In the international market, the DXY index fell 1.71 points from the previous week to 105.78, ending the index’s three-week winning streak.

The USD weakened as President-elect Donald Trump’s statements on tariffs painted a more complex economic picture for the coming year. His plans for higher tariffs and increased government spending could stimulate growth but also add inflationary pressure.

|

BRICS is an acronym for the emerging economies of Brazil, Russia, India, China, and South Africa. This group has expanded to include five more members: Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE. |

In a post on Truth Social media on November 30, President-elect Donald Trump warned that BRICS nations must commit to not creating a new currency and not supporting any other currency as a substitute for the USD. “Or they will face a 100% tariff and should get ready to say goodbye to selling their goods to the fantastic US economy,” Mr. Trump wrote.

Earlier, he had proposed a 10% tariff on all imports into the US from all countries, with a higher rate of 60% for China. More recently, he has threatened to impose a 25% tariff on neighbors Canada and Mexico and an additional 10% on China if they don’t stop illegal immigration and the flow of fentanyl into the US.

Reacting to President Donald Trump’s statements, the minutes of the November meeting of the US Federal Reserve (Fed), released on November 26, indicated that officials remain open to adjusting monetary policy. While they did not provide a clear signal about the next round of rate cuts, they suggested that they would continue to gradually lower borrowing costs over time.

This suggests that the Fed may still opt for another rate cut in December to pursue a soft landing for the economy, i.e., cooling inflation without causing a recession, before Mr. Trump’s tariff policies take effect and push inflation higher again.

Source: SBV

|

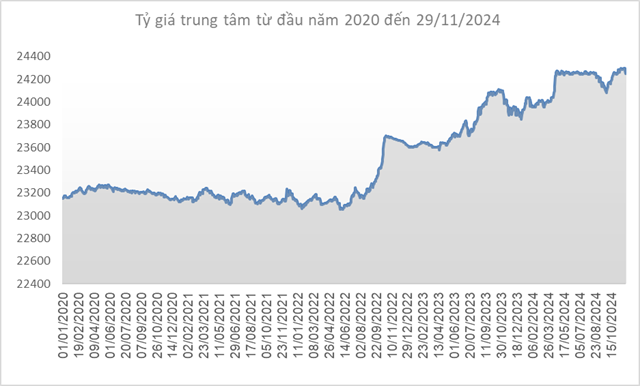

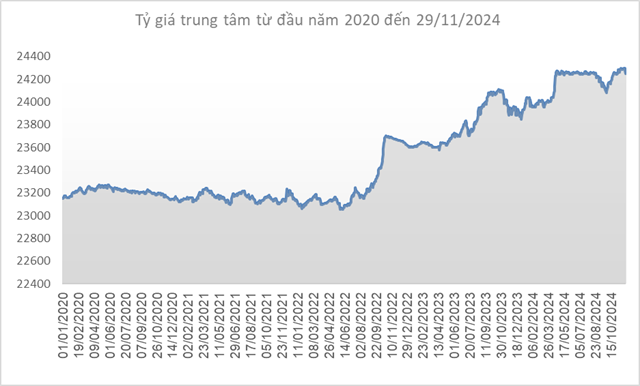

Domestically, the central exchange rate of the Vietnamese dong to the USD decreased by 44 VND/USD compared to the previous week (November 22), reaching 24,251 VND/USD in the session on November 29, 2024.

With a 5% fluctuation band, the USD/VND exchange rate at commercial banks is allowed to trade within the range of 23,038-25,464 VND/USD.

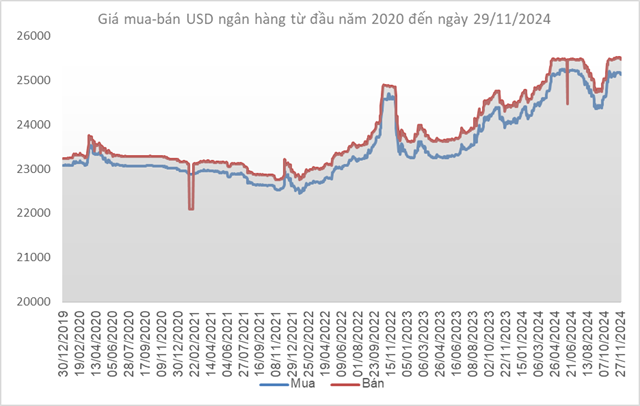

At the State Bank of Vietnam (SBV), the buying rate for spot transactions remained unchanged at 23,400 VND/USD. The selling rate was also kept fixed at 25,450 VND/USD from October 25, which is the intervention rate set by the SBV to “rein in” the exchange rate (equivalent to the intervention rate in Q2/2024). Commercial banks can purchase USD from the SBV provided that their foreign currency position is negative.

Source: VCB

|

Following a similar trend, Vietcombank decreased the buying rate by 40 VND/USD and the selling rate by 46 VND/USD compared to the previous week, quoting a rate of 25,130-25,463 VND/USD (buying-selling).

Source: VietstockFinance

|

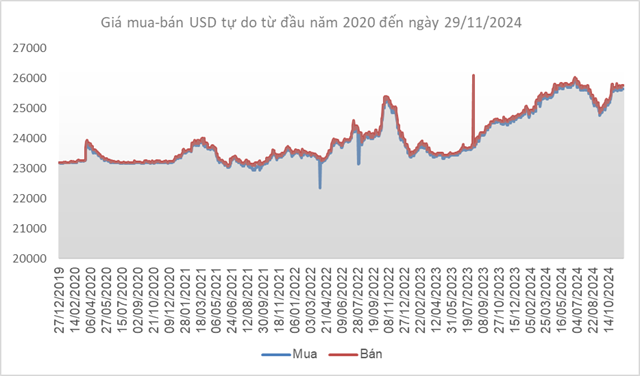

In contrast, the USD/VND exchange rate in the free market increased by 50 VND/USD in both buying and selling, reaching 25,650-25,750 VND/USD (buying-selling).

Is There Still Appeal in Vietnamese Stocks? A Deep Dive into the $3.8 Billion Foreign Sell-Off on HOSE.

The extent and trend of foreign investor retreat from the stock market is indeed surprising, given that Vietnam has consistently boasted of being a developing country with the fastest-growing economy in Asia and the world.

The Golden Opportunity: Unlocking the Power of Words for Global Appeal

A master craftsman of words, with an innate understanding of the English language, has the unique ability to captivate and inspire. With a deft touch, this wordsmith can transform the ordinary into the extraordinary, crafting titles that are a work of art in themselves.

The global gold price on November 28 continued to rise amid geopolitical tensions and trade war fears, driving safe-haven demand. Trading volume was also lower than expected as US stock markets were closed for the Thanksgiving holiday.

The Prime Minister Calls for Lower Bank Interest Rates

Prime Minister Pham Minh Chinh has urged the Governor of the State Bank of Vietnam to continue instructing commercial banks to cut costs, boost digital technology adoption, and reduce interest rates for businesses and individuals. This move aims to stimulate production and business activities in the remaining months of this year and the beginning of 2025.