Vietnam’s stock market ended the last trading week of November on a high note, with the main index rebounding nearly 2% led by Bluechip stocks, while foreign capital returned to net buying after a long period of selling. The VN-Index successfully reclaimed the 1,250-point level, but lackluster liquidity remained a concern, indicating that investor sentiment was not yet fully positive.

While many large-cap stocks thrived, shareholders of a real estate company watched their stock price sink to new lows. Specifically, TDH, the stock code for Thuduc House Development Joint Stock Company, closed at VND 2,250 per share on November 29, marking the third consecutive session of declines. This was the lowest price since the company’s listing on the stock exchange. Since the beginning of 2024, TDH’s market price has plummeted by 52%. If we consider the peak price set in September 2021, the stock has lost more than 85% of its value, with market capitalization falling to just over VND 253 billion.

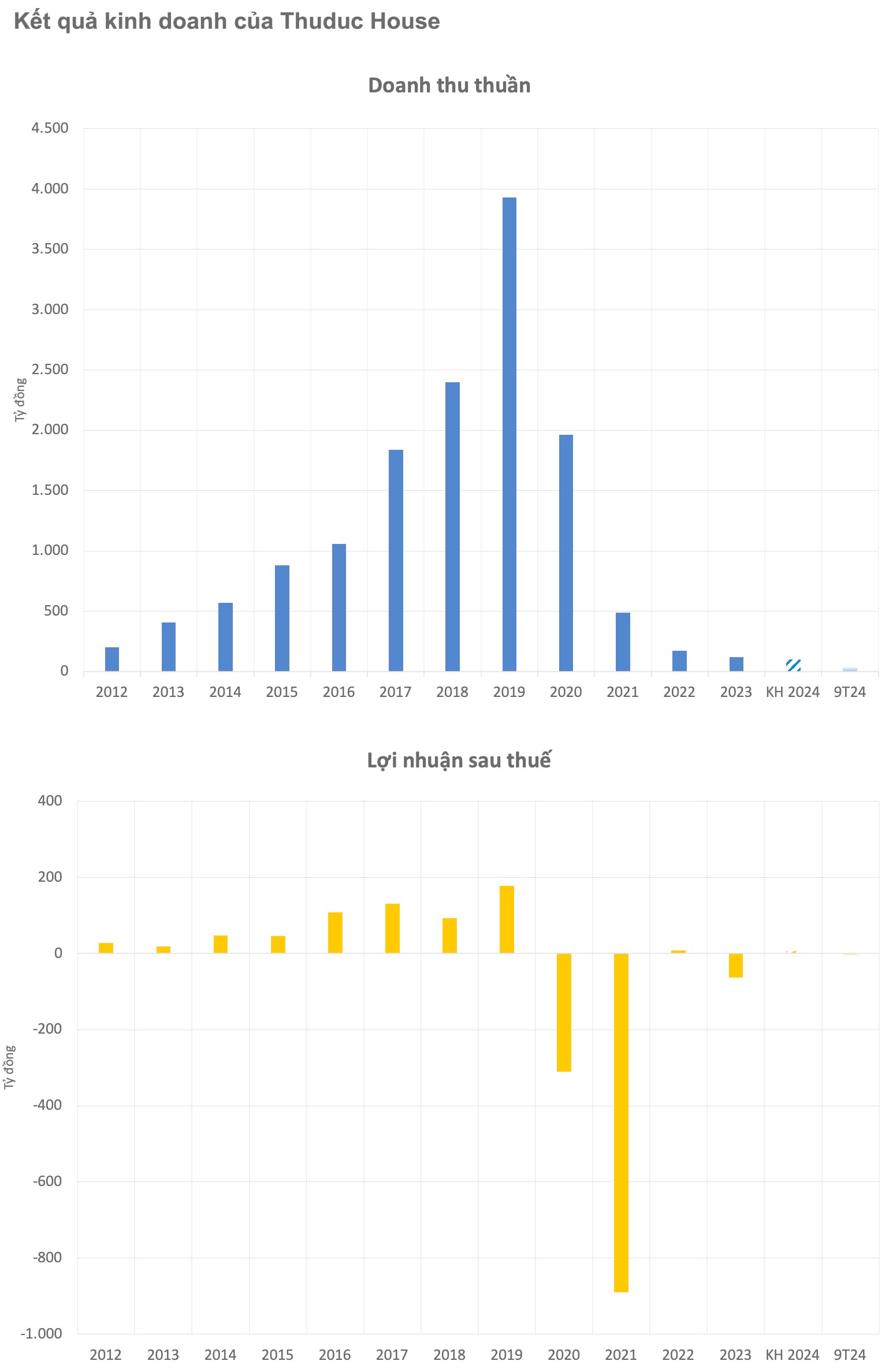

Leadership Changes and Nearly VND 800 Billion in Accumulated Losses

The negative performance of TDH occurred as Thuduc House announced unusual information related to changes in its top management. Specifically, Mr. Nguyen Hai Long, the company’s CEO, resigned for personal reasons. The timing of his resignation will be decided by the Board of Directors. Mr. Long was elected to this position in mid-April 2024, replacing Mr. Dam Manh Cuong, who had also resigned, citing his belief that he did not meet the criteria of the new Board.

With Mr. Long’s departure, there will be no remaining members in the company’s Board of Directors. Previously, in June, Ms. Van Thi Hue, Deputy General Director and Secretary of the Board of Directors, was also relieved of her duties.

Since 2022, Thuduc House’s management team has undergone continuous changes, with several leaders facing legal issues, and the company has seen three different Chairmen of the Board of Directors during this period.

In the latest update, the Thuduc House Board of Directors has approved the dismissal of Mr. Nguyen Hai Long as CEO effective November 29, 2024, and appointed Ms. Tran Thi Lien as the new CEO for the remainder of the Board’s term (2020 – 2025) or until a new decision is made. Ms. Tran Thi Lien holds a Bachelor’s degree in Economics.

In terms of business performance, Thuduc House’s financial results for the first nine months of 2024 were disappointing, with revenue decreasing by 55% year-on-year to nearly VND 37 billion. Consequently, the company posted a post-tax loss of nearly VND 4 billion for the nine-month period, bringing the accumulated loss as of September 30, 2024, to VND 755 billion.

As of the end of the third quarter, Thuduc House’s assets were less than VND 983 billion, mainly in accounts receivable and inventory. Owners’ equity stood at VND 372 billion. Recently, the company received a decision from the Ho Chi Minh City Tax Department to enforce the administrative decision on tax management by deducting more than VND 91 billion from the company’s bank account.

Market Beat: A Tale of Diverging Fortunes, VN-Index Revisits 1,251 Points

The market ended the session on a positive note, with the VN-Index climbing 0.75 points (0.06%) to reach 1,251.21; the HNX-Index also rose, by 0.68 points (0.3%), closing at 225.32. The market breadth tilted towards decliners, with 373 tickers in the red and 319 in the green. The large-cap basket, VN30, witnessed a dominant performance, as evident in the 17 gainers, 9 losers, and 4 unchanged stocks.

The Power of Persuasive Writing: Crafting Compelling Headlines

A good headline should be like a powerful magnet, attracting readers’ attention and leaving them intrigued. It should be a delicate balance of creativity and clarity, enticing readers to want to learn more.

The VN-Index has been on a consistent upward trajectory since surging above the Middle Bollinger Band. If, in upcoming sessions, the index remains above the 200-day SMA, coupled with improved trading volume, this bullish trend will be further reinforced. Currently, the Stochastic Oscillator and MACD indicators continue to ascend, having already signaled a buy. Should this status quo persist, the positive short-term outlook is here to stay.

Technical Analysis for the Session Closing November 28th: A Mix of Positive and Negative Signals

The recent volatile trading sessions of the VN-Index and HNX-Index, characterized by a tug-of-war between buyers and sellers and erratic liquidity, reflect the fragile sentiment among investors.