Nam A Bank has recently appointed three new key personnel: Mr. Huynh Thanh Phong as Director of Risk Management, Mr. Nguyen Minh Tuan as Director of the Central and Central Highlands regions, and Ms. Lam Kim Khoi as Director of the Western region.

Nam A Bank appoints three deputy general directors at once.

With these new appointments, Nam A Bank’s Executive Board now comprises a total of ten members. Mr. Tran Khai Hoan serves as the Acting General Director, and the nine deputy general directors are Mr. Hoang Viet Cuong, Mr. Ha Huy Cuong, Mr. Le Anh Tu, Mr. Nguyen Vinh Tuyen, Mr. Vo Hoang Hai, Mr. Huynh Thanh Phong, Mr. Nguyen Minh Tuan, Ms. Ho Nguyen Thuy Vy, and Ms. Lam Kim Khoi.

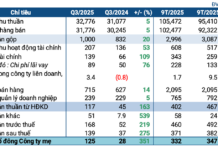

As of the latest reporting period ending September 30, Nam A Bank’s nine-month cumulative profit stood at VND 3,323 billion, representing a 62% increase compared to the same period last year and achieving 83% of the full-year plan.

The bank’s total assets reached nearly VND 240,000 billion, a nearly 16% increase, thus completing 103% of the annual plan. Capital mobilization amounted to nearly VND 173,000 billion, reflecting a more than 5% increase and achieving 97% of the annual plan.

Lending balances stood at nearly VND 164,000 billion, a nearly 24% increase, meeting 102% of the annual plan. As of September 30, Nam A Bank’s non-performing loan ratio remained stable at around 2.85%.

Earlier on June 5, the State Bank of Vietnam approved Nam A Bank’s plan to increase its charter capital, as agreed upon by the bank’s shareholders during the 2024 Annual General Meeting. This year’s capital increase amounts to VND 3,145 billion, raising the bank’s charter capital from VND 10,580 billion to VND 13,725 billion.

The Race to Raise Deposit Rates: Why Banks Are Competing to Offer Higher Returns

As we approach the year-end, there has been a significant surge in demand for capital, especially medium and long-term funds. In response, banks have engaged in a fierce competition to raise deposit interest rates, with the highest rate reaching an impressive 6.4% per annum for terms of 18 months and beyond.

The Profit Windfall: KBC’s Q3 2024 Net Profit Soars to 14 Times the Previous Year’s, Raking in Over $40,000 in Daily Bank Interest

For the nine-month period, Kinh Bac Urban reported a 58% and 82% year-on-year decline in revenue and net profit, respectively, to VND 1,994 billion and VND 351 billion.