In a recent development, Nam Long has once again raised the bar with its sales policy for its villa products at the 355-hectare Waterpoint urban area – a project located right at the western gateway to Ho Chi Minh City. Accordingly, customers who purchase river-view villas at The Aqua will receive a Merry Fisher 895 yacht worth nearly VND 8 billion, while those who buy canal-view villas at Park Village will be gifted a Mercedes GLC300 valued at nearly VND 2.8 billion. This generous offer has immediately caught the market’s attention.

Previously, this developer also surprised the market with its policy of gifting a Mercedes-Benz GLC 200 worth VND 2 billion to customers who purchase single-detached villas at Park Village. If customers choose not to accept the car gift, the equivalent value will be deducted from the sale price in the contract. Each villa is priced from VND 17.7 billion per unit for an area of 225 square meters and above and is a limited-edition product located along the canal/river within the 355-hectare Waterpoint urban area.

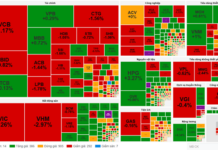

Thus, the flexible sales policy with increasing levels of incentives during the Tet holiday season has created positive liquidity for some projects with new supply entering the market. Thanks to the “aggressive” sales policy to clear their inventory, some southern real estate projects recorded a favorable transaction rate in the last quarter of the year. This is both a strategy of the investor to create a pre-Tet market effect and an opportunity for buyers in the context of prices not having increased sharply and the market not having really entered the “race” to increase prices.

According to DXS-FERI, the average absorption rate on new supply in the last quarter of 2024 increased significantly compared to the same period, reaching an average of 62%. This growth stems from the relatively scarce new supply, from projects with favorable locations and high liquidity. Along with this, projects that continued to announce new sales incentive policies after their launch accelerated the absorption rate.

This unit believes that financially capable customers will quickly make purchasing decisions when suitable products are available, even for some projects with relatively high selling prices. This indicates that the market recovery is becoming more apparent.

According to DKRA Group, although primary real estate prices have not decreased, buyers have benefited from various policies offered by developers. This has stimulated the demand for home ownership. Moreover, the fear of missing out on opportunities to buy properties with attractive prices and policies has helped some projects achieve successful transactions since the beginning of the year. “The constantly updated sales policies by developers have proven effective at this stage. The quick decision-making of buyers has improved project liquidity after a period of market exploration,” the representative of DKRA Group affirmed.

According to some insiders, investors still expect outstanding incentives from developers and real estate agencies to maximize profits when the market enters the “recovery point.” Direct discounts on sale prices or valuable gifts are preferred by investors. On the other hand, actual buyers with modest initial finances tend to favor policies that extend the payment schedule and allow for installment payments. Therefore, at this point, developers who can design attractive sales policies along with reasonable total prices will still see positive demand.

Mr. David Jackson, CEO of Avison Young, opined that this is the stage where demand will show signs of increasing towards the end of the year, so investors are also stimulating the market with aggressive sales policies. These policies are unlikely to be present in a nascent market context.

The Prime Minister Approves Construction of an Underground Tunnel to Connect Ho Chi Minh City and Dong Nai

Prime Minister Pham Minh Chinh has approved the proposal to construct a tunnel under the river, replacing the previous plan to build the Cat Lai Bridge, connecting Dong Nai and Ho Chi Minh City.