Continuationsection class=”article-body” data-widget=”text_body” data-container-css-class=”article-body”>

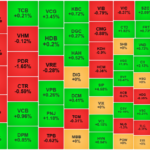

The VN-Index rebounded this week, building on the previous weekend’s recovery, and has now retaken the 1,250-point threshold. Positive macroeconomic news, both domestically and internationally, has supported the market’s upswing.

Specifically, currency pressures eased last week as the DXY index hovered around 106 following a strong yen surge due to expectations of an interest rate hike by the Bank of Japan in upcoming meetings after Japan’s inflation surpassed the 2% target.

Additionally, interbank interest rates fell below 5% following supportive moves by the State Bank. News of credit growth reaching 11.12% as of November 22nd also bolsteredsection class=”article-body” data-widget=”text_body” data-container-css-class=”article-body”> bolstered prospects for a 14-15% credit growth target for the year, thereby supporting expectations for the banking sector in the final quarter. Other positive developments included the reinstatement of a 5% VAT on fertilizers and net foreign buying, which spurred a broad recovery across various sectors.

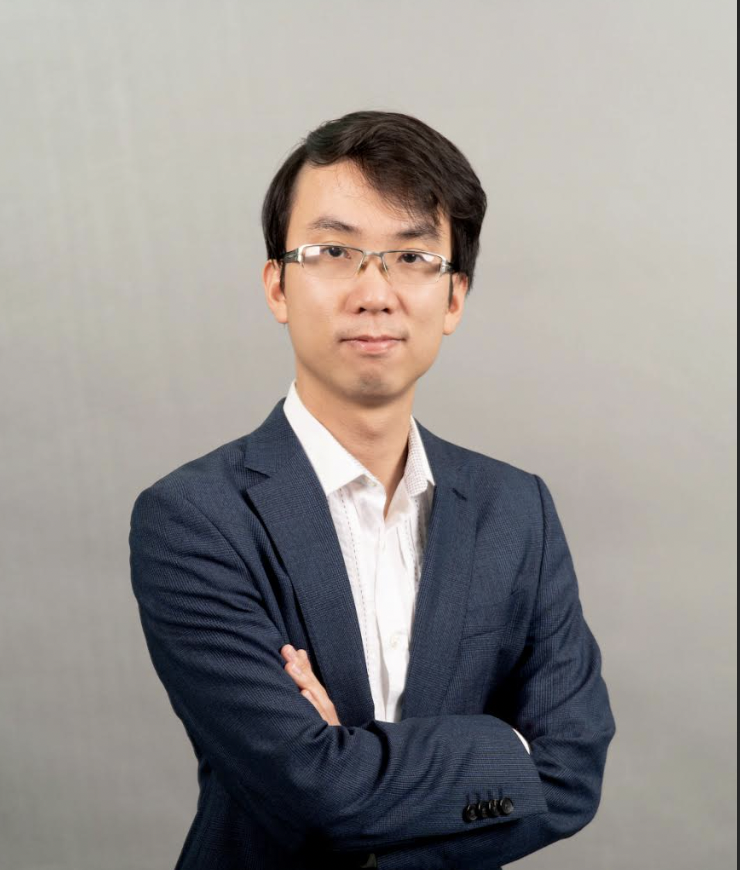

Commenting on the stock market in December, Mr. Dinh Quang Hinh, Head of Macroeconomics and Market Strategy at VnDirect Securities Company, expressed optimism about the market’s overall recovery as risks such as exchange rates and short-term liquidity tensions ease. This optimism stems from expectations of a Fed rate cut in the upcoming December meeting and an improved domestic USD supply towards the year’s end.

Typically, export businesses tend to sell foreign currency back to commercial banks towards the year-end to facilitate domestic purchases, pay bonuses to employees, etc. This, coupled with sustained positive FDI disbursements and remittances flowing into the country during this period, will help ease currency pressures.

As a result, the State Bank will be able to shift its focus to other objectives, including supporting system liquidity and credit growth, to achieve the ambitious 15% credit growth target for the year. Should this target be met and money flows into the real economy, it would provide a significant boost to the stock market in December and early next year.

Therefore, investors should take advantage of adjustments to increase their stock holdings and build investment portfolios for the coming year, prioritizing sectors expected to report positive Q4 earnings, such as technology, logistics, exports (garments, seafood), and banking.

According to Ms. Tran Thi Khanh Hien, Head of Analysis at MBS Securities, after a drop of over 100 points from the October peak to the psychological support level of 1,200 points, the domestic market has found a balance and holds promise for a December recovery.

Several issues that previously constrained the market in October have been gradually resolved, supporting a cautious recovery. These include the continued outperformance of US stocks compared to the rest of the world, coupled with adjustments in the Dollar Index (DXY) and yields on 10-year US Treasury bonds, which have eased pressure on the USD/VND exchange rate.

Domestically, as the year draws to a close, the market has received a slew of supportive news, aiding the VN-Index’s recovery from the 1,200-point psychological threshold and providing opportunities for further gains. Currency pressures have eased as the State Bank has injected funds to support liquidity, and interbank interest rates are on a downward trend.

On November 28th, the State Bank of Vietnam (SBV) adjusted the credit growth target for 2024 upwards, creating favorable conditions for credit institutions to expand their operations transparently and fairly.

The clearest signal of support for the market from easing currency pressures is the net foreign buying for six consecutive sessions after a record-breaking net selling streak of over $3.3 billion across the market since the beginning of the year.

Market liquidity showed signs of bottoming out, with November’s average daily liquidity of VND 16,000 billion being the lowest since the beginning of the year (compared to VND 22,000 billion previously).

As the year draws to a close, the market continues to receive positive news, such as the Prime Minister’s Directive No. 122/CD-TTg, which tasks the State Bank with eight key missions to achieve the 15% credit growth target, ensure the smooth and safe operation of the banking system, and enhance efficiency.

Additionally, the market welcomed some positive macroeconomic news: The Ministry of Finance proposed extending the 2% VAT reduction for certain goods and services for another six months, until mid-2025. The goal is to stimulate consumption and, in turn, boost production and business activities to contribute to state revenue and support the economy.

Furthermore, on November 26, 2024, the National Assembly passed the amended Value-Added Tax Law, which will subject fertilizers to a 5% output VAT rate from July 1, 2025. This could benefit domestic fertilizer companies next year.

Meanwhile, the electricity sector awaits the amended Electricity Law, expected to be passed by the National Assembly this week, with privatizationsection class=”article-body” data-widget=”text_body” data-container-css-class=”article-body”> a focus on privatizing the industry from 2025. The new law will introduce a two-part electricity pricing mechanism, increase retail prices for EVN, and encourage direct power purchase agreements between renewable energy project developers and power generation companies. It also encourages private investment in transmission lines of 220kV and below.

Several stock sectors with attractive discounts, such as real estate, securities, and oil and gas, have seen bottom-fishing by investors during the recent sharp decline.

Technically, according to Ms. Hien, the VN-Index’s more than 100-point drop from the October peak to the psychological support level of 1,200 points, or a decline of over 8%, resembles the two sharp drops of over 9% in April and July this year when the market corrected to the lower bound of the 1,180-1,300 point range. Although the recovery is cautious due to declining liquidity, the VN-Index’s continued uptrend is supported by positive domestic news.

“The market may fluctuate at the notable resistance level of 1,260 points this week, providing an opportunity for latecomers and portfolio restructuring by investors,” said Ms. Tran Thi Khanh Hien. “Investment opportunities exist in sectors such as real estate, industrial park real estate, logistics, exports (garments, seafood, wood), Viettel, steel, chemicals, and securities.”

Drip Feed Selling, VN-Index Turns Green at the Last Minute, Foreigners Dump Again

Selling pressure mounted slightly in the afternoon session, pushing the VN-Index briefly into negative territory with a sea of red on the screen. However, the extremely low trading volume indicated that buyers were mostly sitting on the sidelines, and the market was quick to rebound as bottom-fishers jumped in.

Stock Market Outlook for the Week of December 2nd to 6th: Will the VN-Index’s Robust Recovery Finally Bring Relief to Investors?

The stock market soared this week, bolstered by a strong showing from foreign investors who bought net for several consecutive sessions.

Market Beat: A Tale of Diverging Fortunes, VN-Index Revisits 1,251 Points

The market ended the session on a positive note, with the VN-Index climbing 0.75 points (0.06%) to reach 1,251.21; the HNX-Index also rose, by 0.68 points (0.3%), closing at 225.32. The market breadth tilted towards decliners, with 373 tickers in the red and 319 in the green. The large-cap basket, VN30, witnessed a dominant performance, as evident in the 17 gainers, 9 losers, and 4 unchanged stocks.

The Power of Persuasive Writing: Crafting Compelling Headlines

A good headline should be like a powerful magnet, attracting readers’ attention and leaving them intrigued. It should be a delicate balance of creativity and clarity, enticing readers to want to learn more.

The VN-Index has been on a consistent upward trajectory since surging above the Middle Bollinger Band. If, in upcoming sessions, the index remains above the 200-day SMA, coupled with improved trading volume, this bullish trend will be further reinforced. Currently, the Stochastic Oscillator and MACD indicators continue to ascend, having already signaled a buy. Should this status quo persist, the positive short-term outlook is here to stay.