief Justice of the Supreme People’s Court’s proposal to appoint a Supreme Court judge, all through a secret ballot.

The National Assembly Approves Additional Capital Injection of VND 20.7 Trillion for Vietcombank

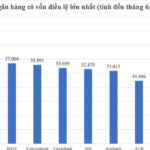

Vietcombank has significantly increased its charter capital, issuing an additional 27,666 billion VND in shares. With this move, the bank’s total charter capital has reached an impressive 83,557 billion VND, making it the highest in the Vietnamese banking system to date. This substantial increase in capital underscores Vietcombank’s strong position and dynamic growth in the market.

The Inefficient Management of State-Owned Enterprises: A Tale of Missed Opportunities and Underutilized Assets

“There is a pressing need for a new mechanism to oversee the operations of state-owned enterprises, according to Delegate Hoàng Văn Cường from the Hanoi Congressional Delegation. He emphasized that wherever there is investment of state funds, there must be a corresponding mechanism to monitor and manage that capital effectively.”