Illustration

Oil prices slip as Middle East conflict eases, but set for weekly loss

Oil prices dipped but were on track for a weekly loss as concerns over supply risks from the Israel-Hezbollah conflict eased and on expectations of higher output in 2025, although OPEC+ is likely to continue with production cuts.

Brent crude futures fell 34 cents, or 0.46%, to $72.94 a barrel. U.S. West Texas Intermediate (WTI) crude futures fell 72 cents, or 1.05%, to $68 per barrel, compared with Thursday’s close before the Thanksgiving holiday.

For the week, Brent was down 3.1% and WTI was down 4.8%.

Four Israeli tanks entered a Lebanese border village, according to Lebanon’s official news agency on Friday. A ceasefire that took effect on Wednesday has calmed the conflict, although both sides have accused each other of violations.

However, the Middle East conflict has not disrupted supply, and supply is expected to be more abundant in 2025. The International Energy Agency (IEA) forecasts an additional 1 million barrels of oil per day (bpd), or more than 1% of global supply.

“The updated forecasts imply that next year will see a larger oil surplus than this year, and prices will average below 2024 levels,” said Tamas Varga, analyst at oil broker PVM.

The OPEC+ group, which includes the Organization of the Petroleum Exporting Countries and allies, including Russia, postponed their next policy meeting from Dec. 1 to Dec. 5. OPEC+ is expected to decide at that meeting to continue with production cuts.

A Reuters survey of 41 analysts forecast Brent would average $74.53 a barrel in 2025, marking the seventh consecutive reduction in monthly price forecasts in the Reuters poll.

Gold prices rise on weaker dollar, geopolitical tensions

Gold prices rose, aided by a softer U.S. dollar and prolonged geopolitical tensions, but the metal was still on track for its biggest monthly decline since September last year, following a post-election selloff after Donald Trump’s victory.

Spot gold rose 0.5% to $2,652.71 an ounce by 18:40 GMT, but was still poised for a weekly loss of over 2% after a steep fall earlier in the week. U.S. gold futures settled up 0.6% at $2,681.

Gold prices have fallen 3% so far this month, the biggest monthly loss since September 2023, as the “Trump rally” boosted the dollar earlier this month and stalled gold’s momentum, triggering a post-election selloff.

The dollar index fell to its lowest in over two weeks, but was still on track for a 2% gain in November, as Trump’s Nov. 5 victory sparked expectations of higher fiscal spending, higher taxes, and tighter borders.

Gold, which has been supported by geopolitical tensions and U.S. Federal Reserve rate cuts this year, now faces pressure as higher taxes could boost inflation and force the Fed to be more cautious.

Silver rose 0.9% to $30.54 an ounce, platinum gained 1.7% to $946.83, and palladium rose 0.7% to $981.63, although all three metals were set for monthly losses.

Copper prices edge up on stronger China demand, but set for second monthly fall

Copper prices edged up on signs of stronger demand from China, but gains were limited by potential tariffs from the United States.

London Metal Exchange (LME) three-month copper rose 0.1% to $9,014 a tonne, but was still headed for a 5.3% fall in November. COMEX copper futures for delivery in December rose 0.4% to $4.11 per pound.

The most-traded January 2025 contract on the Shanghai Futures Exchange (SHFE) closed almost unchanged at 73,830 yuan ($10,216.28) per tonne, registering a second straight monthly fall.

“China is in wait-and-watch mode until they know the full extent of the impact of the tariffs, before they roll out fiscal stimulus,” Shah added.

LME copper has fallen 11% since hitting a four-month high of $10,158 on Sept. 30, as investors sold off their bullish positions due to tariff concerns and disappointment over the lack of strong stimulus from China.

However, some positive signals are emerging from China, including inventories on the SHFE, which have fallen by two-thirds since early June to 108,775 tonnes, the lowest since Feb. 5, 2024.

Investors also hope that upcoming data will show that China’s stimulus measures are starting to take effect.

Analysts in a Reuters poll forecast that China’s manufacturing activity likely grew modestly in November, marking a second straight month of expansion, while home prices are expected to stabilize in 2026 after a slowdown in price gains this year and next.

Additionally, a weaker dollar has supported metal prices, making dollar-denominated metals cheaper for buyers using other currencies.

Among other metals, LME aluminum was almost unchanged at $2,598 a tonne, zinc rose 1.6% to $3,104, lead gained 0.8% to $2,074, tin added 2.4% to $28,860, while nickel fell 1% to $15,905.

Iron ore futures rise to over 1-month high on stronger China economic outlook

Dalian iron ore futures rose to their highest in over a month, ending the week with gains, as a stronger economic outlook from China boosted market sentiment.

The January 2025 iron ore contract on the Dalian Commodity Exchange (DCE) ended the daytime trading session up 1.14% at 797.5 yuan ($110.29) per tonne.

The contract earlier hit a high of 806.5 yuan, its loftiest since Oct. 14, and was up 2.90% for the week.

The December 2024 iron ore contract on the Singapore Exchange rose 0.94% to $104.70 a tonne, gaining 3.12% for the week as of 07:21 GMT. Earlier, the price hit $104.55, its highest since Nov. 8.

China’s manufacturing activity likely grew modestly in November, marking a second straight month of expansion, while home prices are expected to stabilize in 2026 after a slowdown in price gains this year and next, according to two Reuters polls.

The surveys add to a string of recent data showing that stimulus measures are gradually taking effect and providing the necessary boost to China’s manufacturers.

“Chinese steel mills have started to stock up on iron ore to ensure sufficient raw materials for steel production during the winter,” said China-based consultancy Mysteel.

On the Shanghai Futures Exchange, steel rebar rose nearly 0.5%, hot-rolled coil gained about 0.6%, wire rod climbed about 0.5%, while stainless steel dropped 0.46%.

Robusta coffee slips from 2-month peak

January 2025 robusta coffee futures closed up 0.6% at $5,565 per tonne, after hitting a two-month peak of $5,613 earlier in the session.

Traders said the strength in the arabica contract, which rose to a near half-century peak on Wednesday, supported the robusta market.

Federal auditors in Brazil began an indefinite nationwide strike over salary issues, according to a statement on the union’s website, warning that the strike would continue until their demands were met and that there would be a protest in the capital Brasilia next week. Brazilian coffee traders Atlantica and Cafebras will negotiate with their creditors in court, a statement on Wednesday said, citing debt issues due to poor crop yields and currency volatility.

A slower-than-usual start to the harvest in top grower Vietnam also supported prices. A trader in Vietnam’s coffee growing region said, “The volume of new crop coffee beans purchased from farmers this season is much lower than in previous years.”

Sugar declines

March 2025 white sugar fell 0.7% to $556.10 per tonne.

Traders noted that Brazil’s cane crop was showing signs of weakness, contributing to price support, with sugar mills closing earlier than usual.

Brazil’s agricultural agency, Conab, on Thursday estimated the country’s 2024/25 sugar production at 44 million tonnes, down from its previous forecast of 46 million.

Cocoa:

March 2025 London cocoa rose 2.3%, closing at £7,612 per tonne.

Improved demand boosts export prices for Indian, Thai rice

Export prices for Indian rice rose after three weeks of stability, supported by improved demand this week. Meanwhile, deliveries and strong demand from regular buyers pushed Thai rice prices to a one-month high.

India’s 5% broken parboiled rice was being offered at $445-$453 per tonne this week, the highest since Oct. 24, up from $440-$447 in the previous fortnight. Indian white rice was quoted around $450-$458 per tonne, up from $445-$452 last week.

Last month, India removed export taxes on parboiled rice and scrapped a minimum export price of $490 per tonne for 100% broken white rice to boost sales.

Meanwhile, Thai 5% broken rice prices rose slightly to $510 per tonne, on par with the last quote of $500 per tonne on Oct. 25, after deliveries were made and strong demand came from regular buyers, traders said.

Prices could rise slightly further, but the market will become more competitive as India continues to export more, a Bangkok-based trader said.

Vietnam’s 5% broken rice was quoted at $520 per tonne on Nov. 28, unchanged from last week, according to the Vietnam Food Association. However, traders were offering lower prices, ranging from $500 to $510 per tonne.

“Trading is slow as both buyers and sellers are unhappy with the current price,” a Ho Chi Minh City-based trader said. Vietnam’s parliament this week approved changes to the value-added tax law, imposing a 5% tax on fertilizers from July 2025, a move traders said would make domestic rice less competitive in the international market.

Japanese rubber futures slip on supply concerns, uncertain China economy

Japanese rubber futures slipped but were still on track for a weekly gain as investors weighed supply concerns against an uncertain economic outlook for top consumer China.

The May 2025 rubber contract on the Osaka Securities Exchange (OSE) fell 4.1 yen, or 1.12%, to close at 363.0 yen ($2.43) per kg.

In contrast, the May 2025 rubber contract on the Shanghai Futures Exchange (SHFE) rose 160 yuan to 18,260 yuan ($2,526.74) per tonne.

For the week, the OSE contract was up 1.82% and the SHFE contract was up 4.61%.

Some flooding in southern Thailand supported Thai rubber prices, although the rainfall was mostly confined to the south and was unlikely to significantly affect production compared with earlier this year.

Concerns over reduced global supply and the potential for stronger demand ahead of new U.S. tariffs are driving the sharp rise in natural rubber prices, according to Jom Jacob, an analyst at Indian analytics firm Rubber.

However, uncertainty about China’s fiscal stimulus, concerns about trade risks related to higher U.S. tariffs, and a stronger yen are expected to limit the upside for natural rubber, Jacob said.

The yen has strengthened as much as 1.2% to a six-week high of 150 yen to the dollar, making yen-denominated assets less attractive to foreign investors.

The December 2024 rubber contract on the SICOM exchange in Singapore last traded at 192.3 U.S. cents per kg, up 0.7%.

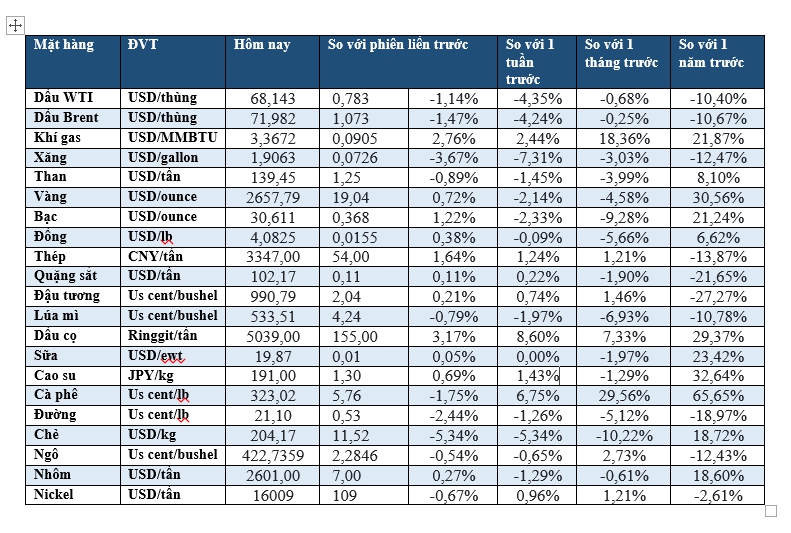

Key commodity prices as of this morning

The Golden Opportunity: Unlocking the Power of Words for Global Appeal

A master craftsman of words, with an innate understanding of the English language, has the unique ability to captivate and inspire. With a deft touch, this wordsmith can transform the ordinary into the extraordinary, crafting titles that are a work of art in themselves.

The global gold price on November 28 continued to rise amid geopolitical tensions and trade war fears, driving safe-haven demand. Trading volume was also lower than expected as US stock markets were closed for the Thanksgiving holiday.

The Golden Conundrum: Navigating the Tug-of-War Between Conflicting Factors

The Swiss bank UBS predicts that gold prices will continue to oscillate in the short term “between mixed signals”.