Phú Thọ Tourist has recently announced that it received 12 decisions on November 19 from the 11th District Tax Department regarding enforcement measures to collect overdue taxes. The enforced amount totals over 3.4 billion VND.

The 11th District Tax Department has sent these decisions to commercial joint-stock banks where Phú Thọ Tourist holds accounts, such as Sacombank, Vietcombank, and VPBank, requesting them to deduct the amount from the company’s accounts.

Previously, on July 24, the Ho Chi Minh City Tax Department had issued a decision to enforce a suspension of invoice usage for Phú Thọ Tourist due to overdue taxes totaling more than 57.3 billion VND. However, the company was allowed to continue using invoices as they complied with the tax payment, as per the decision made by the Ho Chi Minh City Tax Department on October 17.

Phú Thọ Tourist manages and operates four business units: Đầm Sen Cultural Park (Đầm Sen Khô), Ngọc Lan – Phú Thọ Hotel Cluster, Dam Sen Tourism Service Center, and Vàm Sát Mangrove Forest Ecotourism Area. The company also has associations with Đầm Sen Nước and financial investments in two hotels, Saigon – Da Lat (Lam Dong) and Saigon – Dong Ha (Quang Tri).

Entertainment activities at Dam Sen Cultural Park

|

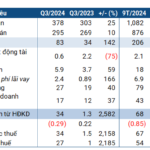

In terms of business performance, in the third quarter of 2024, Phú Thọ Tourist incurred a loss of nearly 14 billion VND, mainly due to a decrease in revenue as a result of lower visitor numbers. This was also the company’s heaviest quarterly loss since 2023.

For the first nine months of the year, revenue reached 161 billion VND, and pre-tax profit was 10 billion VND, a decrease of 9% and 44%, respectively, compared to the same period in 2023. Compared to the plan, the company achieved 49% of the revenue target but exceeded the profit target by more than three times.

In 2023, Phú Thọ Tourist returned to profitability after three consecutive years of losses, with a net profit of 2.3 billion VND. However, this profit was mainly attributed to financial activities, with the highest contribution coming from dividends from Đầm Sen Nước.

| Phú Thọ Tourist’s Annual Business Results |

The management of Phú Thọ Tourist acknowledged that the dry park is outdated and less appealing to younger generations, resulting in a loss of competitive advantage. In 2023, this park alone incurred a pre-tax loss of more than 43.3 billion VND.

In the stock market, DSP shares closed at 16,500 VND per share on the last trading day of November, doubling in value over two months but still 18% lower than at the beginning of the year. The stock remains on the warning list, as per the decision of HNX on April 2, due to audited financial statements being qualified for three consecutive years.

| DSP Share Price Movement in the Past Year |

“Eximbank Receives Approval from State Bank of Vietnam to Amend Chartered Capital to Over VND 18,688 Billion”

On November 25, 2024, the State Bank of Vietnam approved a change in the charter capital of the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Eximbank, HOSE: EIB). As a result, Eximbank’s charter capital has been adjusted to VND 18,688,106,070,000 (eighteen thousand six hundred and eighty-eight billion one hundred and six million seventy thousand dong).

Why Hasn’t the Late Chairman Nguyen Thien Tuan’s Wife Accepted Her Full Inheritance of Shares?

Mrs. Le Thi Ha Thanh, the wife of the late Chairman Nguyen Thien Tuan, has inherited nearly 12.22 million DIG shares out of the total of almost 16.97 million registered for trading.

The Power of Persuasion: Crafting Compelling Copy for a Successful Business

“Ailing Power Company Raises $38 Million in “3-No” Bonds Despite $216 Million Losses”

Despite recording a post-tax loss of over VND 500 billion in the first half of this year, a power company has surprisingly raised nearly VND 900 billion in “three-no” bonds, with a three-year maturity.