On November 26, the National Assembly officially passed the Value Added Tax Law (amended) with 407 out of 451 deputies agreeing, accounting for 84.97% of the total number of deputies. The law will take effect from July 1, 2025.

THE VAT EXEMPTION THRESHOLD IS VND 200 MILLION/YEAR

Reporting on the explanation, reception, and editing of this bill, Mr. Le Quang Manh, Chairman of the National Assembly’s Finance and Budget Committee, said that there were opinions suggesting considering raising the VAT exemption threshold to above VND 200 million. Besides, there were opinions suggesting a level of over VND 300 million or VND 400 million for the coming years.

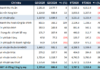

According to the National Assembly Standing Committee, the current law stipulates a tax exemption threshold of VND 100 million/year. Calculations by the Ministry of Finance show that if the tax exemption threshold is set at VND 200 million/year, the number of households and individuals subject to tax payment will decrease by 620,653, and state budget revenue will decrease by about VND 2,630 billion.

According to calculations by the Ministry of Finance, if the tax exemption threshold is set at VND 200 million/year, the number of households and individuals subject to tax payment will decrease by 620,653, and state budget revenue will decrease by about VND 2,630 billion.

If the tax exemption threshold is VND 300 million/year, the number of households and individuals subject to tax will decrease by 734,735, and tax revenue will decrease by about VND 6,383 billion.

Therefore, to ensure a reasonable increase in the tax exemption threshold, which is relatively suitable for the GDP and CPI growth rate from 2013 up to now, the bill stipulates a threshold of VND 200 million/year.

The government proposed being assigned the authority to adjust this threshold to suit the socio-economic development situation in each period to ensure flexibility in management and practicality.

The Chairman of the Finance and Budget Committee said that this content was voted on by the deputies. Accordingly, 204 deputies (accounting for 63.35% of the total number of National Assembly deputies who gave opinions) agreed to stipulate: “Goods and services of households and individuals with an annual business turnover of VND 200 million or less are exempt from tax”, as shown in the bill.

NO IMPORT TAX EXEMPTION FOR SMALL-VALUE GOODS

Regarding VAT refunds, there were opinions suggesting clarifying the provisions of Clause 3, Article 15 in the case of production units that produce both goods subject to a 5% tax rate and goods subject to a 10% tax rate, with input materials subject to a 10% tax rate, and the main revenue comes from 5% taxable items. In this case, the enterprise will not be able to deduct the full amount of 10% input VAT and will not be refunded, causing difficulties for the enterprise.

Receiving the opinions of the delegates, the National Assembly Standing Committee edited the bill to allow tax refunds for establishments that produce and supply both services subject to 5% and 10% taxes at the same time, and assign the Government to stipulate the determination of the amount of input VAT to be refunded according to the allocation ratio as stipulated in Clause 3, Article 15 of the bill.

Regarding the suggestion to not exempt taxes for small-value imported goods through e-commerce platforms and to clarify this content in the common Resolution of the session on the termination of Decision No. 78/2010/QD-TTg, Mr. Le Quang Manh stated that recently, there have been some e-commerce platforms selling goods to Vietnam with very small, low, and competitive values and prices.

The National Assembly Standing Committee highly appreciates the fact that the Government has promptly proposed supplementing the provisions on tax collection for e-commerce in both the draft Value Added Tax Law and the draft Tax Administration Law to improve tax collection efficiency.

However, if Decision No. 78/2010/QD-TTg has not yet come into force, the amended contents of the Value Added Tax Law and the Tax Administration Law will not be able to take effect to ensure tax collection for e-commerce.

Therefore, receiving the opinions of the delegates, the National Assembly Standing Committee included this content in the common Resolution of the session, requesting the Government to urgently issue a Decree on customs management for goods exported and imported through e-commerce channels, ensuring that no import tax exemption is allowed for small-value goods.

For now, Decision 78/2010/QD-TTg should be terminated immediately to provide a legal basis and sanctions for tax authorities to manage and collect taxes from foreign e-commerce platforms selling goods to Vietnam.

Preparing Sufficient Land Reserves for Logistics and E-Commerce

Savills Vietnam has observed a boom in e-commerce and logistics, which has led to a surge in demand for warehouses and industrial properties. This sector is poised for significant growth in the coming years, and the company foresees vast potential for development in the real estate market to cater to these industries.

A Taxing Matter: How Increased Excise Taxes on Alcohol Could Stangle Enterprises and Harm Vietnam’s Economy

The special consumption tax on alcoholic beverages needs to be set at a reasonable rate to ensure effective and sustainable state budget revenues without putting pressure on the macroeconomic factors.