In the corridors of the National Assembly, some delegates shared that the upcoming amendments to the Value-Added Tax Law will significantly impact businesses and state budget revenues. They emphasized the need for coordinated efforts between ministries, sectors, and local authorities to facilitate business operations and promptly address any emerging challenges.

Several delegates highlighted the direct impact of the amended Value-Added Tax Law on the rights and interests of organizations, individuals, citizens, and businesses. The law includes provisions for exempting certain imported goods from taxation. To ensure effective implementation, ministries, sectors, and local governments need to closely coordinate and widely communicate these changes to affected entities, fostering unity in action and alignment with market economy demands and international practices.

The amended Value-Added Tax Law will directly impact the rights and interests of organizations, individuals, citizens, and businesses (Photo: KT)

Delegate Ho Thi Minh from Quang Tri province shared, “While reducing value-added tax may result in revenue shortfalls, we believe that in the current context, this is an opportunity to revive business activities. The government needs to provide strong leadership to ensure that the reduction does not compromise budget revenues and facilitates business growth. We strongly agree with and support the need to stand by our businesses. When enterprises thrive and survive due to our policies, we will recoup these losses. Accompanying businesses is also the responsibility of the National Assembly and its delegates.”

According to some delegates, when applying these amendments in practice, it is crucial to clearly define the goods and services subject to taxation, tax-exempt items, tax calculation methods, and the timing of value-added tax determination. Regarding the provision authorizing the Government to specify tax-exempt household and personal goods and services, delegates emphasized the importance of this delegation to ensure flexibility and effectiveness in governance.

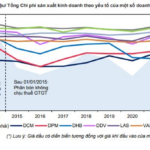

Delegate Tran Hoang Ngan from Ho Chi Minh City remarked, “For items with high value, such as jewelry, further discussion is needed to determine the threshold, with detailed regulations provided by the Government. Increasing taxes does not necessarily lead to higher budget revenues, as higher taxes may result in decreased sales. The critical factor is sales volume. Why have we been able to reduce value-added tax continuously for the past two years while still increasing budget revenues?”

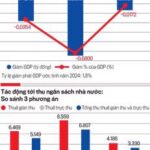

Delegate Nguyen Quang Huan from Binh Duong province emphasized that to achieve the strategy of mobilizing 16-17% of GDP into the state budget by 2030, with taxes and fees accounting for 14-15% of GDP, domestic revenue collection must reach 86-87%. He suggested that tax policies need to be flexible and practical. As an example, he cited the proposed continuation of a 2% VAT reduction in the first six months of 2025 to stimulate consumption and support production and business activities. The expected revenue loss for the state budget during this period is equivalent to approximately VND 26.1 trillion, a substantial amount. Therefore, specific priority sectors and industries should be identified.

“Reducing VAT for businesses is beneficial, but some businesses may not need it as they can pass on the costs to consumers. The Government should carefully consider this. Reducing taxes for manufacturing businesses is excellent for stimulating demand, as they are still struggling. However, for businesses that are unaffected or already stable, a tax reduction may not be necessary,” suggested Delegate Nguyen Quang Huan.

A Taxing Matter: How Increased Excise Taxes on Alcohol Could Stangle Enterprises and Harm Vietnam’s Economy

The special consumption tax on alcoholic beverages needs to be set at a reasonable rate to ensure effective and sustainable state budget revenues without putting pressure on the macroeconomic factors.

Farmers and Agricultural Businesses Yearn to Pay VAT

The upcoming agenda for the National Assembly includes the discussion and potential passage of the Value-Added Tax Law (amended) on November 26th. A highly debated topic among the public is the government’s proposal to shift fertilizers, agricultural machinery, and fishing vessels from tax-exempt to a 5% tax-liable status.

A Plea to Postpone the Increase in Excise Tax on Beer to Give Businesses Time to Restructure Their Product Offerings

Recognizing the potential impact on multiple industries within the supply chain, several National Assembly delegates proposed postponing the special consumption tax increase on beer until 2027 during the discussion session on November 22nd regarding the Draft Law on Special Consumption Tax (amended). This delay would provide businesses with much-needed time to restructure their product offerings and mitigate any abrupt shocks to various interconnected sectors.

What Challenges Lie Ahead for the 2025 Growth Target?

The National Assembly has recently approved an ambitious GDP growth target of 6.5-7% for 2025, striving for an even higher 7-7.5%. With the global economy still fraught with uncertainties, what makes Vietnam confident in aiming for such robust growth? And what potential challenges lie ahead in achieving this lofty goal?