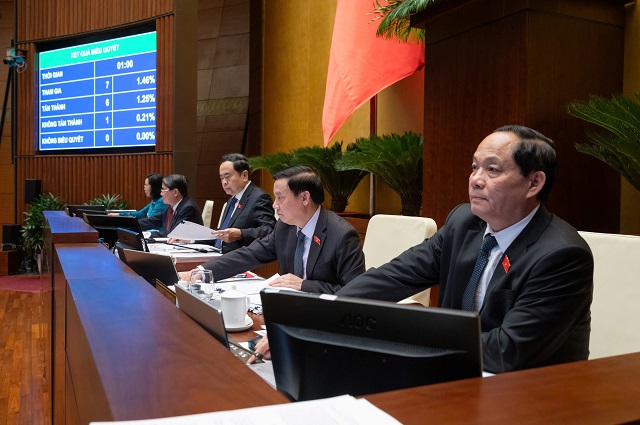

On the afternoon of November 29, under the direction of Vice President of the National Assembly Nguyen Duc Hai, the National Assembly voted to pass the Law amending and supplementing a number of articles of the Law on Securities, Accounting Law, Law on Independent Audit, Law on State Budget, Law on Management and Use of Public Assets, Law on Tax Administration and Law on National Reserves (1 law amending 7 laws).

National Assembly leaders vote to pass the Law amending and supplementing a number of articles of 7 laws

|

Earlier, the National Assembly listened to the member of the Standing Committee of the National Assembly, Chairman of the Finance and Banking Committee, Le Quang Manh, presenting the report on explaining, adopting, and editing the draft Law amending and supplementing a number of articles of 7 laws.

Accordingly, in the process of explaining, adopting, and editing the draft Law, some contents of the amendments and supplements of the Law on Independent Audit relate to the provisions of the Law on Handling Administrative Violations. Amendments and supplements to a number of articles of the Law on Tax Administration are related to the provisions of the Law on Personal Income Tax. Therefore, the National Assembly Standing Committee (NASC) reported to the National Assembly for consideration to supplement the contents of amendments to these two Laws and change the name of this draft Law to “Law amending and supplementing a number of articles of the Law on Securities, Accounting Law, Law on Independent Audit, Law on State Budget, Law on Management and Use of Public Assets, Law on Tax Administration, Law on Personal Income Tax, Law on National Reserves, and Law on Handling Administrative Violations.”

Regarding the Law on Securities: During the verification of the contents of the amendments and supplements to the Law on Securities, as well as the opinions of the NA deputies expressed at the Groups and the Hall, there were 02 contents with many different opinions. These were related to: (1) Report on the chartered capital and (2) the participation of commercial banks as clearing members and payment for securities transactions on the securities trading system. The National Assembly Standing Committee directed the agencies to receive and edit the regulations on these 02 contents in the draft Law. The direction was towards having the law include the principle and assigning the Government and the Minister of Finance to elaborate specific regulations to ensure feasibility. The received and edited contents are shown in Clause 7, Point b Clause 12, and Clause 18, Article 1 of the draft Law.

Regarding the Law on Independent Audit: During the verification of the contents of the amendments and supplements to the Law on Independent Audit, as well as the opinions of the NA deputies, there were 02 contents with many different opinions. Specifically, regarding the audited units, the NA Standing Committee directed the agencies to explain and fully receive the opinions of the NA deputies towards removing the object “other organizations of a large scale that must audit financial reports” to ensure feasibility. At the same time, the Government was requested to carefully and thoroughly assess the impact to specify in the draft Decree the scale of enterprises that must be audited annually.

Regarding the handling of violations of the law on independent auditing: There were opinions suggesting: (i) clarifying the basis of administrative sanction levels to ensure deterrence; (ii) only doubling the maximum penalty compared to the present and the maximum time limit for sanction is 2 years due to the shortage of auditing staff compared to the market size.

The NA Standing Committee believed that this was the maximum fine and was only applied to some serious violations of auditing standards that had not yet reached the level of criminal prosecution. Therefore, it was possible to consider stipulating as in the draft Law to ensure deterrence for auditing firms and auditors, especially during the past time, there have been some cases of serious violations of professional and ethical standards by auditing firms and auditors. In the process of perfecting the draft Decree for guidance, the Government was requested to review and assess the specific impact and have reasonable penalties for each act as per the opinions of the NA deputies.

Regarding the Law on State Budget: Amending and supplementing Clause 10, Article 8 of the State Budget Law on supplementing the regulations on programs, projects, and plans outside the mid-term public investment plan (Point a, Clause 1, Article 4 of the draft Law): Many opinions suggested not amending this regulation. Many opinions suggested clarifying “projects outside the mid-term public investment plan but implemented according to the State Budget Law.” Some opinions suggested that in special cases where the procedure needs to be shortened, the National Assembly assigns the Standing Committee of the National Assembly to have the authority to consider supplementing the list during the time between the two sessions and reporting to the National Assembly at the nearest session.

Receiving the opinions of the NA deputies, the NA Standing Committee directed the agencies to review and amend this clause towards maintaining the current regulation in Clause 10, Article 8, and the competence to allocate the source of reserves and increased revenue and savings of the annual state budget according to the provisions of Article 10 and Article 59 of the current Law for programs, tasks, and projects outside the mid-term public investment plan. In addition, supplementing the regulation: “The Government shall stipulate the order and procedures for investment and implementation of programs, tasks, and projects to ensure tightness, efficiency, and proper purposes.”

Supplementing Clause 10a, Article 8 of the State Budget Law on investment expenditure and regular expenditure for implementing some tasks and projects (Point b, Clause 1, Article 4 of the draft Law): Many opinions agreed to supplement this regulation but suggested narrowing the scope of tasks using regular expenditure or assigning the Government to guide in detail and take responsibility for ensuring the structure of state budget expenditure. Some opinions suggested not supplementing this regulation.

Chairman of the Finance and Budget Committee, Le Quang Manh

|

Receiving the opinions of the NA deputies, the NA Standing Committee directed the agencies to review and edit. At the same time, the Government suggested the need to supplement this regulation as a basis for promulgating and implementing the guiding Decree. This content was reflected in Clause 1, Article 4 of the edited draft Law. Supplementing Point d, Clause 5, Article 19, and Point d, Clause 2, Article 30 of the State Budget Law on allocating the state budget expenditure that has not been allocated in detail: Many opinions disagreed with amending this content as it was inconsistent with the competence; Many opinions suggested that the National Assembly Standing Committee should be given the authority to consider and decide; Some opinions suggested that this content could be handled by amending the regulations on the use of reserves.

As the amendment of this regulation relates to different interpretations, the NA Standing Committee directed the agencies to review the relevant legal provisions. Based on the review results, to ensure consistency with the competence of the National Assembly and the People’s Councils as prescribed in the Constitution, the Law on Organization of the Government and the Law on Organization of Local Governments, and to ensure consistency among the contents of the clauses and articles of the State Budget Law; At the same time, the NA Standing Committee requested the National Assembly to allow the amendment of this regulation and to amend and supplement Point a, Clause 5, Article 19 of the State Budget Law on the tasks and powers of the National Assembly and Point a, Clause 2, Article 30 of the State Budget Law on the tasks and powers of the People’s Councils at all levels as reflected in Clause 3 and Clause 4, Article 4 of the edited draft Law.

Regarding the Law on Management and Use of Public Assets: Regarding the content of decentralization and empowerment in the management, use, and handling of public assets, many opinions agreed to amend the mechanism from “decentralization” to “empowerment” in the management and use of public assets. Many opinions suggested considering and not amending and supplementing these clauses, and it was necessary to carefully evaluate the impact, review, and ensure consistency and synchronization to avoid contradictions and overlaps within this Law and relevant legal documents, especially the provisions of the Law on Government Organization, the Law on Local Government Organization, and specialized laws.

The NA Standing Committee requested the agencies to carefully review the contents of the amendments and supplements related to decentralization and empowerment to ensure consistency with the provisions of the Law on Government Organization and the Law on Local Government Organization. Receiving the opinions of the NA deputies, the scope of the proposed amendment was narrowed to include the contents related to the competence of the People’s Councils of the provinces at Clause 2, Article 17 on the tasks and powers of the People’s Councils of the provinces and the contents related to the competence to approve the scheme on the use of public assets at public non- business units for business, leasing, joint venture, and association purposes. These contents were specifically reflected in Clause 1, Clause 7, Clause 8, and Clause 9, Article 5 of the edited draft Law. Supplementing the form of handling public assets at state agencies “transfer to local management”: Some opinions agreed to supplement the form of “transfer to local management and handling” as proposed by the Government; Some opinions believed that it was not necessary to amend these clauses and items because, in reality, they were being implemented and there were no difficulties.

The NA Standing Committee stated that the supplement of this regulation was to have a basis for implementing the form of transferring assets to local management and handling. Therefore, the NA Standing Committee requested the National Assembly to allow the supplement of the form of “transfer to local management and handling” and not to legislate the specific contents in the Decree.

Regarding the rearrangement of houses and land according to the law on the management and use of public assets of SOEs: Some opinions agreed with the regulations of the draft Law, supplementing the phrase “Not required to rearrange houses and land according to the law on the management and use of public assets.” Some opinions believed that the rearrangement of houses and land of enterprises was very necessary, and if this regulation in the Law on Management and Use of Public Assets was removed, it would create a big loophole as no other law would stipulate the rearrangement of houses and land of enterprises.

According to the Government’s report, the amendment and supplement of this regulation would not create a legal gap in the management and use of houses and land in SOEs. Therefore, the NA Standing Committee suggested that the National Assembly allow the amendment and supplement of this regulation as reflected in Clause 22, Article 5 of the edited draft Law.

Regarding the Law on Tax Administration: Amending to remove the phrase “without a permanent establishment in Vietnam” of foreign suppliers with business activities in electronic commerce or on a digital platform (Clause 4, Article 42 of the current Law): Some opinions believed that removing the phrase “without a permanent establishment in Vietnam” of foreign suppliers with business activities in electronic commerce or on a digital platform was not suitable.

To clarify the opinions of the NA deputies, the chief editor agency reviewed and affirmed that the amendment to remove the phrase “without a permanent establishment in Vietnam” was suitable for the international trend, ensuring effective and fair tax management among countries. At the same time, it created a basis and legal corridor for the tax agency to urge foreign suppliers with a “permanent establishment” to register, declare, and pay taxes through the electronic information portal for foreign suppliers, ensuring comprehensive coverage, expanding the tax base, and preventing tax losses, especially in the field of e-commerce and digital platforms. Therefore, the NA Standing Committee suggested that the National Assembly allow the amendment of this content as reflected in Clause 5, Article 6 of the edited draft Law.

Regarding the regulation allowing taxpayers to supplement tax declaration dossiers after having a decision on inspection and examination: There was an opinion suggesting considering the amendment of Article 47 of the current Law on supplementing the tax declaration dossier to ensure the effectiveness of post-inspection and examination. Receiving the opinions of the NA deputies and to proactively prevent negative phenomena, the NA Standing Committee agreed with the Government to present to the National Assembly to supplement the contents of amendments, supplements, editing, and perfecting the draft Law, towards removing the regulation allowing taxpayers to supplement tax declaration dossiers after having a decision on inspection and examination. The received and edited contents were reflected in Clause 6, Article 6 of the edited draft Law.

In addition to the above issues, the NA Standing Committee directed the research and full reception of the opinions of the NA deputies to edit and perfect the draft Law in terms of content and text to submit to the National Assembly for consideration and passage. After receiving, editing, and perfecting, the draft Law had 11 articles, supplementing 02 Articles compared to the draft Law presented to the National Assembly at the beginning of the 8th session of the 15th National Assembly.

The National Assembly Unanimously Passes a Resolution to Establish Hue as a Centrally-Controlled Municipality

On November 30, the 15th National Assembly’s 8th Session witnessed a historic moment as 458 out of 461 attending delegates, accounting for 95.62% of the total number of delegates, voted in favor of a resolution to establish Hue as a centrally-controlled city.

The Legislative Body Confirms Key Appointments

On November 28, the National Assembly elected a member of the National Assembly Standing Committee and the Secretary General of the National Assembly for the 15th term. They also approved the Prime Minister’s proposal to appoint the Minister of Finance and the Minister of Transport for the 2021-2026 term. Additionally, they endorsed the Chief Justice of the Supreme People’s Court’s proposal to appoint a Supreme Court judge, all through a secret ballot.

The National Assembly Approves Additional Capital Injection of VND 20.7 Trillion for Vietcombank

Vietcombank has significantly increased its charter capital, issuing an additional 27,666 billion VND in shares. With this move, the bank’s total charter capital has reached an impressive 83,557 billion VND, making it the highest in the Vietnamese banking system to date. This substantial increase in capital underscores Vietcombank’s strong position and dynamic growth in the market.

Unveiling the 6 Manipulative Behaviors in the Stock Market

Placing buy and sell orders for the same securities on the same trading day, trading securities in collusion, or enticing others to do so are considered manipulative behaviors in the securities market.