Although transaction value decreased by 28% year-on-year, Vietnam’s M&A market continues to attract significant interest from foreign investors, with an increase in deal volume, largely driven by small and medium-sized transactions, according to data from FiinGroup.

Specifically, FiinGroup reports that M&A activity slowed during the first nine months of 2024, with a consecutive decline in transaction value, dropping by 28% compared to the same period last year. This downturn was influenced by global economic uncertainties stemming from geopolitical tensions and currency pressures.

However, the number of deals increased by 5.3% year-on-year, indicating sustained interest from investors as they shifted their focus to smaller, strategic transactions. This stable deal activity reflects Vietnam’s appeal as a dynamic investment destination, even amid challenging global conditions.

The majority of M&A deals in Vietnam during the first nine months of 2024 were mid-sized acquisitions, ranging from USD 1 million to USD 25 million, accounting for 52.6% of the total deal volume. In contrast, FiinGroup recorded only four large deals with transaction values exceeding USD 100 million.

Completing large transactions has become more challenging in the current economic climate, particularly for real estate deals in Vietnam. On the other hand, mid-sized deals are less affected by market fluctuations, allowing investors to proceed cautiously and take advantage of lower valuations instead of taking risky moves with unforeseen risks.

For the first nine months of 2024, inbound M&A deals dominated Vietnam’s M&A market. Specifically, inbound deals accounted for 67.6% of the total transaction value, while domestic M&A deals contributed 32.1%, and only 0.3% came from outbound deals.

Domestic deals accounted for 32.1% of the total transaction value during the first nine months of 2024. This recovery can mainly be attributed to the increase in real estate transactions during this period compared to the same period in 2023. Specifically, the contribution of the real estate sector to the domestic deal value witnessed significant growth, rising from 1% in the first nine months of 2023 to 10% in 2024.

FiinGroup identified Thailand and the UAE as emerging investors in the first nine months of 2024, contributing 54% to the total inbound deal value, amounting to USD 1,131 million. Specifically, after showing signs of slowing down since its peak in 2020, Thai investors regained their leading position in M&A activities in 2024 with a significant deal between SCBX and Home Credit.

The UAE was recognized as a new investor in Vietnam with a substantial deal in the energy sector.

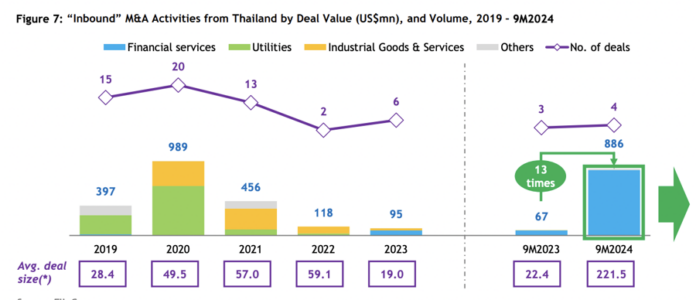

Focusing on Thailand, the country’s investments in Vietnam demonstrated significant momentum through M&A transactions during the first nine months of 2024. Thailand regained its position as the top investor in inbound M&A activities with the involvement of a substantial deal worth USD 870 million between the SCBX Group and Home Credit.

After reaching a peak in 2020, M&A activities from Thai investors experienced a gradual decline until 2023, dropping to USD 95 million. This downturn was mainly due to Thailand’s negative economic situation during this period, impacted by the COVID-19 pandemic and rising inflation. During 2018–2020, Thailand was one of the most active investors in Vietnam’s M&A market, peaking at USD 989 million in 2020, largely driven by multiple deals in the energy sector.

Despite a 61.5% year-on-year decrease, Singapore retained its second position among the top foreign investors for the first nine months of 2024, with a total investment value of USD 304 million. The utility sector was the primary focus of Singaporean investors during this period, with a strong emphasis on renewable energy.

In contrast, Japanese investors recorded a significant dip of 94%. FiinGroup attributed this decline to the reduced number of significant M&A deals involving Japanese investors during this period. The total value of inbound deals from Japanese investors amounted to approximately USD 91 million, with notable transactions including (i) Nishi Nippon Railroad and Paragon Dai Phuoc, and (ii) NTT-e Asia and AWING.

Singaporean investors continued their M&A activities, reaching a total value of USD 355 million, with a primary focus on the energy sector. Specifically, FiinGroup identified Sembcorp as the largest investor during the first nine months of 2024, contributing 53% of the total investment value from Singaporean investors.

The Rising Dragon: Vietnam’s Property Prices Soar Above the Rest

“Over a 5-year period, Vietnam’s property price growth reached an impressive 59%, outperforming many other countries such as the US (54%), Australia (49%), Japan (41%), and Singapore (37%). The high rate of price increase has led to a rental yield of just 4% for Vietnamese properties, while many other countries, including the Philippines, Malaysia, Thailand, Indonesia, the UK, Australia, and the US, enjoy rental yields ranging from 5% to 7%.”

What’s the Land Price in Soc Son near the ‘3-billion VND per square meter’ Auction Area?

The Soc Son land auction on November 29 caused a stir with a plot reaching an astonishing 30 billion VND per square meter. Although the bid was not genuine, it has sparked curiosity about the actual land prices in the surrounding area.