|

VN-Index Surges in the Latter Half of the Morning Session

Source: VietstockFinance

|

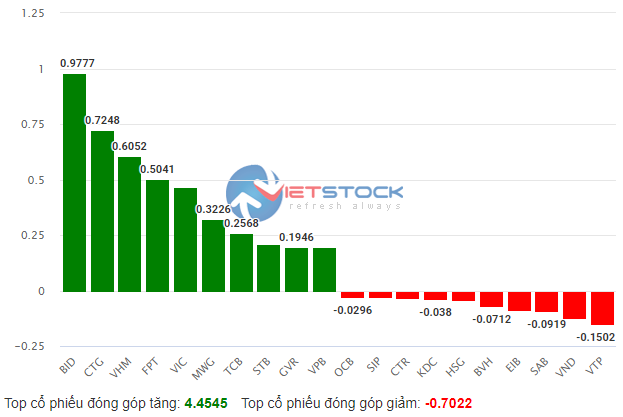

Large-cap stocks made significant contributions to the index’s gains, with BID

nearing a 1-point increase, CTG up by over 0.7 points, VHM rising by more than 0.6

points, and FPT climbing by over 0.5 points. In total, the top 10 stocks with the

most positive impact on the VN-Index added nearly 4.5 points.

|

Top Stocks Influencing the VN-Index

Source: VietstockFinance

|

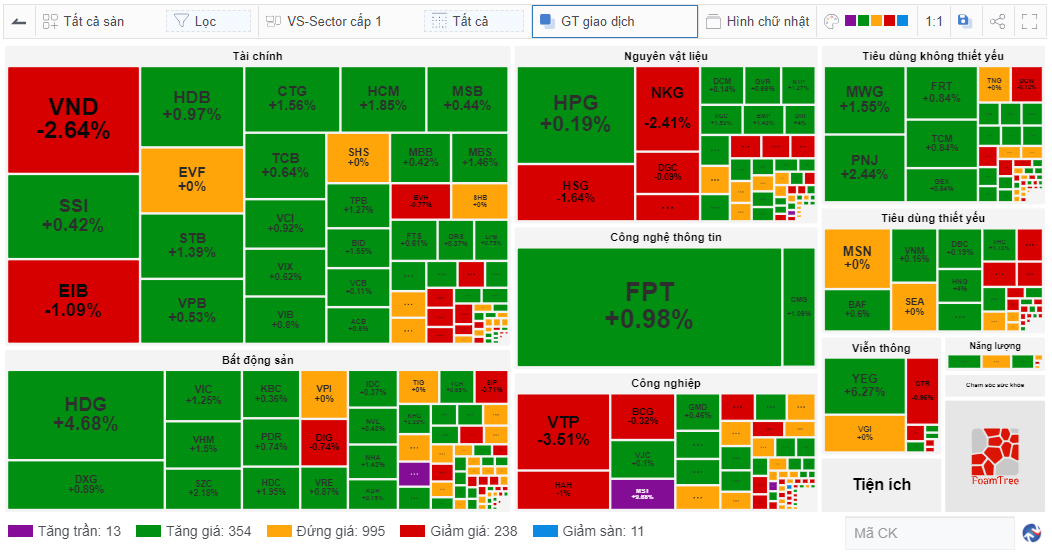

Banking and securities stocks continued to closely follow the index’s movements, with

most codes ending in the green. Notable gainers included CTG, up by 1.56%,

HCM rising by 1.85%, STB increasing by 1.39%, and SSI up by 0.42%. A

few rare decliners were VND, down by 2.64%, and EIB, falling by 1.09%.

Real estate stocks demonstrated stronger consensus, with HDG leading the gains

at 4.68%, followed by VIC rising by 1.25%, VHM up by 1.5%, SZC

climbing by 2.18%, HDC increasing by 1.95%, and DXG rising by 0.89%.

Additionally, the non-essential consumer goods group also witnessed positive momentum,

with PNJ up by 2.44%, MWG rising by 1.55%, FRT climbing by 0.84%, and

TCM increasing by 0.84%. The information technology sector also saw gains, led by

the large-cap stock FPT, which rose by 0.98%.

Overall, the market recorded 367 stocks with price increases, including 13 stocks

hitting the ceiling price, significantly outnumbering the 249 declining stocks, of

which 11 hit the floor price.

|

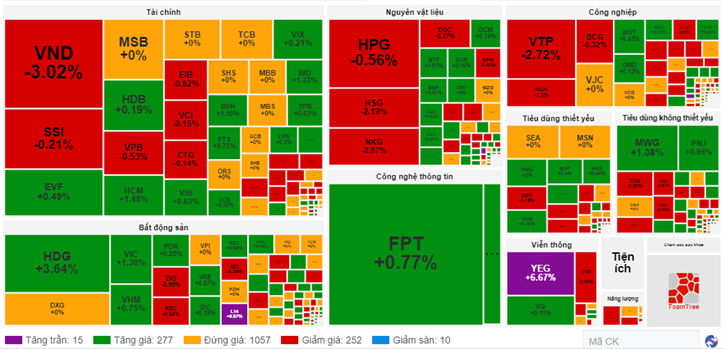

Market Map at the End of the Morning Session on December 5th

Source: VietstockFinance

|

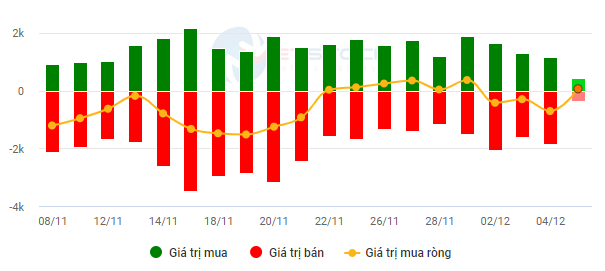

The market’s liquidity was not particularly remarkable, with over 300 million shares

traded, corresponding to a value of nearly VND 6,518 billion, almost unchanged from

the same period in previous sessions.

Foreign investors also significantly narrowed their trading scale, with purchases

totaling over VND 420 billion and sales of over VND 362 billion, resulting in a

temporary net buy value of more than VND 58 billion.

|

Foreign Investors Narrow Trading Scale in the Morning Session of December 5th

Source: VietstockFinance

|

Opening: Mounting Pressure, Many Large-caps Turn Red

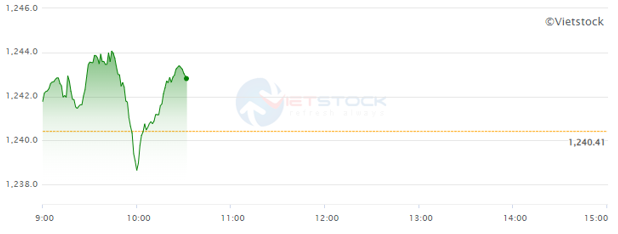

After a positive start, the market began to face increased pressure. As of 10:30

a.m., the VN-Index and HNX-Index managed to stay in the

green, recording gains of 2.41 points and 0.2 points, respectively, reaching

1,242.82 and 224.82. Meanwhile, the UPCoM-Index turned red, falling by 0.08

points to 92.36.

|

VN-Index Faces Pressure After Initial Enthusiasm

Source: VietstockFinance

|

The mounting pressure was evident as the number of declining stocks accelerated to

262, including 10 stocks hitting the floor price, while the number of advancing

stocks stood at 292, including 15 stocks touching the ceiling price.

A glance at the market map revealed that many large-cap stocks were in the red,

ranging from slight decreases such as VCI down by 0.15%, SSI falling

by 0.21%, CTG down by 0.14%, and VPB declining by 0.53%… to more

substantial losses like HSG down by 2.19%, NKG falling by 2.67%, VTP

declining by 2.72%, and VND down by 3.02%.

On the upside, not many prominent names were visible, but a few worth mentioning

included FPT, up by 0.77%, MWG rising by 1.38%, PNJ

climbing by 0.96%, and HDG increasing by 3.64%.

|

Many Large-cap Stocks Decline

Source: VietstockFinance

|

In terms of contribution to the VN-Index, BID took the lead

with a 0.83-point increase, followed by VIC at 0.5 points and VCB at

0.4 points. On the flip side, HPG was the stock that took away the most points,

but the impact was negligible, at just over 0.2 points.

Opening: Echoing Global Markets, VN-Index Edges Higher at the Start of the

Session

During the first 30 minutes of December 5th, the indices posted slight gains,

with the VN-Index rising by 2.84 points (equivalent to a 0.23%

increase) to 1,243.25, while the HNX-Index and UPCoM-Index also

trended higher, reaching 225.14 and 92.51, respectively.

The majority of stocks remained unchanged during the initial 30 minutes, while 251

stocks advanced (including 10 stocks hitting the ceiling price, notably L14

and YEG) and 139 stocks declined (including 4 stocks touching the floor

price). Overall, the green hue dominated the market.

The market’s liquidity at the opening was unremarkable, with approximately 34.6

million shares traded, corresponding to a value of over VND 777 billion.

In terms of sector performance, only three sectors declined and three remained

unchanged, while 17 sectors posted gains. The specialized services and trade sectors

led the advance with a 5% increase, driven by VEF‘s 6.19% surge. The insurance

sector also rose sharply by 1.22% thanks to gains in BVH, BIC, PVI,

VNR, MIG, and BMI, which all traded in the green, up by 1-2%. The

media and entertainment sector also contributed significantly to the market’s

performance, led by YEG.

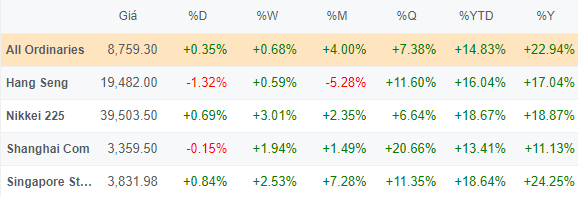

Asian markets were up 0.33% at the opening, but the picture was mixed. Notably, the

Nikkei 225 rose 0.69% to 39,503.5 points, and the Singapore Straits Times climbed

0.84% to 3,831.98 points, while the Hang Seng dropped 1.32% to 19,482 points and the

Shanghai Composite fell 0.15% to 3,359.5 points.

|

Asian Markets Open with Mixed Performance

Source: VietstockFinance

|

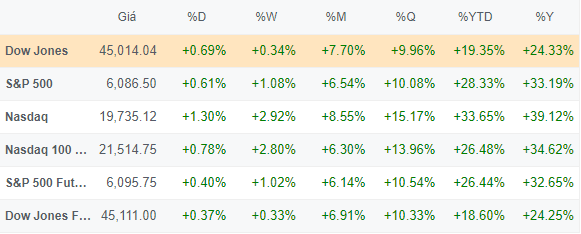

Overnight, Wall Street witnessed a buoyant session, with technology stocks leading

the rally following robust reports from Salesforce and Marvell Technology.

At the close of the trading session on December 4th, the S&P 500 advanced 0.61% to

6,086.49 points, while the Nasdaq Composite added 1.3% to 19,735.12 points. The Dow

Jones index gained 308.51 points (equivalent to a 0.69% increase) to 45,014.04 points.

All three major indices closed at record highs, with the Dow Jones surpassing the

45,000-point threshold for the first time.

|

Wall Street Closes with Enthusiasm

Source: VietstockFinance

|